E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Natural Gas Rigs Down Two as Oil Drilling Sends BHI Count Higher

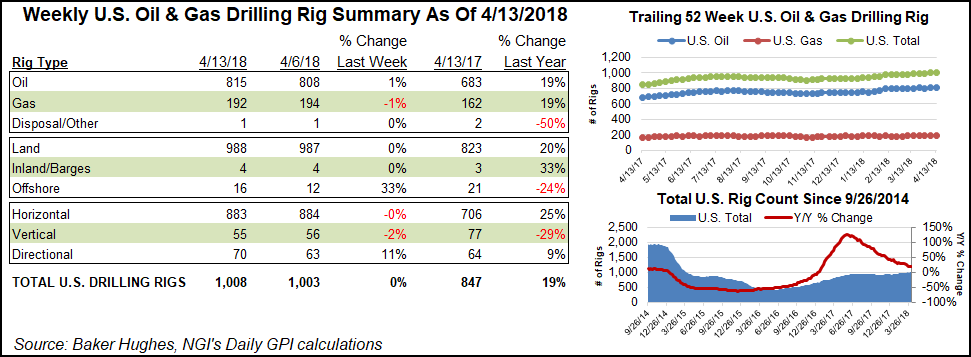

Oil-focused activity continued to drive growth in the domestic rig count during the week ended Friday, while natural gas drilling declined after finishing flat the week before, according to data from Baker Hughes Inc. (BHI).

The United States dropped two gas-directed rigs but added seven for oil to finish the week at 1,008 active units, up from 847 a year ago. Seven directional units were added during the period, while one horizontal unit and one vertical unit exited the patch, according to BHI. The Gulf of Mexico saw four rigs return to action to end at 16, while U.S. land units saw a net increase of one overall.

In Canada, seven oil rigs departed along with two gas rigs, leaving its tally down nine to 102 rigs (versus 118 a year ago).

The combined North American rig count finished the week at 1,110, down four week/week but up from 965 active units at this time last year.

Among the major basins BHI tracks, the largest increases for the week came in the Eagle Ford Shale and the Cana Woodford, which each added two to their respective tallies. The Permian Basin, Utica Shale and Arkoma Woodford each added one.

Meanwhile, the Marcellus Shale saw one rig depart to end at 55 (45 a year ago), according to BHI’s breakdown.

Among states, Texas led the way with a net gain of three units for the week, followed by two rigs returning to action in Oklahoma. Colorado, Louisiana and Ohio each added a rig, while Kansas, New Mexico and West Virginia each saw one rig pack up.

During the prior week, oil drilling activity pushed BHI’s rig count above 1,000 for the first time since April 2015, and with Nymex West Texas Intermediate crude prices surpassing $67/bbl Friday, oil-focused growth in the U.S. onshore appears poised to continue.

Requests for oil and natural gas drilling permits continued to strengthen in March, when U.S. land permits totaled 5,586, up 34% from February and 42% year/year, according to recent data from Evercore ISI.

“Texas permitting grew 34% on the back of flat growth a month before; with over half of the working U.S. oil rigs, Texas continues to be the single-most important state in terms of evaluating the magnitude and direction of U.S. permitting trends,” said Evercore’s James West.

It was the second straight month for permitting to improve sequentially and from a year earlier, with the monthly total in March above 5,000 for the first time since late 2014.

Meanwhile, while oil and natural gas explorers view the Permian Basin and Oklahoma’s myriad reservoirs as the top development destinations, two formations in Texas — the Eagle Ford and Austin Chalk — are high on the list too, along with more Rockies targets, according to a recent survey by Haynes and Boone LLP.

“Respondents predict that the Eagle Ford and Austin Chalk will be the next ”big play,’” the firm said. Thirty people named the overlapping play as the next go-to exploration area, the most of any other region.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |