Infrastructure | NGI All News Access

After Years of Decline, SOEP to Shut Down Next Year

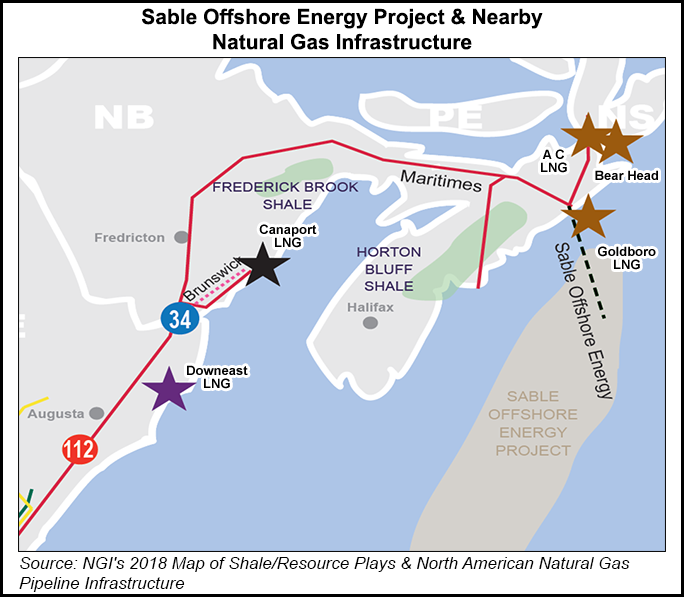

Canada will have one less pipeline, and a depleted source of natural gas exports to the U.S. Northeast will vanish next year, when the Sable Offshore Energy Project (SOEP) begins winding down its operations.

SOEP plans to shut down and flush its 200 kilometers (120 miles) of sea-floor pipe along the Atlantic coast of Nova Scotia in the spring and summer of 2019. The schedule surfaced in an abandonment application by SOEP senior partner ExxonMobil Canada Ltd. to the National Energy Board (NEB). The step follows confirmation that the project’s 22 wells on the shallow Scotian shelf are running out of gas.

Even at the annual peaks of demand and prices last winter, SOEP production hovered at meager averages of 61-99 MMcf/d, according to performance records posted by the Canada-Nova Scotia Offshore Petroleum Board (CNSOPB).

The latest heating season flows were less than one-fifth of the stellar full-year average of 536 MMcf/d that SOEP swiftly achieved after the start of production in late 1999. Total output over the past 19 years exceeds 2 Tcf.

SOEP owners ExxonMobil (50.8%), Shell Canada Ltd. (31.3%), Imperial Oil Ltd. (9%), Pengrowth Energy Corp. (8.4%) and Mosbacher Operating Ltd. (0.5%) spent C$4.17 billion ($3.3 billion) to develop and operate the project, CNSOPB records indicate.

In estimates provided to the NEB, the consortium predicted abandoning the sea-floor pipeline and dismantling SOEP’s gas processing plant on the Nova Scotia coast at Goldboro will cost C$51.7 million ($41.3 million). Separate well shutdowns and cleanups are also in the works.

The SOEP abandonment would end Canadian Atlantic gas production that was originally forecast to become a growth item before the onset of cheaper, more prolific U.S. unconventional development.

Flows from the only other project offshore of Nova Scotia, Encana Corp.’s even more depleted Deep Panuke, were only 18 MMcf/d in January and fell to zero in February, the CNSOPB said. Encana has posted a preliminary project description for abandoning its 175-kilometer (105-mile) pipeline.

The abandonment programs call for the discarded pipes to stay on the ocean floor, following international safety and environmental standards that only require them to be cleaned out and filled with seawater. Extra precautions in the plans include prevention of fishing hardware snags with partial burials or removals.

The offshore abandonments would leave Nova Scotia and New Brunswick dependent on imports of U.S. gas made by reversing flows on the former export conduit for SOEP and Deep Panuke, Maritimes & Northeast Pipeline (M&NE). Expensive imports from overseas are also possible via Canada’s only liquefied natural gas (LNG) terminal on the New Brunswick coast at Saint John.

As an export service, M&NE delivered up to 600 MMcf/d, or more than triple the total 175 MMcf/d consumption of Canada’s sparsely populated maritime region. But the New Brunswick and Nova Scotia governments ruled out reviving exports, or even satisfying their provinces’ own needs, from their estimated 70 Tcf-plus of unconventional gas deposits by enacting politically popular hydraulic fracturing bans.

A contested toll settlement, approved recently by the NEB, gave M&NE and its shippers until 2020 to work out a new regime for reliance on imports. The temporary package includes an accelerated depletion provision forecast to reduce future costs of excess capacity. New arrangements remain to be negotiated, with no toll forecasts made yet.

The pipeline abandonments do not entirely end industry activity offshore of Nova Scotia. A new generation of Atlantic Canadian gas and oil development is in a gestation stage, with no birth dates predicted.

BP plc and Hess Corp.’s Canadian units recently obtained national environmental approval for a Scotian Shelf drilling program, named after its location along the submarine boundary between the continent and the deep Atlantic. The plan calls for up to seven wells before the late 2022 expiry of exploration leases granted in 2012, starting with drilling at least one this year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |