Markets | NGI All News Access | NGI Data

Bullish Miss in EIA Storage Gives Brief Bump to Natural Gas Futures; Balance Still Seen Loose

The Energy Information Administration (EIA) on Thursday reported a natural gas storage withdrawal that was somewhat tighter than the market had been expecting, and futures got a slight bump on the news before pulling back.

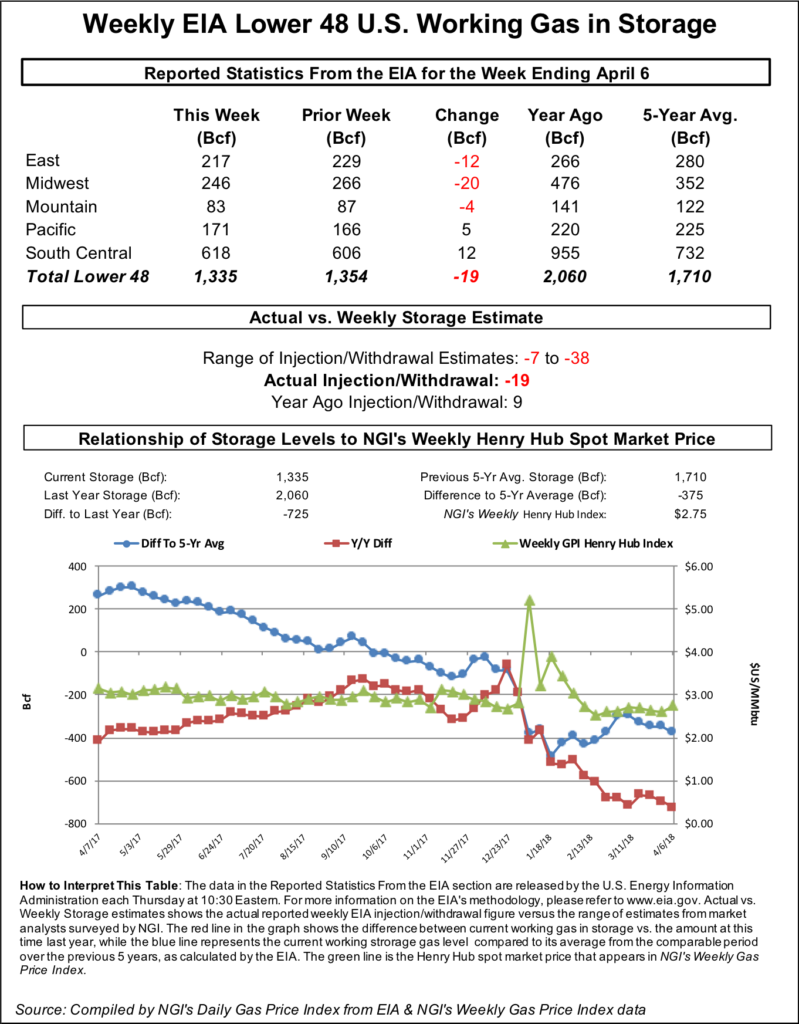

EIA reported a 19 Bcf withdrawal from Lower 48 underground storage for the week ending April 6, a net decrease to stocks during a stretch that typically marks the start of injection season. Last year, 9 Bcf was injected during the period, matching the five-year average.

Immediately following the 10:30 a.m. ET release of the final number, the May contract added 1.5-2 cents but stayed within a range established earlier in the morning, briefly topping $2.695. However, by 11 a.m. ET, May was trading down around $2.672, a fraction of a penny below Wednesday’s settle.

Prior to the report, the market had been looking for a withdrawal somewhat looser than the actual figure. A Reuters survey of traders and analysts on average had predicted a 14 Bcf withdrawal for the period, with estimates ranging from 9 Bcf to 38 Bcf. A Bloomberg survey had produced a median estimate for a 12 Bcf withdrawal, with a range of 7 Bcf to 18 Bcf.

IAF Advisors analyst Kyle Cooper had called for a withdrawal of 12 Bcf, while Intercontinental Exchange EIA storage futures settled Wednesday at a pull of 14 Bcf. OPIS by IHS Markit had also called for a 14 Bcf withdrawal. Bespoke Weather Services had called for a 16 Bcf withdrawal and said it viewed Thursday’s report as “slightly bullish” by comparison.

“This is right within the range of our expectations, though it appears a number of analysts got carried away with even looser expectations,” Bespoke said. “We still see this number as confirming the looseness of the last few weeks but not showing such dramatic looseness as to necessitate a break below the floor from $2.60-2.62.

“Overall, then, we would expect prices generally within the $2.60-2.75 range to remain off this print,” the firm said. “Some downside still does exist short-term, with a floor test likely necessary, but downside is fairly limited as well there.”

Total working gas in underground storage stood at 1,335 Bcf as of April 6, versus 2,060 Bcf a year ago and five-year average inventories of 1,710 Bcf, according to EIA. The year-on-year deficit widened week/week from 697 Bcf to 725 Bcf, while the year-on-five-year deficit increased from 347 Bcf to 375 Bcf, EIA data show.

By region, the Midwest and East saw the largest withdrawals for the period at 20 Bcf and 12 Bcf, respectively, while 4 Bcf was pulled in the Mountain region. Warmer conditions in the other regions during the report week led to injections, including 5 Bcf put back into storage in the Pacific. The South Central saw a 12 Bcf injection for the period, including 8 Bcf into salt and 3 Bcf into nonsalt, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |