E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Diamondback’s Permian Volumes Climb 74% in First Quarter

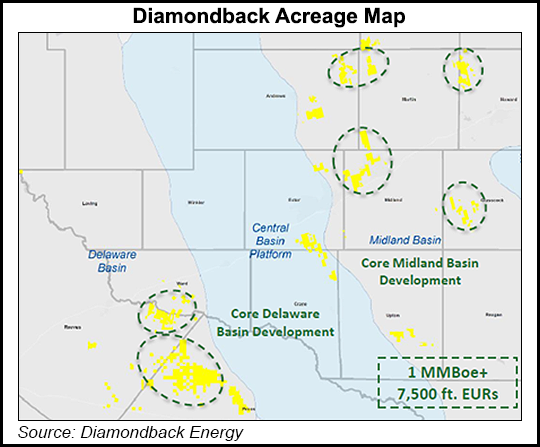

Permian pure-play Diamondback Energy Inc. said production between January and March jumped 74% year/year and was up 10% from the fourth quarter.

Output for the West Texas-focused independent averaged 102,600 boe/d in the first quarter, versus 4Q2017 production of 92,900 boe/d. Volumes were 74% weighted to oil. Subsidiary Viper Energy Partners LP said its first quarter volumes, also all from the Permian, climbed 14% sequentially to 14,100 boe/d.

“In just over five years as a public company, Diamondback has grown production volumes to over 100,000 boe/d from a starting point of 2,500 boe/d,” said CEO Travis Stice.

Diamondback is currently running 11 drilling rigs and has five dedicated completion crews working its leasehold. During the fourth quarter conference call, management signaled it would raise rigs as necessary into 2018.

Since its initial public offering in October 2012, “our industry has experienced oil prices as high as $110 and as low as $26/bbl, and Diamondback has grown production over 40 times in spite of these challenges while maintaining a fortress balance sheet,” Stice said.

“This growth has been a direct result of an unwavering focus on low cost operations, accretive growth through a disciplined returns-focused acquisition strategy and, above all, best in class execution of our operating plan.”

The Midland, TX-based operator plans to continue to increase production “within cash flow and add rigs as operating cash flow allows, with our 11th operated rig recently beginning operations in the Delaware Basin.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |