Natural Gas Futures Higher Amid Estimates for April Storage Withdrawal

Natural gas futures nosed higher Wednesday ahead of a government storage report expected to show a withdrawal for the first week of the injection season thanks to lingering April cold. Spot prices tumbled in the East amid moderating temperatures and falling demand, while SoCal Citygate eased off recent gains; the NGI National Spot Gas Average dropped 17 cents to $2.51/MMBtu.

The May contract settled at $2.675 Wednesday, up 1.9 cents after trading as low as $2.621 and as high as $2.690. June added 1.5 cents to settle at $2.709.

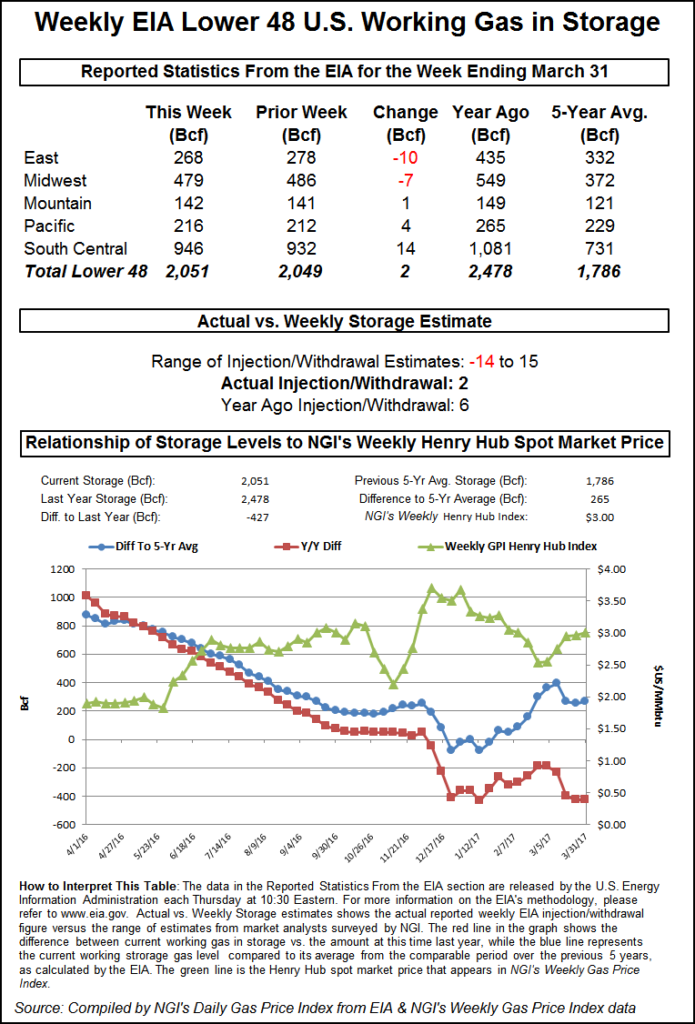

Estimates for Thursday’s Energy Information Administration (EIA) storage report have been pointing to a withdrawal during the first week of April, bullish versus the year-ago and five-year average for a period that would have kicked off the injection season if not for below normal temperatures sticking around.

A Reuters survey of traders and analysts on average predicted a 14 Bcf withdrawal from Lower 48 gas stocks for the period ending April 6, with estimates ranging from 9 Bcf to 38 Bcf. A Bloomberg survey produced a median estimate for a 12 Bcf withdrawal, with a range of 7 Bcf to 18 Bcf. Last year 9 Bcf was injected, matching the five-year average for the period.

IAF Advisors analyst Kyle Cooper called for a withdrawal of 12 Bcf, while Intercontinental Exchange EIA storage futures settled Tuesday at a pull of 14 Bcf.

OPIS by IHS Markit said it’s expecting EIA to report a 14 Bcf withdrawal for the week ending April 6, 15 Bcf looser week/week based on “warmer weather across the U.S. Lower 48 and a slight uptick in dry gas production.”

Inventories have fallen below 1,400 Bcf for the first time since May 2014, OPIS PointLogic analysts Callie Kolbe and Kevin Adler said in a note to clients Wednesday.

“The cause of the decline can be summed up in one word: demand. Thanks to a lengthy (though not unusually cold) winter across the Midwest and Northeast, along with record levels of exports, demand in Winter 2017/18 has been well above the level of the prior two years,” the analysts wrote.

“But unlike winter 2013/14, when strong demand and falling inventories sent prices surging, the market has basically shrugged its shoulders this year. Prices spiked for a couple weeks in late December/early January, but they quickly returned to their prior range, and have stayed there.”

Among the most notable differences between then and now is production, the analysts said. OPIS PointLogic data shows March 2018 U.S. dry gas production averaged 78.3 Bcf/d, a nearly 30% increase over the 60.3 Bcf/d produced on average in March 2014.

“More gas is coming,” according to Kolbe and Adler. “Gas production already has increased by 3 Bcf/d since January, and OPIS PointLogic is forecasting that production will reach a record level of 80 Bcf/d this year, on average. In 2014, average production was 70 Bcf/d.

“As we look ahead to the summer injection season, all signs point to a return to inventory levels at the five-year average and continued low volatility in prices,” the analysts said. “However, the fundamentals surrounding high-turnover salt storage makes it the key EIA storage sub-region to watch this summer for signals of imbalances. Conditions there may likely influence storage behavior elsewhere and, in turn, the direction of prices.”

Portland, OR-based analytics firm Energy GPS said Wednesday Lower 48 dry gas production is estimated to have topped 80 Bcf/d over the last four days, part of an “eye-catching” increase in domestic production this spring.

“Looking at the steady increase in production since February, it is no wonder that the Henry Hub forward contract has remained relatively weak despite the volatile weather pattern this spring that has driven the basis markets crazy,” Energy GPS said. “With 80 Bcf/d of production hitting the grid it is hard to see the upside for the market,” as heating degree days “continue to tumble through the month.

“The next test will be to see if power burns can remain strong enough at the given price to keep the grid balanced through the shoulder season, or if the market needs to price itself lower to manage the abundance of production.”

As for the latest weather outlook, midday data Tuesday was “a touch colder trending, especially after next week in the Global Forecast System model that” has been “colder than the rest of the data,” NatGasWeather.com said Wednesday. “No change bigger picture as we continue to expect a close to seasonal pattern over the next two weeks with weather systems traversing the country every few days” bringing “a mix of warm and cool conditions.”

In the spot market, milder temperatures and declining demand to close out the week sent prices tumbling throughout the Northeast and Appalachia.

“Spring conditions will finally arrive across the Great Lakes and East the next several days as a warm ridge quickly builds overhead, producing highs of upper 60s to lower 70s from Chicago to New York City, while quite warm into the southern U.S. with 80s, locally 90s over the Southwest and South Texas,” NatGasWeather said.

“However, another strong weather system and cool shot with heavy showers and powerful thunderstorms will track across the Central U.S. this weekend, advancing slowly toward the East Sunday into early next week. More importantly to the nat gas markets, temperatures will again be 10-25 degrees colder than normal as lows again drop into the teens to 30s with this system.”

Transco Zone 6 New York dropped 38 cents to $2.79, while Transco Zone 5 shed 7 cents to $2.75. Algonquin Citygate, volatile recently amid maintenance restrictions on Algonquin Gas Transmission, fell $2.55 on the day to average $4.23.

In California, prices at SoCal Citygate moderated after big gains the past two days. SoCal Citygate remained elevated Wednesday but dropped 48 cents to $3.35.

Southern California Gas Co. (SoCalGas), which has been dealing with ongoing import constraints, was forecasting system demand to hover around 2.3-2.4 Bcf/d through the end of the week, with receipts forecast to exceed 2.5 Bcf/d.

Elsewhere in the region, SoCal Border Average gave up 21 cents to $2.19, while El Paso South Mainline/North Baja shed 34 cents to $2.17.

Further upstream in West Texas, El Paso Permian dropped another 4 cents to average $1.43 Wednesday after Tuesday’s low of 96 cents set a new mark for the cheapest trade NGI has ever recorded there going back to 1993.

Takeaway restrictions appeared to contribute to the low prices, as Genscape Inc. noted on Tuesday that El Paso Natural Gas would be performing testing Wednesday and Thursday on its Black River Station, limiting westbound flows on its L2000 line.

But the low at El Paso Permian comes during a period of depressed pricing throughout West Texas as rising production out of the Permian Basin competes for limited pipeline capacity.

“Permian Basin natural gas production is growing at a torrid pace,” RBN Energy LLC analyst Jason Ferguson said in a recent note. “After starting 2017 just below 6 Bcf/d, production is set to breach the 8 Bcf/d mark soon on its way to 10 Bcf/d by the end of 2019.

“Pipelines flowing out of the basin are coming under increasing strain, and just about every single gas pipeline leaving the Waha hub in West Texas is now being utilized at levels not witnessed in years — if ever,” Ferguson said. “Even routes north from the Permian to the Midcontinent and Midwest markets, traditionally only attractive on the coldest winter days, are starting to look viable year-round.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |