Eagle Ford Shale | E&P | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Eagle Ford, Austin Chalk Viewed as Next ‘Big Plays’ After Permian, Oklahoma

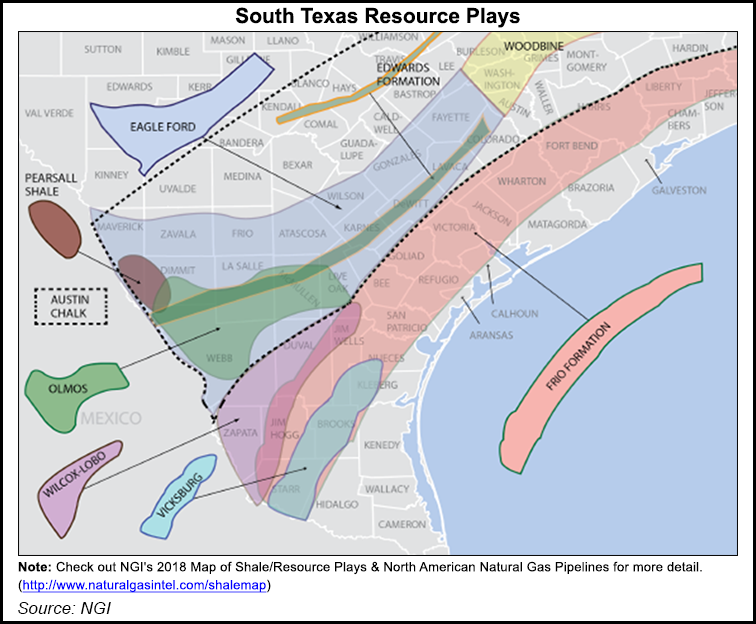

Oil and natural gas explorers view the Permian Basin and Oklahoma’s myriad reservoirs as the top development destinations, but two formations in Texas, the Eagle Ford Shale and Austin Chalk, are high on the list too, along with more Rockies targets, a survey by Haynes and Boone LLP found.

The law firm reported its findings Tuesday as part of a borrowing base redetermination survey recently conducted of oil and gas producers, oilfield services companies, financial institutions, private equity (PE) firms and professional services providers. The firm has conducted seven surveys since April 2015; 108 responded in the newest survey.

“Respondents predict that the Eagle Ford and Austin Chalk will be the next ”big play,’” the firm said. Thirty people named the overlapping play as the next go-to exploration area, the most of any other region.

The significant amount of Eagle Ford merger and acquisition (M&A) activity during the first quarter “indicates that acquirers believe this to be the case as well,” the firm said.

In 1Derrick’s review of 1Q2018 M&A activity, TPG Pace Energy Holdings Corp., led by former Occidental Petroleum Corp. CEO Stephen Chazen, scored the second biggest deal in March in its purchase of EnerVest Ltd.’s Eagle Ford assets worth $2.66 billion. TPG and EnerVest also formed South Texas pure-play Magnolia Oil & Gas Corp.

The Eagle Ford is a massive play, extending from South Texas to north of Houston, while the parallel Austin Chalk formation, which in part sits on top of the Eagle Ford, extends into southeastern Louisiana.

The survey also found “strong interest” in the Rockies, with 20 acknowledging the next big plays would be the Niobrara formation and the region’s Denver-Julesburg, Green River, Powder River and San Juan basins.

The Haynesville Shale, which extends across East Texas into North Louisiana, as well as the Cotton Valley play in Louisiana, drew 14 responses as the next big targets. Only seven said they see Williston Basin/Bakken Shale as the big play going forward, while six listed the Marcellus/Utica shales.

While the firm asked about exploration activity, the primary objective of the survey is to get clarity and an idea of what lenders, borrowers (producers) and others are experiencing regarding redeterminations “in light of the price uncertainty in the commodity markets.” Redeterminations about lending to exploration and production companies (E&P) are done twice a year, in the fall and the spring.

“Respondents are very positive about spring 2018 borrowing bases — over 80% expect borrowing bases to increase, with most expecting 10-20% increases,” the survey found.

E&Ps also are locking in increased oil prices.

“The respondents estimate that producers have a significant percentage — 50-60% — of their 2018 production hedged. Public filings of E&P companies indicate this trend started at the end of 2017 and has held strong through 2018.”

Producers plan to use cash flow from operations, bank debt and private equity as their primary sources of capital in 2018. “Public debt and equity markets are taking a back seat to these sources,” the survey found.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |