Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory | Utica Shale

Mariner East Remains Offline, Raising Questions on Longer-Term Impacts

Ethane and propane transport on the Energy Transfer Partners LP (ETP) Mariner East (ME) 1 pipeline remains suspended more than a month after Pennsylvania regulators ordered a halt to operations because of sinkholes, with little clarity on exactly when service will resume.

Three sinkholes, one of which came within 10 feet of a house’s foundation, formed in West Whiteland Township near the area where horizontal directional drilling for the ME 2X pipeline was underway. That prompted the Pennsylvania Public Utility Commission (PUC) to issue an emergency order in March directing ETP subsidiary Sunoco Pipeline LP to conduct an investigation of the integrity of ME 1 and geophysical testing in the construction area.

The investigation was initially estimated by the state to last up to 14 days, but ETP said it could last up to six more weeks.

PUC spokesperson Nils Hagen-Frederiksen said the emergency order and the suspension of natural gas liquids (NGL) transport on ME 1 remains in full effect. Under the terms of the order, Sunoco can’t resume operations on the system until regulators are satisfied with the test results and any corrective actions necessary. The order notes that Sunoco must share all of its findings and meet regularly with the PUC.

The ongoing suspension indicates that various conditions, all of which are subject to the review and approval of the PUC, have not been met by Sunoco.

“We are working with the PUC and appropriate agencies to complete the necessary testing and remediation in order to ensure integrity of the pipeline before putting it back into service,” said ETP spokesperson Lisa Dillinger. “We expect this work to take up to four-to-six weeks depending on what we do, or do not find.”

Dillinger said the preliminary investigation does “not indicate any impacts from the subsurface area to any of the homes nearby.” The PUC Bureau of Investigation and Enforcement is also conducting an independent investigation. A flurry of activity has occurred in the residential area as a result, which has partly spurred a number of opposition filings on the PUC docket by various individuals, townships and a homeowners’ association.

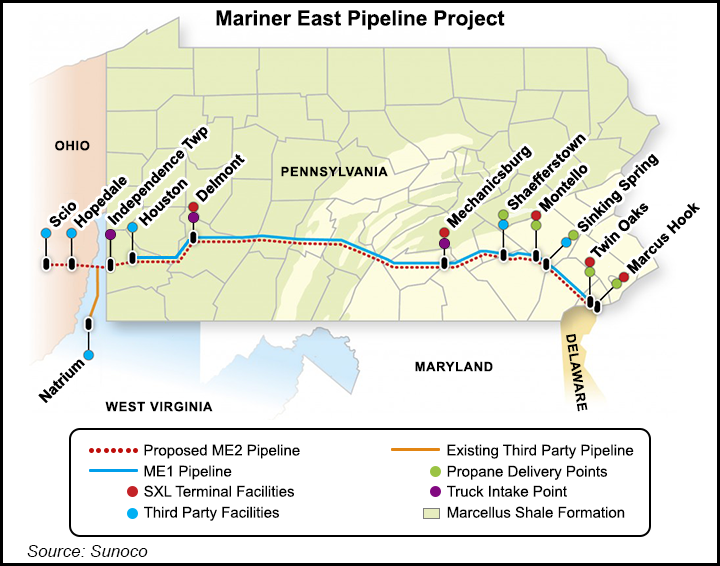

ME 2 and 2X, pipelines that are being built in the same right-of-way as ME 1, would run parallel for about 350 miles to move NGLs from processing facilities in Ohio, Pennsylvania and West Virginia to the Marcus Hook Industrial Complex for domestic and international distribution. Companies including Ineos Group Ltd. and Borealis have made investments to ship gas from the facility overseas. Ethane exports from Marcus Hook started in 2016.

While propane can move via rail or truck, purity ethane has to be moved from the Appalachian Basin by pipeline because of its high vapor pressure. Other pipelines move ethane in the region, including ETP’s Mariner West, Enterprise Product Partners LP’s Appalachia-to-Texas Express and Kinder Morgan Inc.’s Utopia pipeline, but there are few options compared to other parts of the country. The longer ME 1 is offline, the more likely it is to have a significant effect on the producers shipping on the line.

“From an outright production standpoint, I think the effect is probably minimal, because there are some other options to actually move these barrels, other ethane pipelines, you also have a lot of dry gas production,” said BTU Analytics senior analyst Marissa Anderson. “So, from a heat content perspective, that’s probably not an issue that would outright limit natural gas production in the region.

“However, because you have to seek out other opportunities, there could be transportation- and netback-type implications for producers in the region.”

In other words, pipeline transportation costs for propane are likely lower than rail and truck, Anderson said, while other sales arrangements on different pipelines could be more costly as well.

ME 1’s anchor shipper, Range Resources Corp., said shortly after the suspension that it was finding work-arounds to the problem, including using rail, other pipelines and additional sales arrangements. CNX Resources Corp. said the same, adding that it was rejecting ethane into the gas stream, which Range had said was an option. Range said at the time, however, that its netback price for propane would decrease by $3/bbl during the downtime because of increased transportation costs.

Anderson said the ME 1 outage also demonstrates the importance of the ME 2 and 2X projects to the basin’s NGL operations. Those two lines, combined with ME 1, would have a capacity of up to 745,000 b/d. The pipelines are expected to be complete by the end of June. Dillinger said that mainline construction is 97% complete, and the ME 1 investigation has not impacted those projects.

Ethane exports from Marcus Hook, however, appear to have stopped. Bloomberg reported Wednesday that the last ship to leave the facility departed March 18 for Scotland. According to Bloomberg New Energy Finance data, the facility has reported no ethane exports since then. Records also show that Ineos’ ships, for example, are bound for Europe or heading only to Enterprise’s Morgan’s Point facility on the Houston Ship Channel, the only other ethane export terminal in the country.

Neither ETP nor Ineos confirmed that Marcus Hook ethane exports have stopped. But Anderson noted that “Mariner East was how you were getting ethane out, so with that line down, you can’t ship ethane over to the East Coast.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |