Markets | NGI All News Access | NGI Data

Mild Temps No Help to Weekly NatGas Spot Prices as Cold Forecast Lifts Futures

A cold start to April helped natural gas futures rally as mild conditions corresponded with generally weak spot prices during a holiday-shortened week of trading. The NGI Weekly Spot Gas Average dropped a nickel to $2.48/MMBtu.

Prices at most Northeast points pulled back on moderating conditions, though forecasts for cold to return across the Midwest and Northeast by the start of April supported gains to close out the week. Algonquin Citygate gave up 98 cents week/week to average $2.98, while Transco Zone 6 New York fell 26 cents to $2.77.

In the Midwest, Chicago Citygate added 16 cents to $2.66, while in the Midcontinent Northern Natural Ventura added 17 cents to $2.61.

A number of points in the Gulf Coast and Texas followed the futures higher for the week. Henry Hub climbed 12 cents to $2.75, while Katy jumped 16 cents to $2.83.

In the West, SoCal Citygate declined most of the week on relatively moderate demand before yet another restriction affecting imports for utility Southern California Gas Co. saw prices jump on Thursday. Weekly spot prices at SoCal Citygate finished 31 cents lower at $3.05, while SoCal Border Average fell 11 cents to $1.95.

Natural gas futures gained ahead of the holiday weekend Thursday on a colder-trending outlook that had early April chills sticking around a while longer, though a looser-than-expected government storage report kept the rally in check.

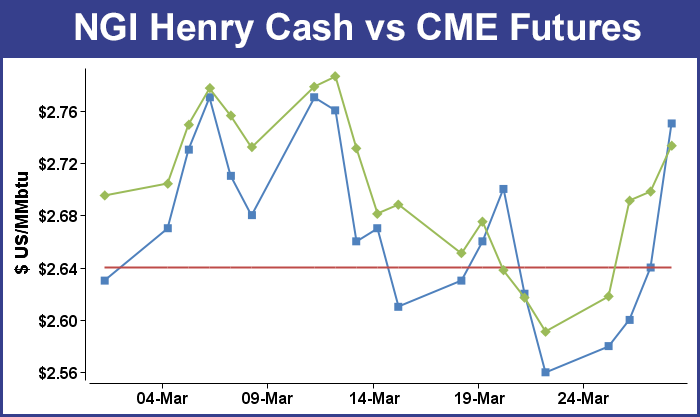

The May contract settled at $2.733 Thursday, up 3.5 cents on the day. Week/week, May added a dime after settling at $2.633 March 23.

The Global Forecast System model trended colder overnight heading into Thursday’s session, “especially April 7-12, but was a touch warmer” midday, “putting it more in line with the overnight European model,” NatGasWeather.com said Thursday. “Essentially, not as cold as Wednesday night’s run, but colder than the ones previous.

“No major changes timing-wise, as colder than normal conditions pour across much of the northern half of the country starting Sunday and lasting through” the upcoming week “other than a break between cold shots Tuesday,” the firm said. “The April 9-14 period continues to look more seasonal with only regionally cool conditions over the northern and central U.S. and mild to warm elsewhere in a rather neutral and uneventful setup.”

The May contract opened higher Thursday on the colder overnight trends, but futures pulled back a few cents after the Energy Information Administration (EIA) reported a weekly natural gas storage withdrawal that missed to the bearish side of market expectations.

EIA reported a 63 Bcf withdrawal from Lower 48 storage for the week ended March 23, tighter versus the 58 Bcf withdrawn in the year-ago period and a five-year average withdrawal of 46 Bcf.

As the figure crossed trading desks at 10:30 a.m. EDT, the May contract dipped as low as $2.735 after trading above $2.755 minutes just before and as high as $2.764 about a half hour earlier. By 11 a.m. EDT, May was trading around $2.742, up about 4 cents from Wednesday’s settle.

Prior to the report, the market had been looking for a withdrawal somewhat tighter than the actual figure. A Reuters survey of traders and analysts had on average predicted a 70 Bcf withdrawal from U.S. gas stocks with responses from 50-81 Bcf. OPIS by IHS Markit had predicted a 67 Bcf withdrawal, while IAF Advisors analyst Kyle Cooper also called for a 67 Bcf pull. Intercontinental Exchange futures for the upcoming report had settled at a withdrawal of 63 Bcf Wednesday. EIA had reported an 86 Bcf withdrawal for the period ending March 16.

“This is the fourth week where EIA data was on the looser side of expectations, as data shows the impact of increased production and limited nuclear outages last week,” Bespoke Weather Services said. “On a seasonal basis the print shows structural tightness also easing as production soars.

“An increase in nuclear outages this past week may lend a bit more raw tightness, and adjusted burns still do not seem loose, so today’s price strength is not entirely unwarranted,” the firm said. “However, room for prices above $2.75 seems limited, and once cash strength and short-term weather catalysts ease we should pull back.”

Total working gas in underground storage stood at 1,383 Bcf as of March 23, versus 2,055 Bcf a year ago and five-year average inventories of 1,729 Bcf, according to EIA. The year-on-year deficit increased slightly week/week from 667 Bcf to 672 Bcf, while the year-on-five-year deficit increased from -329 Bcf to -346 Bcf, EIA data show.

By region, the East and Midwest both recorded hefty withdrawals for the period at 28 Bcf and 31 Bcf, respectively. The South Central saw a net injection for the week, with a 3 Bcf injection into nonsalt offsetting a 1 Bcf pull from salt. In the Mountain region, 2 Bcf was withdrawn, while 3 Bcf was withdrawn in the Pacific, according to EIA.

Spot prices posted double-digit gains Thursday throughout the eastern two-thirds of the Lower 48 amid expectations for cold to sweep through the Midwest and Northeast and bring higher demand to to start off the new workweek; the NGI National Spot Gas Average jumped 16 cents to $2.48/MMBtu.

Prices surged in the Midwest and Northeast, with Appalachia, Midcontinent, Southeast and Gulf Coast points also seeing a bump ahead of the colder temperatures expected to move into the northern United States over the extended weekend. Henry Hub climbed 11 cents to $2.75.

Radiant Solutions was calling for lows to drop into the teens and 20s in Midwest cities like Chicago and Minneapolis over the weekend, about 10-15 degrees below normal. Meanwhile, above-normal temperatures along the East Coast Thursday in cities like Boston, New York and Philadelphia were expected to flip to below normal by Monday, including lows approaching freezing in Boston, according to Radiant.

Chicago Citygate jumped 26 cents to $2.66, while Northern Natural Ventura climbed 26 cents to $2.61.

A pattern of Lower 48 demand swings in the month of March should continue into April, OPIS by IHS Markit analyst Robert Applegate told clients Thursday.

“Total Lower 48 consumption…is expected to hit 66.2 Bcf March 29, with the population-weighted temperature at 3 degrees above normal,” Applegate said. “Compare that to just eight days ago, when the Lower 48 population-weighted temperature was 7 degrees below normal and total consumption was over 82 Bcf…The large swings in temperature are forecast to continue into April, as the 3 degrees above average temperature Thursday is expected to be 5 degrees below average” by Sunday (April 1).

The market has also seen swings in production over the past month, according to Applegate. “March started out at 78.6 Bcf/d of dry gas production in the Lower 48, down 900 MMcf/d from the day before. Although March will end as a record production month for natural gas,” a graph of output data going back to March 1 “looks like a roller coaster ride swinging wildly between 78.5 Bcf/d and 79.5 Bcf/d.”

In the Northeast, Algonquin Citygate jumped 63 cents to $2.98, while Iroquois Zone 2 gained 35 cents to $2.81. Further south, Transco Zone 5 notched a 13-cent increase to average $2.78, while in Appalachia, Dominion South climbed 39 cents to $2.48.

In the West, SoCal Citygate surged 63 cents to average $3.05 amid new restrictions through import-constrained Southern California Gas Co.’s (SoCalGas) Southern Zone, announced Wednesday afternoon.

SoCalGas told shippers that the Southern Zone capacity “will be reduced indefinitely due to the expiration of a right-of-way agreement for SoCalGas pipeline across federal lands held in trust for the Morongo Band of Mission Indians. The Blythe Subzone will be revised to 980 MMcf/d and Otay Mesa receipt point will remain unchanged at 400 MMcf/d.”

Genscape Inc. estimated that “the actual impact to flows will be less than 250 MMcf/d, due to both the unplanned ”Southern Zone Reduction’ that SoCalGas implemented” earlier in March “and the voluntary decrease of Line 2000 throughput capacity that has been in place since anomaly repairs were made in mid-2011.

“SoCalGas has three high pressure import lines, including Line 2000, that cross the Morongo Reservation near Cabazon, CA,” the firm told clients Thursday. “Another of those lines, Line 5000, could see its right-of-way expire later this summer.”

SoCal Border Average fell 4 cents to $1.94 Thursday, including an 11-cent decline at SoCal Border-Ehrenberg reported in NGI’s MidDay Alert.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |