April Cold Springs May NatGas Forwards Higher Despite Near-Record Production, Bearish Storage Miss

May natural gas forward prices climbed an average 9 cents from March 23 to 28 as sustained cold weather trends for early April supported the market despite near-record production, according to NGI’s Forward Look.

Nymex futures led the way, with the May contract rising 6.5 cents during that time despite a slight pull-back Wednesday to $2.698. Weather models overnight Wednesday lifted the prompt month back up in overnight trading and early Thursday as both European and American guidance showed heating demand easily remaining above average across the country through April 12, with only minor warming across the East, according to Bespoke Weather Services.

Additionally, Bespoke said it noticed significant colder trends with the cold shot around April 5, “the likes of which were strong enough to move the natural gas market.” While the forecaster said it was unsure models would continue trending colder into the third week of April, “the short-term upside off cold over the next couple of weeks remains, and if $2.75 breaks, we could even see room up to $2.82,” Bespoke forecasters said.

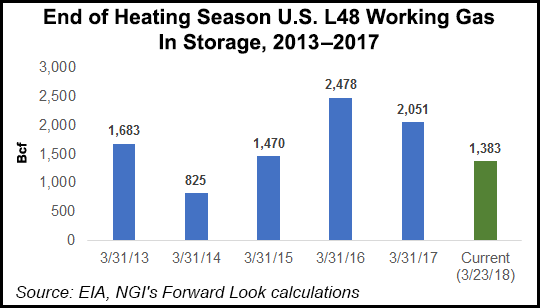

The May contract reached a high of $2.764 early Thursday, but bearish storage data from the U.S. Energy Information Administration (EIA) put somewhat of a damper on the rally. EIA reported a 63 Bcf withdrawal from storage inventories for the week ending March 23, a figure that fell just short of expectations in the mid-60 to lower 70 Bcf range. At 1,383 Bcf, stocks are 672 Bcf less than last year at this time and 346 Bcf below the five-year average of 1,729 Bcf.

As the figure crossed trading desks at 10:30 a.m. EDT, the May contract dipped as low as $2.735 after trading above $2.755 minutes just before. By 11 a.m. EDT, May was trading around $2.742 and eventually settled at $2.733, up 3.5 cents on the day.

“This is the fourth week where EIA data was on the looser side of expectations, as data shows the impact of increased production and limited nuclear outages last week,” Bespoke said. On a seasonal basis, the print shows structural tightness also easing as production soars.

An increase in nuclear outages during the last week of March may lend a bit more raw tightness, and adjusted burns still do not seem loose, “so today’s price strength is not entirely unwarranted,” Bespoke forecasters said. Room for prices to run above $2.75 seems limited, however, and once cash strength and short-term weather catalysts ease, prices should pull back.

The weekly natural gas storage reports for the month of March continue to imply strong year-on-year demand growth, according to Mobius Risk Group analysts. The storage report for the week ending March 23 and estimates on the Intercontinental Exchange for the week ending March 29 also imply continued robust year-on-year demand growth of about 3 Bcf/d.

But, production estimates have been near record highs almost every day for the last week or so, resulting in year-on-year production growth of 6 to 7 Bcf/d, analysts said. This higher production, though, is being partially offset by higher liquefied natural gas and Mexican exports of about 2 Bcf/d, and the Cove Point LNG facility appears ready to start taking more feed gas as its export operations are expected to begin in earnest in April.

“The weather forecast and implied demand continue to be supportive of a move higher in prices to better balance current supply and demand; however, the possibility of accelerating year-on-year production growth at low prices would indicate that a move higher may not be necessary before next winter,” Houston-based Mobius said.

But with storage inventories trailing historical levels, a move higher indeed may be necessary in order to lower the level of coal-to-gas switching the market will likely see at price levels around $2.70, Barclays analysts said. “We see a move from $2.70/MMBtu to $3.00/MMBtu destroying around 700-800 MMcf/d of gas-fired power burn, equating to 150 Bcf over refill season (214 days April-October).”

As the end of March approaches, Barclays estimates that end-winter storage levels will be 1.4 Tcf, around 17% lower than the five-year average end-March level of 1.7 Tcf. Although this March’s storage number may seem bullish relative to past years, “the market continues to discount its significance due to increasing production levels.” Indeed, Lower 48 dry gas production was expected to hit 79.3 Bcf on March 29, but based on previous intraday revisions, could near 79.8 Bcf, according to OPIS.

Additionally, forecasts for end-March storage were at more bullish levels over the course of the winter, Barclays said. At times in January, when the cold freeze helped to drive cash prices as high as $7, the market had been pricing for end-March storage levels closer to 1-1.2 Tcf. A relatively mild second half of January and February, however, allowed for opportunistic storage refills in the South Central region and created a more neutral storage picture for injection season.

Going forward, Barclays analysts expect heavy Q2 storage injections as May and June historically are the largest storage build months of the year for natural gas. During the past five years, May and June have accounted for 35% of total April-October builds in storage, it noted.

Based on its end-March and end-October estimates, total build demand would equal 11 Bcf/d, 3 Bcf/d higher than last year and 1 Bcf/d higher than the five-year average. Assuming a 2,452 Bcf build (April-October) would mean May and June builds combined should equate to around 891 Bcf, the highest level since 2014. “With record production increases this year, the call on volumes for storage refill, specifically in Appalachia and the Gulf Coast, should provide an outlet for incremental production,” Barclays said.

Supply Points Post Double-Digit Gains

Most pricing locations across the United States tracked higher for the March 23-28 period on the back of rising futures, with gains more or less tracking those of the Nymex. There were some exceptions, however. Among the more notable ones are price points in the Midcontinent and Permian Basin, where gains of more than a dime were the norm, according toForward Look.

At El Paso-Permian, May forward prices jumped 18 cents during that time to reach $1.437, still a $1.26 discount to Henry Hub but an improvement from the previous week when it dropped $1.30 below the benchmark. June forwards climbed 12 cents to $1.523, the balance of summer (June-October) rose 7 cents to $1.58 and the winter 2018-2019 inched up just two cents to $1.64.

Waha May forward prices shot up 20 cents from March 23 to 28 to reach $1.509, while June tacked on 14 cents to hit $1.603 and the balance of summer (June-October) rose 9 cents to $1.66. The winter 2018-2019 strip was up just 4 cents to $1.69, Forward Look shows.

The gains seen in Permian forward prices may be short lived. El Paso Natural Gas (EPNG) began maintenance March 27 on its South Low Pressure Mainline, cutting about 230 MMcf/d of westbound flows. Capacity at the “CORN LPW” meter will be set at 962 MMcf/d through late April; recent flows have averaged just under 1,200 MMcf/d, according to Genscape Inc.

Although EPNG may be able to reroute cut flows on its other South Mainline systems (High and Intermediate Pressure), “there is some potential for slight price decreases as gas is backed up into Waha,” Genscape said.

In the Midcontinent, forward prices at OGT also were up by the double digits across the front end of the curve. May was up 21 cents from March 23 to 28 to $1.381, June was up 20 cents to $1.538, the balance of summer (June-October) was up 18 cents to $1.55 and the winter 2018-2019 was up 25 cents to $1.87.

AECO Slips, But Signs Point to Recovery

Despite the generally strong undertones of most forward markets during the March 23-28 period, western Canada ended the week in the red as regional demand was set to soften in the coming weeks as temperatures rise to more seasonal levels. Genscape shows Alberta demand sliding to an average 5.204 Bcf/d for the April 2-6 work week, down from a projected peak of 5.69 Bcf/d on March 29. The April 9-12 period is expected to see demand average just 5.11 Bcf/d.

As such, AECO May forwards slipped 3 cents to 77.9 cents, and June held steady at 78.5 cents. But signs of a price recovery emerged farther out the curve, with the balance of summer (June-October) edging a penny higher to 93 cents, and the winter 2018-2019 picking up 3 cents to reach $1.59, Forward Look shows.

And shifting fundamentals within the region have analysts at Tudor, Pickering, Holt & Company (TPH) “officially taking a bull stance on the Canadian benchmark after pushing a bear thesis since our Canadian initiation this past September.”

TPH data indicate a balanced market (seasonally adjusted) in Q1’18, a far cry from the investment bank’s initial expectations of 1 Bcf/d oversupply, as a remarkably cold winter and stronger-than-expected exports resulted in the improbable balance. With no production growth on the horizon and price spreads between AECO and Dawn/Chicago continuing to incentivize export flows, “we see the AECO market moving into a state of undersupply (-0.2 Bcf/d) in 2018.”

To meet local demand and keep inventories from getting dangerously low, TPH analysts believe gas will need to be pulled off export pipes, requiring AECO prices to approach parity with Chicago/Dawn. Forward curves at both Chicago and Dawn have prices in the $2.40-$2.50 range through the summer, Forward Look shows.

Meanwhile, Alberta storage inventories are sitting at 165 Bcf. This marks a 30 Bcf deficit to last year’s same-date level, but is right in line with — only 0.56 Bcf above — this date’s previous five-year average, according to Genscape.

Prices in the Midwest could materially weaken this summer, TPH analysts noted, with 1.25 Bcf/d of Rover volumes set to come on. But with the AECO strip for the remainder of 2018 at just U.S.$1.05, “materially weaker prices in the Midwest still result in a net win for AECO.”

Looking farther down the road, TPH said it was no longer worried about 2019, “as North Montney Mainline volumes simply pull us back into balance, rather than exacerbate an oversupply.” Incremental egress, coupled with base load demand from the oilsands and coal retirements, puts the region back to undersupply in 2019. This requires growth and, more importantly, “price levels high enough to generate that growth; we think this price is north of C$2.25 (U.S.$1.75), 40% above current 2019 AECO strip levels.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |