Markets | NGI All News Access | NGI Data

Natural Gas Futures Slip After Early-Week Rally; Spot Market Mixed

Natural gas futures inched lower Wednesday as the outlook for April chills looked a little less supportive, while predictions for Thursday’s government storage report pointed to a less impressive withdrawal versus last week.

In the spot market, most points along the East Coast continued to trend lower amid moderating demand, while prices were mixed through the central United States and in the West; the NGI National Spot Gas Average fell 3 cents to $2.32/MMBtu.

In its first day as the prompt month, the May contract retreated 1.6 cents to settle at $2.698 after trading in a tight range between $2.690 and $2.731. June settled at $2.751, down 1.5 cents.

The midday weather data Wednesday showed only “subtle changes with a few days slightly milder and a few slightly colder, but still with below normal temperatures expected to cover the northern half of the country the first week of April for strong demand,” NatGasWeather.com said. “However, we continue to see increasing potential for moderating temperatures over the eastern U.S. April 9-12 as the cold pool either fizzles/moderates or retreats into Canada.

“Essentially, we see the data as bullish the first week of April, then becoming neutral to potentially bearish depending on just how warm the eastern U.S. becomes.”

The firm said it still sees $2.72 as a crucial area that has “provided both support and resistance for the front month for the past numerous weeks.”

Price Futures Group Senior Analyst Phil Flynn said the early April cold was already priced into the market prior to Wednesday.

“We got our rally on the weather Tuesday, and then of course today without the pressure of the short-covering April, the reality set in that even though we’re cold, the season is coming to an end,” Flynn told NGI.

Near-record production continues to pressure the market, he said.

“The thing is, what we’re seeing on the drilling side, it’s not abating. We’re still adding rigs, still a lot of associated gas out there, and the production levels are staying high,” Flynn said.

As for Thursday’s Energy Information Administration (EIA) storage report, a significant bullish miss could inspire a move higher, “but other than that I don’t see it turning around,” he said. “…It doesn’t take a huge stretch of the imagination to think that we could get to $2.40” during the shoulder season.

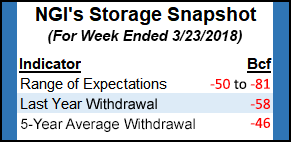

Estimates for the EIA report this week were pointing to a smaller withdrawal compared to last week’s but tighter versus recent norms.

A Reuters survey of traders and analysts on average predicted a 70 Bcf withdrawal from U.S. gas stocks for the week ending March 23, with responses ranging from -50 Bcf to -81 Bcf. Last year, 58 Bcf was withdrawn during the period, and the five-year average is a withdrawal of 46 Bcf.

Last week, EIA reported an 86 Bcf withdrawal for the period ending March 16.

Analysts with OPIS by IHS Markit said they expect EIA to report a 67 Bcf withdrawal Thursday. This would be 19 Bcf looser than the prior week “owing to warmer weather across the Lower 48 and a significant decrease in heating demand.”

OPIS is forecasting an end-of-withdrawal season “inventory of 1.34-1.36 Tcf, or 340-360 Bcf” below the five-year average. This would “require an average summer injection of 11.5 Bcf/d” or about 3.5 Bcf/d more than last summer. “Growing production over the summer will diminish the inventory deficit and serve growing export demand as the summer unfolds.”

IAF Advisors analyst Kyle Cooper called for a 67 Bcf pull from gas stocks, while Intercontinental Exchange futures for the upcoming report settled at -65 Bcf Tuesday.

In the spot market, deals done in the Northeast — for delivery Thursday through the end of the month — trended lower on average for the sixth straight trading day.

Algonquin Citygate gave up 13 cents to $2.35 after averaging as much as $5.50 last week. Transco Zone 6 New York dropped a nickel to $2.52. Further south, Transco Zone 5 fell 5 cents to $2.65.

Genscape Inc. was forecasting New England regional demand to fall to 2.48 Bcf/d Thursday and 2.39 Bcf/d Friday, versus a recent a seven-day average of 3.22 Bcf/d. Appalachian regional demand was expected to decline to 10.13 Bcf/d Thursday, down from a recent seven-day average of 14.16 Bcf/d. The firm was calling for Southeast and Mid-Atlantic demand to total around 12-13 Bcf/d over the next several days after a recent seven-day average of 16.76 Bcf/d.

“High pressure will cover the eastern U.S. through Thursday with conditions milder than normal as highs reach the upper 50s and 60s,” NatGasWeather said in its one- to seven-day outlook Wednesday. “Brief cooling will sweep across the Midwest and Northeast late Thursday and Friday as a weather system races through, then warming Saturday.

“For next week, stronger cold shots will arrive across the northern U.S., while the southern and western U.S. remains mild to warm with highs of 60s to 80s.”

In the West, SoCal Citygate declined for the fifth straight trading day, slipping another 24 cents to average $2.42. SoCal Border Average eased a penny to $1.99.

Southern California Gas was forecasting system to demand to decline further heading into the holiday weekend, down to about 2 Bcf/d by Saturday from closer to 2.6 Bcf/d on Tuesday.

Elsewhere in California, PG&E Citygate climbed 2 cents to $2.56, while Malin added 5 cents to $2.02.

“Planned maintenance Thursday on PG&E’s Gerber Station will cut about 65 MMcf/d of Redwood Path flows versus the previous two-week average and would represent a cut of 228 MMcf/d versus the previous two-week maximum,” according to Genscape.

“Operational capacity will be limited to 1,604 MMcf/d on Thursday and to 1,845 MMcf/d on Friday. Genscape meteorologists are forecasting very mild weather in northern California; PG&E will likely accommodate for lost Redwood flows via storage withdrawals.”

Points throughout much of the Gulf Coast, Texas, Midwest and Midcontinent traded within a nickel of even Wednesday. Henry Hub added 4 cents to $2.64.

In South Texas, Tres Palacios climbed 4 cents to $2.61, while Texas Eastern S. TX fell a penny to $2.59 and Tennessee Zone 0 South dropped a penny to $2.49.

Southbound South Texas flows on the Tennessee Gas Pipeline (TGP) were expected to reverse this week due to restrictions from maintenance on the Mexican side of the border, according to Genscape.

“Wednesday and Thursday, TGP will be restricting Segment 109 in tandem with Los Ramones MX maintenance, which has started to push gas northwards due to the southbound route facing major restrictions,” Genscape said. “TGP exports to NET Mexico, which feeds Los Ramones, have fallen around 500 MMcf/d since Tuesday. This has led Segment 109 flows to fall well below the TGP indicated operational capacity in order to perform the emergency shut down test on Station 9.

“It is not likely that flows along this segment will return to pre-maintenance levels until early next week,” the firm said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |