Infrastructure | NGI All News Access

Pemex Signs First Revamped OFS Contract for Unconventional Natural Gas Project in Burgos

San Antonio, TX-based Lewis Energy Group has inked an oilfield services (OFS) contract to evaluate and develop an unconventional natural gas project owned by Petroleos Mexicanos (Pemex) in northeast Mexico.

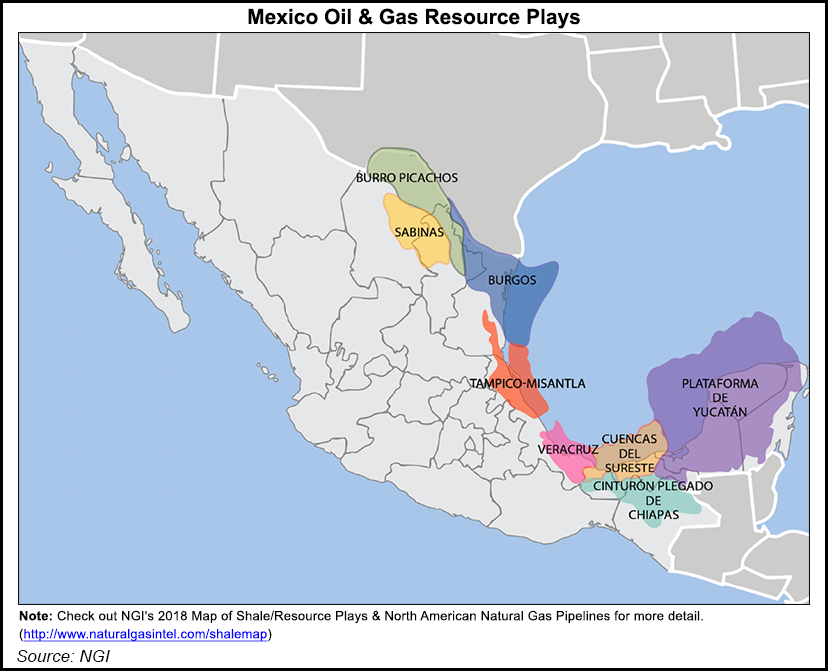

The project, known as the Olmos field, is in Coahuila state in the Burgos Basin, Mexico’s main producer of non-associated gas.

“With this contract, we are expecting a $617 million investment and anticipate the project to achieve production of around 117 MMcf/d by 2021,” Pemex said. The field is estimated to contain 800 Bcf.

Privately owned Lewis Energy has focused on unconventional gas production in the prolific Eagle Ford Shale in South Texas, where it has drilled more than 500 wells and is one of the play’s top gas producers. The company also has international operations in Colombia.

The Eagle Ford extends into part of the Burgos in Mexico, although there has been little to no unconventional development to date south of the border.

The OFS agreement signed this week marks the debut of Pemex’s revamped integrated exploration and production (E&P) services contracts.

The contract model, known as CSIEE by its Spanish acronym, is a revised version of the OFS contracts that the state oil company signed with private and foreign partners before the 2013-2014 energy reforms ended Pemex’s decades-long monopoly over the upstream sector. Contractors under the CSIEE model receive a per-barrel or per-Mcf fee that increases as production rises.

Pemex also launched a tender in September for a CSIEE contract for a project to develop two mature fields, San Ramon and Blasillo, both in the southern state of Veracruz. The company prequalified seven bidders this week and has scheduled data room visits for April.

The new contract at the Olmos field, in turn, appears to replace an older OFS agreement that Lewis won at a bidding round in 2004. At the time, the company estimated it would invest about $340 million over 20 years to produce 40 MMcf/d.

To date, however, Olmos has fallen short of those expectations. The field began producing in March 2009 and peaked at around 6 MMcf/d in mid-2013 before tapering off, according to historical data from the Comision Nacional de Hidrocarburos (CNH), Mexico’s upstream regulator.

Output at Olmos during January averaged 1.26 MMcf/d.

Continuing Contract Migration

Pemex signed a total of 22 OFS agreements, including the original Olmos contract from 2004, before the Mexican government began to implement the energy reforms.

The company is now looking to migrate the other OFS contracts to the new legal regime, which would allow its partners a direct share in the production or revenues generated from the projects and thus incentivize new investments.

So far, Pemex has moved two OFS contracts to production-sharing agreements. In December it migrated the Santuario-El Golpe project, and earlier in March it migrated the Mision block.

The Mision block is a dry gas-rich area in northeast Mexico that produced 60 MMcf/d in December. The new contract is expected to generate an investment of $637 million and allow the block to reach production of 103 MMcf/d by 2020, according to Pemex.

The Mexican government is eager to boost domestic gas production to ease the country’s dependence on imports. Imported gas, mostly via pipeline shipments from the United States, covers around 62% of Mexican gas demand, which averaged around 8 Bcf/d in 2017.

Companies participating in Tuesday’s offshore bidding Round 3.1 mostly overlooked the gas-rich blocks on offer, which included areas in the Burgos and Tampico-Misantla-Veracruz basins. Instead, the most competitive bidding was for light oil prospects in the Sureste basin, a proven area for shallow water exploration and production.

Officials attributed the lackluster interest in gas prospects to the industry’s lack of familiarity with the areas on offer in Tampico-Misantla-Veracruz and offshore Burgos, as well as the prevailing low prices for natural gas.

“We believe we will see more interest in gas fields at the two upcoming onshore auctions,” Energy Minister Pedro Joaquin Coldwell said at a press conference after the bidding results were announced. “Specifically, there are various gas blocks available in Round 3.2, and Round 3.3 in Burgos is practically an all-gas auction that will substantially increase production if we are successful in awarding the contracts.”

Round 3.2 is to offer 37 conventional onshore blocks, again in the Burgos, Tampico-Misantla-Veracruz and Sureste basins. Bids are due to be opened on July 25.

Round 3.3 is to be Mexico’s first auction with unconventional resources prospects. The tender, scheduled for Sept. 5, would offer nine blocks, all of them in the northeast state of Tamaulipas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |