E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Jagged Peak Eyeing 70% Growth in Permian Oil Volumes for 2018

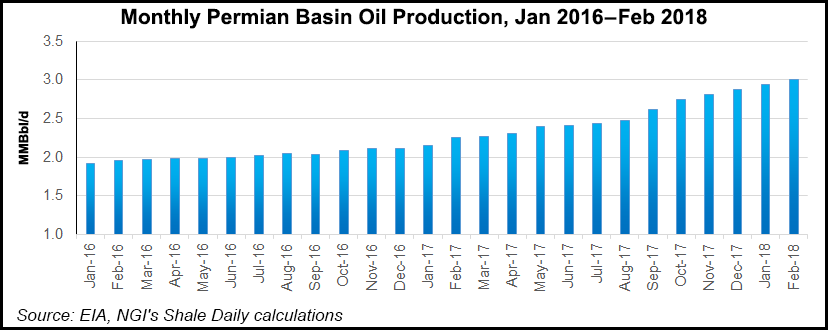

Denver-based Jagged Peak Energy Inc., whose talents are geared to the Permian Basin, said oil volumes jumped 273% in the fourth quarter year/year and climbed 25% sequentially to 24,037 boe/d. However, there’s more growth ahead, management said.

The independent produced on average 16,974 boe/d during 2017, 80% weighted to oil, which was 200% higher output than in 2016. The Permian pure-play early last year launched an initial public offering (IPO).

CEO Joe Jaggers, who is retiring at the end of this month, called 2017 “a transformative year” for the company. “We completed our IPO and, through the use of these proceeds, more than quadrupled our activity level based on the number of wells we brought online and more than tripled our total production.”

The drilling inventory increased by more than 55% to about 2,090 locations, Jaggers said. Jagged Peak’s total leasehold position at the end of 2017 was about 75,200 net acres.

The company in February acknowledged some operational issues late last year, which Jaggers again addressed.

The company “managed our activity level to make certain operating improvements and to ensure efficient capital investments, which deferred our production growth profile…Following those operational improvements, we are currently deploying five rigs and four completion fleets.”

Between October and December Jagged Peak spud 14 gross operated horizontal wells and also brought online 14. For 2017, it spud 54 gross horizontals and completed/brought online 46.

Capital expenditures (capex) for drilling/completion (D&C) in 4Q2017 were $168.5 million, with $567.6 million spent for the entire year.

The focus on capital discipline remains “paramount,” and has been instrumental in the 2018 planning process, said incoming CEO Jim Kleckner.

This year D&C capex is set at $540-590 million, with plans to spud 40-45 wells and complete/bring online 42. Additionally, $20-25 million has been budgeted for water sourcing and disposal infrastructure.

First quarter production is expected to be 27,000-27,300 boe/d, an increase of more than 10% at the midpoint compared to 4Q2017 production.

“Our activity level in 2018 will provide the organization with the necessary time to complete the acquisition and interpretation of 3-D seismic and other technical data,” Kleckner said.

The planned capital program should “increase production by more than 70% over 2017 production.” Most activity is to focus in the lower Wolfcamp A formation in the Cochise and Whiskey River plays, with 2018 production of 28,000-31,000 boe/d

In addition, Jagged Peak is relying on an average oil price of $50/bbl and assumed cost inflation of 10-15% over 2017.

“We are confident that this activity level properly balances the long-term development of our assets with a focus on generating attractive corporate-level returns, while maintaining a strong balance sheet with a conservative leverage profile,” Kleckner said.

Total proved oil and gas reserves at the end of 2017 were 82.4 million boe, 79% weighted to oil, which was 118% higher than at the end of 2016. The reserve replacement ratio was more than 800% in 2017.

Net income for the fourth quarter was $12.8 million (6 cents/share), reversing a year-ago net loss of $1.97 million. Net losses in 2017, which included one-time impairments and costs of the IPO, totaled $451.9 million (minus 36 cents/share), versus a 2016 loss of $9.76 million.

Average realized sales prices for 4Q2017, including settlement of realized oil hedges, were $49.54/bbl oil, $2.45/Mcf natural gas and $30.96/bbl natural gas liquids. The total oil equivalent price for the quarter was $44.15/boe versus 4Q2016’s average of $39.74. Additionally, lease operating expenses, including workovers, averaged $3.25/boe, 14% lower year/year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |