April NatGas Forwards Mostly Lower on Robust Supply; Some Markets Surge on Depleted Storage, Pipe Restrictions

April natural gas prices fell an average 6 cents from March 16-22 as not even a cold weather forecast for early April could turn traders’ attention from near-record production, according to NGI’s Forward Look.

Lower 48 dry gas production was expected to reach close to 79 Bcf/d on Friday (March 23), putting the overall winter 2017-2018 season on pace to exceed last winter’s production levels by 6.9 Bcf/d, the highest 12-month period of growth in U.S. history, according to OPIS. And with new takeaway pipeline capacity coming online this year, production is expected to continue growing, soaring above 80 Bcf/d this summer by most estimates.

“It’s just tough to ignore Lower 48-state production running near all-time record highs,” NatGasWeather forecasters said. Indeed, the Nymex April gas futures contract settled Friday at $2.591, down 2.6 cents on the day.

There are, however, some tools in market bulls’ shed, including a widening natural gas storage deficit. The Energy Information Administration (EIA) on March 22 reported an 86 Bcf draw from underground storage, leaving inventories 667 Bcf below year-ago levels and 329 Bcf below the five-year average of 1,775 Bcf. For the comparable week last year, 137 Bcf was withdrawn from storage and the five-year average withdrawal for the week stands at just 53 Bcf.

Although midday weather data was mixed, with the European model a little warmer and the American model slightly colder, each model showed a decent amount of colder-than-normal air pouring across the northern half of the United States during the first week of April, increasing several heating degree days (HDD) and Bcfs in demand, NatGasWeather forecasters said.

Deficits will increase another -20 to -30 Bcf after the March 29 EIA storage report to near -350 Bcf. “With cool conditions looking likely across the northern U.S. April 1-6, even with the European a touch milder this round, the result is likely to stall the build season a week longer compared to normal,” NatGasWeather said.

Thursday’s reported storage withdrawal implied year-on-year demand growth of around 3 Bcf/d, while the previous weeks of the winter implied almost 4 Bcf/d of growth, according to Mobius Risk Group analysts. Going forward, It will be important to watch the implied demand growth in the storage reports during the spring to see whether prices are adequate to incentivize sufficient storage injections. “If this winter’s level of year-on-year demand growth can be sustained into the spring and summer, prices may need to move higher to achieve adequate storage levels by the end of October,” Mobius analysts said.

Analysts at Bespoke Weather Services view prices already as “a bit low” given expected demand increases and current tightness, but note that “the market must move on from the complacency these production levels are giving it before either weather or any demand-side statistics will significantly matter.”

With the entire Nymex strip trending lower on Friday, Bespoke said the market appears to fear it is oversupplied. Nymex futures settled the day 2.3 cents lower to $2.633 for May, 3 cents lower at $2.73 for the balance of summer (May-October) and 2 cents lower to $2.938 for the winter 2018-2019.

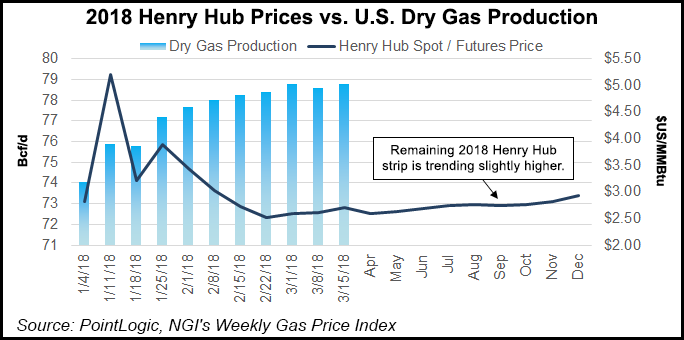

Despite Friday’s downturn in the futures strip, prices for the remainder of 2018 are actually slightly higher than they were at the start of the year, according to NGI’s Weekly Gas Price Index. This, coupled with the number of active rigs, will likely keep production growing, NGI director of Strategy and Research Patrick Rau said.

“I think we are likely headed to 80 Bcf/d of dry gas production this summer. Dry gas production has marched steadily higher so far in 2018, rising from 74 Bcf/d at the start of the year to nearly 79 Bcf/d today,” Rau said, noting, however, that the pace of weekly production increases has slowed since mid-February.

“That all happened despite natural gas prices trending lower since mid-January. However, the current rest of year Henry Hub strip is slightly higher, which likely won’t hurt production, and the number of active drilling rigs has increased by about 60 since the start of the year, so some of those new wells should start contributing by July or so,” he said.

New England April Gas Surges on Depleted LNG Inventory

Looking more closely at market hubs across the country, the fourth nor’easter in three weeks that barrelled across the East Coast during the week did little to move forward markets in most of the region. The exception, of course, was in New England, where liquefied natural gas (LNG) storage inventories at the Everett terminal in Boston have been largely depleted, according to Genscape Inc. The LNG facility had about 1.1 Bcf in storage as of March 21, which was only expected to last about four days. There is, however, a vessel inbound in the next week, it said.

Still, with more cold weather on the way in the weeks ahead, New England traders quickly bid up April forward prices in the region. At Algonquin Citygate (AGT), April forward prices shot up 44 cents from March 16 to 22 to reach $3.87. The rest of the AGT curve moved closer in line with Nymex futures, with May slipping a penny to $2.415, the balance of summer (May-October) falling 2 cents to $2.48 and the winter 2018-2019 falling 6 cents to $6.82, according to Forward Look. Nearly identical price action was seen at Tennessee zone 6 200 leg.

Across the country on the West Coast, Southern California markets also saw a bump in April forward prices as ongoing pipeline restrictions and strong demand continues in the region. Weather systems with heavy rain and snow, along with slightly cool conditions, are expected to move across the region during the next few days, and even eight- to 15-day weather outlooks showed a mix of mild and cool periods. Genscape projected demand in California to average 6.056 Bcf/d for the March 26-30 work week and right at 6 Bcf/d for the April 2-6 work week.

Earlier this month, the California Public Utility Commission (CPUC) issued a letter to Southern California Gas Co. (SoCalGas) directing it to maximize injections into its natural gas storage facilities to avoid possible future service disruptions. According to the CPUC, the SoCalGas inventory is critically low after winter withdrawals, and storage is needed for summer reliability.

As of March 18, SoCalGas reported 48 Bcf in working gas inventory for all four of its storage facilities (64% of 75.5 Bcf of total working gas capacity). The utility’sAliso Canyon storage facility, California’s largest, has been heavily restricted since experiencing a leak from October 2015–February 2016, which reduced its working gas capacity to24.6 Bcf from 86 Bcf. In early March, SoCalGas reported that storage at its three smaller facilities was close to28 Bcf, or 53% of unrestricted capacity.

Inventory at SoCalGas’ four storage facilities has been down significantly since a peak of 125 Bcf at the time the Aliso leak was discovered. SoCalGas inventories had reached their lowest levels — 18.5 Bcf in March 2014 — prior to the leak and after a particularly cold winter, according to EIA. At the time, Aliso had its full storage capacity available, and CPUC did not intervene. Although storage levels last year at this time were lower (39.2 Bcf in working gas capacity), CPUC did not issue a letter of concern about 2017 levels until last July.

In addition to critically low storage levels and cold weather this year, ongoing unplanned maintenance and outages on two major pipelines (Line 3000 and Line 235-2) are continuing to cause supply constraints. CPUC granted SoCalGas an extension to provide a detailed plan to outline minimum month-end storage targets for May through December. It is to project how much natural gas the company will need to procure to ensure system reliability and associated costs, the EIA said.

Given the supply and pipeline limitations in the state, SoCal Citygate April forward jumped 20 cents from March 16-22 to reach $2.594, Forward Look shows. The rest of the curve, however, moved lower, with May falling 12 cents to $2.251, the balance of summer (May-October) easing 2 cents to $2.65 and the winter 2018-2019 slipping 2 cents to $3.04.

Meanwhile, gas prices in Western Canada were on the rise during the March 16-22 time frame as cold weather and rising exports boosted the curve, even if only temporarily. AECO April forwards were up 10 cents from March 16-22 to reach $1.188, May was up 11 cents to 78 cents, the balance of summer picked up 4 cents to hit 89 cents and the winter 2018-2019 tacked on 3 cents to $1.55, according to Forward Look.

But with gas production in the region surging, thanks in part to aggressive production of crude and condensates, prices won’t likely sustain those gains. Despite some concerns that Alberta oil pipeline capacity is more or less full, crude-by-rail is seeing signs of life again and could lead to even more associated gas production.

Even with Canadian gas demand on the rise due to oilsands production and power generation, exports are a critical piece to the region’s supply-demand balance. But the western United States is already awash in supply as gas production growth in the Permian Basin has led to other basins scrambling to find markets. This could quickly put an end to any recent uptick seen in AECO gas prices.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |