NatGas Cash, Futures Slip Despite On Target Storage Withdrawal

April natural gas prices failed to hold onto modest early gains on Thursday, settling 2.1 cents lower at $2.617 as the latest storage data from the Energy Information Administration (EIA) confirmed “no urgent tightness” in the market. Spot gas prices also continued to decline as snow began to thaw and temperatures were rising along the East Coast. The NGI National Spot Gas Average was down 8 cents to $2.48.

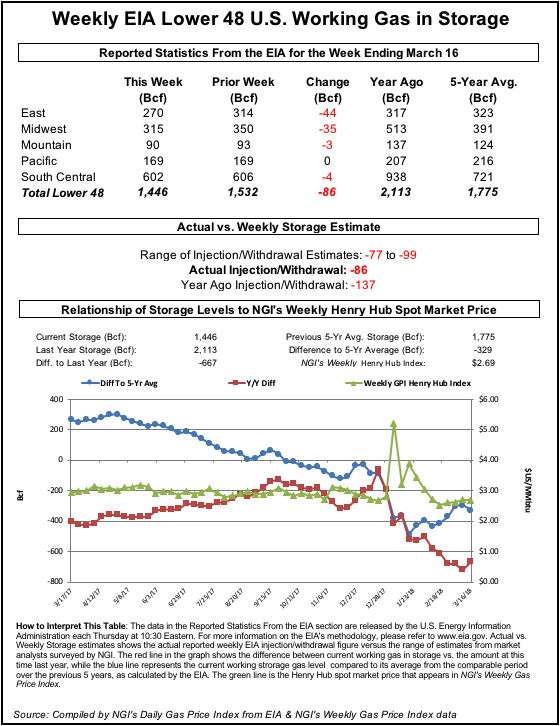

The EIA reported an 86 Bcf withdrawal from underground storage inventories for the week ending March 16, in line with market expectations ranging from the upper 80 to lower 90 Bcf range. For the comparable week last year, 137 Bcf was withdrawn from storage and the five-year average withdrawal for the week stands at just 53 Bcf.

“This is now a third week where the EIA print was looser than our expectation (88 Bcf draw), seemingly justifying trading in this lower range,” Bespoke Weather Services analysts said. Still, the EIA print continues to be viewed as modestly tight on a historical basis, and given forward weather expectations, analysts see rather limited downside for natural gas prices. But they could wander down toward $2.58-2.60, “especially as EIA data is looser than it was through the winter. However, we still have a couple larger draws remaining and once more nuke outages arrive would expect upside.”

But nuclear generation outages are expected to be well below the level of outages seen last year at this time. There is currently about 13.4 GW of generation offline, about 4 GW less than March 2017, which was a notably heavy period for nuke turnarounds, according to Genscape Inc. Scheduled outages are expected to continue increasing through the spring toward a peak of about 18 GW by mid-April, though again, well short of last year’s same-date level of outages.

Heading into the EIA report, a Reuters survey of traders and analysts on average predicted an 87 Bcf withdrawal, with responses ranging from 77 Bcf to 99 Bcf. Kyle Cooper of IAF Advisors projected a storage draw of 87 Bcf, and Stephen Smith Energy Associates forecast a 92 Bcf draw, while OPIS estimated a draw of 89 Bcf, driven by gains in supply offsetting a third week of strong weather-driven demand in the Northeast and Midwest. Intercontinental Exchange EIA storage futures settled at -87 Bcf Wednesday for this week’s report.

As of March 16, working gas in storage levels stood at 1,446 Bcf, according to EIA estimates. Supplies stood 667 Bcf below year-ago levels and 329 Bcf below the five-year average of 1,775 Bcf. For the week, the East Region withdrew 44 Bcf, and the Midwest was close behind with a 35 Bcf draw. The South Central Region dropped 4 Bcf and the Mountain Region declined by 3 Bcf, while the Pacific Region stood pat with no change from the prior week’s level.

Reaction to the storage report was rather muted as prices traded in a tight range of about a nickel. Prior to the 10:30 a.m. EDT report, the prompt-month contract had worked its way higher to $2.661. In the minutes that followed, the April contract reached a high of $2.667 before backing off to $2.627. The April contract fell as low as $2.613 before eventually nudging marginally higher before the close.

Not even increasingly colder trends for early April were enough to stop the downturn in prices. Perhaps that’s because weather models also were milder for next week, when a mild ridge is expected to build over the eastern half of the United States during the middle of the week and continue through next Friday (March 30), bringing with it widespread highs of 60s-80s for a swing back to lighter national demand, according to NatGasWeather.

Cold air pushing down from Canada is still expected to pour across the northern half of the country April 1-6, “lasting a day longer to show colder trends and additional demand, especially across the Midwest and Northeast,” the weather forecaster said. There remains potential, however, for the cold pool over the northern United States to gradually retreat back into Canada around April 7-8, “although the most recent data is slower in doing so,” NatGasWeather said.

With April rolling off the board in the middle of next week, the weather forecaster said there is potential for increased volatility in the coming days, especially as the last several trading sessions have been rather quiet.

Indeed, April appears to be angling for a technical rebound ahead of its expiration next week, said NGI Director of Strategy and Research Patrick Rau. The prompt month is currently trading at the bottom of its Bollinger Band and is oversold on a slow stochastics basis. Its previous reactionary low is $2.565, so that is the major support level.

“Of course, you can throw everything out the window as we get closer to expiration day, however, it wouldn’t surprise me to see a technical rebound ahead of the weekend,” Rau said.

Going forward, the market’s attention should be focused on the amount of demand growth implied by the EIA’s storage reports early in the spring, especially with net supply holding steady and expected to increase sequentially throughout the injection season, Mobius Risk Group analysts said.

“A continuation of the robust demand growth observed this winter could result in higher price levels and less contango in the May through October portion of the term structure, while a return to last summer’s demand level could potentially result in lower prices and less backwardation between the October 2018 and Summer 2019 contracts,” Mobius analysts said.

As of Thursday’s settle, the Nymex May contract stood at $2.656, the balance of summer (May-October) stood at $2.75, winter 2018-2019 was at $2.96, and the summer 2019 was at $2.67.

Switching gears to the spot market, pricing locations across the Northeast continued to decline as demand across the region softened. Outside of the Northeast, losses ranged mostly in the 5-10 cent range as mild conditions were expected to be widespread. The benchmark Henry Hub dropped 8 cents to $2.62, while Houston Ship Channel slid 7 cents to $2.64 and Katy lost 10 cents to reach $2.61.

In East Texas, a one-day maintenance event on the Texas Eastern Pipeline (Tetco) failed to stop gas prices in the region from falling. Tetco is scheduled to shut in Thursday the Cottonwood Power Plant in Newton County for a one-day meter maintenance, cutting about 144 MMcf/d of deliveries. Weather has already switched to cooling degrees in East Texas, and it is expected to be much warmer than normal heading into the weekend, with demand expected to be the highest for this time of year since 2015, according to Genscape. Still, Tetco East Texas spot gas managed to fall 9 cents to $2.48.

Farther west in Texas, El Paso Permian remained on its downtrend as next-day gas slid 9 cents to $1.52, a more than $1 discount to Henry Hub. Gas prices within the oily Permian Basin continue to come under pressure from rising associated gas production. For example, average weekly production for the week ending Jan. 25 was 16.9 Bcf/d and for the week ending March 22, production has averaged 17.7 Bcf/d, according to OPIS. Overall, the Midland sub-basin is up over 0.3 Bcf/d in the past eight weeks followed by the Delaware and Central sub-basins, which combined are above 0.3 Bcf/d as well.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9966 |