Robust Production Pushes Futures, Cash Lower in Nor’easter’s Wake

After what looked to be a solid start to the day, April natural gas prices pulled back to settle Wednesday at $2.638, down 3.7 cents, as near-record production slammed the brakes on any weather-driven bump in prices seen earlier in the day and on Tuesday.

Spot gas prices also fell as the fourth nor’easter in three weeks hitting the East Coast was expected to ease by Thursday, although temperatures should be below normal through the weekend. The NGI National Spot Gas Average was down 9 cents to $2.56.

Lower 48 dry gas production is expected to average above 79 Bcf/d this week, its highest weekly average on record-to-date, according to OPIS. However, roughly 815 MMcf/d is currently inhibited by freeze-offs, particularly in the Northeast, where nearly 600 MMcf/d is estimated to be held back, according to Genscape Inc. The remainder of shut-in production continues to be focused in the Rockies, where recent snowfalls only served to delay field-crew ability to access sites for well and/or line work, the company said.

Still, the month of March has seen six days of production levels above 79.0 Bcf/d, its highest levels since the last two days of February, OPIS said. And over the past eight weeks, weekly average production has increased an impressive 1.7 Bcf/d, or 2.0%. The runaway driver over the past eight weeks has been Texas, which because of relentless Permian Basin associated gas production, accounted for 0.9 Bcf/d of growth.

Also impressive are gains in the Southeast, driven by Haynesville Shale production, up 0.3 Bcf/d. Northeast production has not been as quick to surge, “which is surprising because this was the main pacesetter for the country carrying production levels over 70.0 Bcf/d, 75.0 Bcf/d and so on,” OPIS Vice President Jack Weixel said. Overall, winter 2017/18 dry production will exceed last winter’s production levels by 6.9 Bcf/d, the highest 12-month period of growth in U.S. history, according to OPIS.

Meanwhile, a warmer-trending change in some weather models for the end of March surely didn’t help the gas market. American weather models trended a bit warmer late Wednesday morning and early afternoon, which led to part of the reversal, according to Bespoke Weather Services. A lot of the selling early Wednesday “seemed more production-driven, as we saw back contracts lead the way down,” Bespoke’s chief analyst Jacob Meisel told NGI.

Indeed, the rest of the Nymex futures strip declined as well. May dropped 3.7 cents to $2.667, the balance of summer (May-October) slipped a penny to $2.76 and the winter 2018-2019 slid 1.5 cents to $2.965. “This tends to indicate that it is more production than weather-driven, which would primarily move just the front of the strip,” Meisel said.

Weather models did, however, maintain cold trends for the northern United States April 1-4, but how long those colder-than-normal conditions last after April 5 “is looking suspect and has the potential to turn trend milder in time,” NatGasWeather forecasters said.

Market bulls needed to take out $2.71-2.72 on April futures to regain momentum, and after testing it within 1 cent both Tuesday and early Wednesday, prices have again sold off, the weather forecaster said. It was problematic for the bullish case that notably colder trends in recent weeks have failed to get much of a price reaction. “Clearly the markets want widespread late season cold,” and while the coming pattern is relatively cool besides March 27-31, “the markets appear so far to be saying it’s not intimidating enough.”

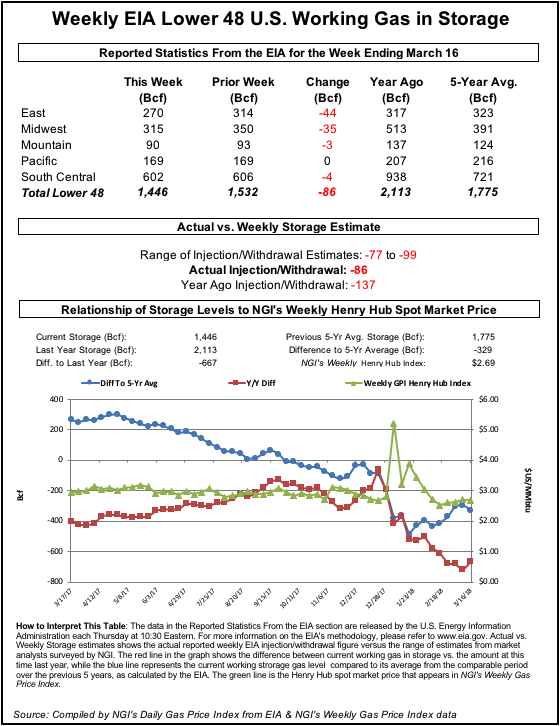

With production near record levels, the market also appears to be growing more comfortable with current storage levels, which are far below historical levels. Early estimates for the week ending March 16 show the Energy Information Administration reporting a storage withdrawal in the upper 80 Bcf to lower 90 Bcf range, would reduce inventories to around 1,445 Bcf and widen the deficit to the five-year average to roughly 335 Bcf. For the comparable week last year, 137 Bcf was withdrawn from storage and the five-year average withdrawal stands at just 53 Bcf.

A Reuters survey of traders and analysts on average predicted an 87 Bcf withdrawal, with responses ranging from 77 Bcf to 99 Bcf. Kyle Cooper of IAF Advisors projected a storage draw of 87 Bcf on Thursday, Stephen Smith Energy Associates forecast a 92 Bcf draw, while OPIS estimated a draw of 89 Bcf, driven by gains in supply offsetting a third week of strong weather-driven demand in the Northeast and Midwest. Intercontinental Exchange EIA storage futures settled at -87 Bcf Wednesday for this week’s report.

“We expect natural gas production to repeatedly set new highs, increasing market comfort with a lower storage trajectory,” Price Futures Group senior analyst Phil Flynn said. He noted, however, that steep storage deficits to both year-ago and five-year average inventory levels “are likely to limit the extent of any price declines this spring.”

In the spot market, Northeast market hubs posted widespread losses as somewhat moderating temperatures are in store beginning Thursday after the latest nor’easter pummelled the region. That’s a blessing for New England, where the Everett liquefied natural gas terminal in Boston has about 1.1 Bcf in storage, which will last only around four days at current sendout levels, according to Genscape.

“This storage will be necessary with temperatures around 5 degrees colder than normal continuing through March 27,” Genscape analyst Molly Rosenstein said, adding that there is a vessel inbound in the next week.

Meanwhile, as near-record production has been keeping the cap on and pressuring the Nymex futures strip, the supply growth is also impacting spot gas at in-basin markets. One issue to watch is how the Permian Basin’s associated gas is pushing into surrounding areas because of shrinking available pipeline capacity before the next round of Texas pipeline expansions comes into service, said Weixel. “Permian regional basis has been in a steady march downward and is currently discounting about $1.00 from Henry Hub.”

Indeed, El Paso-Permian spot gas traded at $1.61, a drop of 4 cents on the day, while Waha traded at $1.75, down 3 cents on the day. The benchmark Henry Hub, meanwhile, rose 4 cents to $2.70.

On the West Coast, Southern California gas prices remained strong for a second day as the region remained under tight supply conditions. Southern California Gas (SoCal Gas) has indicated it is keeping the Honor Rancho storage field in service as stress on storage gas remains high.

Just two weeks ago, SoCalGas issued notice it would be shutting in Honor Rancho because of low inventory, resulting from heavy use this winter with cold and inaccessibility of Aliso Canyon. The need for access to storage remains high with demand projected strong through Tuesday and ongoing limitations on import pipeline capacities, Genscape said.

Adding to that is gas demand for power generation that has migrated more into the Los Angeles Basin in part from an outage at SoCal Edison’s Serrano substation. The Serrano outage limits how much power can flow into the basin from renewables generated in the Mojave Desert and other electrons from the Desert Southwest, Genscape explained. Serrano is not scheduled to return to service until March 27.

SoCal Citygate next-day gas averaged $3.82, up 43 cents on the day and resulting in a two-day increase of 91 cents.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9966 |