Infrastructure | NGI All News Access

NGVs, RNG Able to Compete with EVs, Says Clean Energy CEO

The future for natural gas as a transportation fuel is squarely tied to the wider production and use of renewable natural gas (RNG), or biomethane, in the heavy duty vehicle sector, according to Clean Energy Fuels Corp. CEO Andrew Littlefair.

During a conference call Tuesday to discuss quarterly results, Littlefair expressed confidence that natural gas-fueled trucks and transit buses using near-zero-emission 12-liter engines can compete against electric vehicles (EV). RNG, which Clean Energy brands as “Redeem,” is key, he said.

Clean Energy produced 25 million gallons of Redeem in the fourth quarter, a 32% increase year/year. However, Littlefair said there is a learning curve about RNG benefits. “It takes a while for people to come to understand that.”

During 4Q2017, Clean Energy delivered 86.4 million gallons of natural gas vehicle (NGV) fuel, a 2.7% increase year/year. During 2017, volumes totaled 351.4 million gallons, a 6% increase over 2016.

Littlefair touted the refuse, transit, ports and construction sectors as growth areas for compressed natural gas or liquefied natural gas.

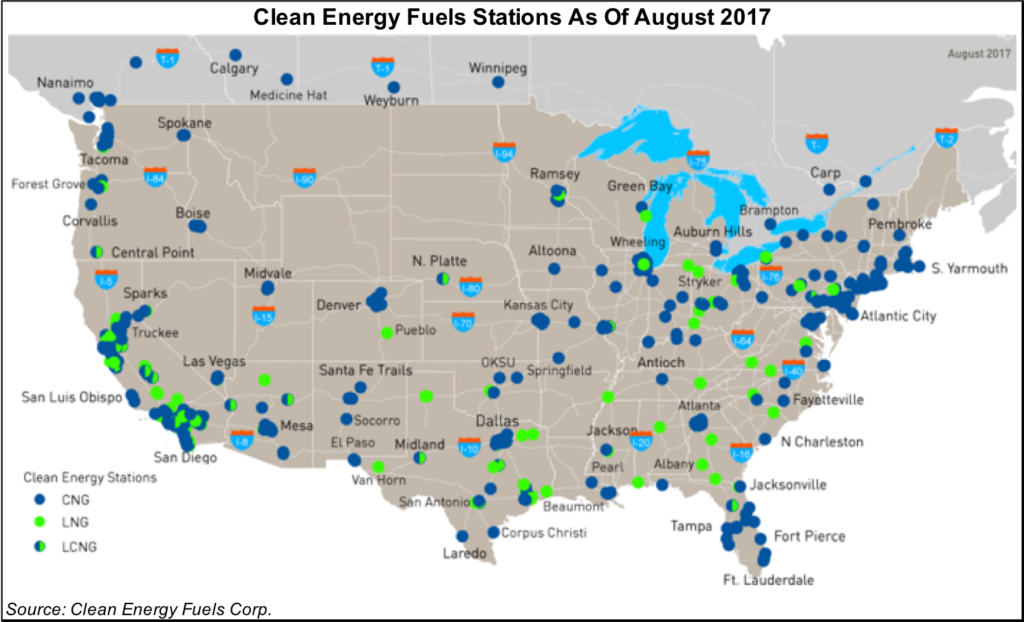

In the second half of 2017, the company took a number of steps to improve its competitiveness, such as reducing its network of nearly 600 national NGV fueling stations and combining its compressor business with Italy’s Landi Renzo SpA. “The combined companies have complementary profit lines with limited geographical overlap,” he said of Landi’s business.

Clean Energy recorded hefty one-time charges in 4Q2017, which together totaled about $13.5 million. Included was a $7 million charge related to carbon credits invalidated by the California Air Resources Board (CARB).

The company is contesting the CARB action that revoked its low carbon fuel standard (LCFS) credits trading. “We have resumed generating and trading LCFS credits” in 1Q2018, Littlefair said.

Net losses totaled $28.3 million (minus 19 cents/share) in 4Q2017, compared with a year-ago net loss of $3.9 million (minus 3 cents). The company reported a net loss in 2017 of $79.2 million (minus 53 cents) from a net loss in 2016 of $12.2 million (minus 10 cents).

Revenue was $89.3 million in 4Q2017, compared with $101.8 million in the year-ago period. Revenues fell to $341.6 million in 2017, a 15.2% decline from 2016.

Clean Energy expects to record a $25 million increase in overall earnings this year from the congressional extension of the alternative fuel tax credit. Last year’s losses were amplified by the absence of that credit, according to the company.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |