April NatGas Forwards Down as Winter Fades; Basin Points Crushed as Production Soars

Natural gas forward prices for April fell an average 6 cents from March 9-15 as any signs of wintry weather are quickly fading. Meanwhile, already weak pricing in some supply basins was exacerbated by rising production and soft demand, and prices plunged as much as 36 cents during the same period, according to NGI’s Forward Look.

Nymex futures led the roller coaster ride as April prices started off March 12 rather strong as initial data from the Energy Information Administration (EIA) indicated a possible triple-digit storage withdrawal prior to the end of winter. As the market’s attention begins to shift toward injection season, “there is a strong probability that the year-over-year storage deficit may begin to carry more weight in terms of downside price risk,” Mobius Risk Group analysts said earlier in the week.

Alas, the March 15 storage report from the EIA reflected only a 93 Bcf withdrawal from U.S. gas stocks for the week ending March 9, tighter than the 55 Bcf withdrawn a year ago and close to the five-year average withdrawal of 97 Bcf. Clearly disappointed by the lower-than-expected draw, traders immediately pushed the prompt month down 3 cents. The Nymex April contract eventually settled at $2.681, 5 cents lower on the day.

“While this withdrawal still implies that temperature-adjusted demand is higher year on year, this week’s report implies less demand growth than the previous three storage reports,” Mobius analysts said.

A report to clients issued late Thursday by Societe Generale noted that while residential/commercial demand grew 16% for the week ending March 9, power loads were down more than 3%. Liquefied natural gas exports, though only a fraction of U.S. supply-demand balances, were also slightly lower on the week.

Not helping market bulls’ case are ever-changing weather forecasts for the remainder of March, which most recently have trended milder in the near term and a little colder to finish out the month. The weather models have been inconsistent after the March 19-23 week, struggling to resolve exactly how much colder Canadian air will be able to push across the border, and exactly which regions of the northern United States will be impacted the most, according to NatGasWeather.

“Where the data is mild/bearish is with a warm break across the Great Lakes and East March 24-26, which seemed to disappoint the markets the past couple days as it trended milder,” NatGasWeather said. The end of the weather models have shown better potential for cold returning across the northern U.S. March 27-30, “but still inconsistent with the timing and placement of weather systems and associated cold blasts.”

On the pricing front, NatGasWeather continued to view the $2.71-2.72 level for April futures as important. After breaking out above this level from March 5-9, then failing to gain much more than several cents above it on colder trends, “it seemed potentially problematic for the bullish case. This so far has turned out to be true with prices selling off the past couple days,” aided by Thursday’s “bearish storage miss,” the weather forecaster said.

Production is also weighing on the market as total dry gas output in the Lower 48 once again moved above 79 Bcf/d earlier in the week before easing back to under 78 Bcf/d by Friday. Holding net supply steady at current levels for the remainder of the injection season would likely result in unacceptably high odds of a stock-out by March 2019, Houston-based Mobius analysts said. The market, however, is anticipating additional production growth this summer, and is currently predicting an end-of-October inventory level of 3,690 Bcf on the Intercontinental Exchange (ICE).

“The weather forecast, the robust demand witnessed this winter and the relatively low inventory balances predicted for the end of March (1,350 Bcf) and the end of October (3,690 Bcf) are all supportive of a rally to higher price levels through the spring months,” Mobius analysts said.

The market, however, is still digesting the rapid growth in production that occurred at the end of last year and is expecting even more growth this summer and beyond. In addition, the summer 2018 injection of 2,340 Bcf implied by the ICE end-of-season estimate is about 600 Bcf higher than last summer’s weather-normalized injection, making the 2018 summer’s estimated supply less demand 2.8 Bcf/d looser than last summer, Mobius analysts said.

Societe Generale shared in the bullish view for natural gas prices and said current market sentiment remains inconsistent, with traders continuing to respond to shifts in weather outlook and highlighting that most participants have become most focused on the very immediate-term.

“It has become clear that speculative appetite is now overwhelmingly focused on the front couple of contracts,” the New York-based investment bank said. This shift in mindset is feeding front-end volatility and keeping the back end of curve stable in the $2.80-2.90/MMBtu range.

“Why is this important? Because it creates a market disconnect. Producers remain focused on the back of the curve due to their need to hedge future production and insulate growth programs, but the speculative market is engaging on the front,” Societe Generale said.

With this in mind, the analyst team expects prices to remain exposed to volatility, even as 2018 production versus demand growth ultimately frames its near-term bullish price view. Societe Generale is forecasting gas prices for 2Q2018 at $2.89/MMBtu versus the Nymex $2.71/MMBtu average; 3Q2018 at $3.00/MMBtu versus the Nymex $2.82/MMBtu average; and 4Q2018 at $2.98 versus the Nymex $2.90/MMBtu average.

As for the storage picture, the withdrawal pace this winter has been “pretty solid” and it estimates that by the end of March, the market will have drawn 2.37 Tcf from storage, “much stronger” than the 1.94 Tcf drawn last winter and even the 2.1 Tcf five-year average.

“Our end-of-March storage expectation trends below 1.45 Tcf. We see a 1.5 Tcf end-of-season finish as neutral, leaving the focus on summer production growth, which will drive the injection pace,” Societe Generale analysts said.

Exports have been solid, and power generation in general has performed well, so demand is expected to show good year-on-year growth this summer, analysts added. Production growth has to thus outpace that demand growth in order to get end-of-October storage to a level comfortable to start winter 18/19. Production is forecast to reach 79 Bcf/d by the end of June, according to Societe Generale.

“From a storage optics perspective, we see the next four months as most exposed to tightening sentiment,” said the analyst team. As production growth continues through 2018, analysts said the market should get back to equilibrium and perhaps even shift back into a period of structural oversupply by exit 2018 under a normal weather scenario.

Mobius analysts said as temperatures increase this April, it will be critical to observe the demand growth implied by most of the recent storage reports. “If last year’s demand models continue to underestimate implied demand by 2-3 Bcf/d, speculators may have to adjust their expectations of end-of-October inventory levels lower, which could be supportive of a continuation of the current rally from the February low of $2.565.”

Production Hits Supply Points Hard

With rising associated gas production coming from the oil-focused Permian Basin, pricing at the Waha Hub and at other supply basin points have come under increasing pressure as there isn’t enough demand to soak up the new supplies and takeaway capacity to where demand is growing remains constrained.

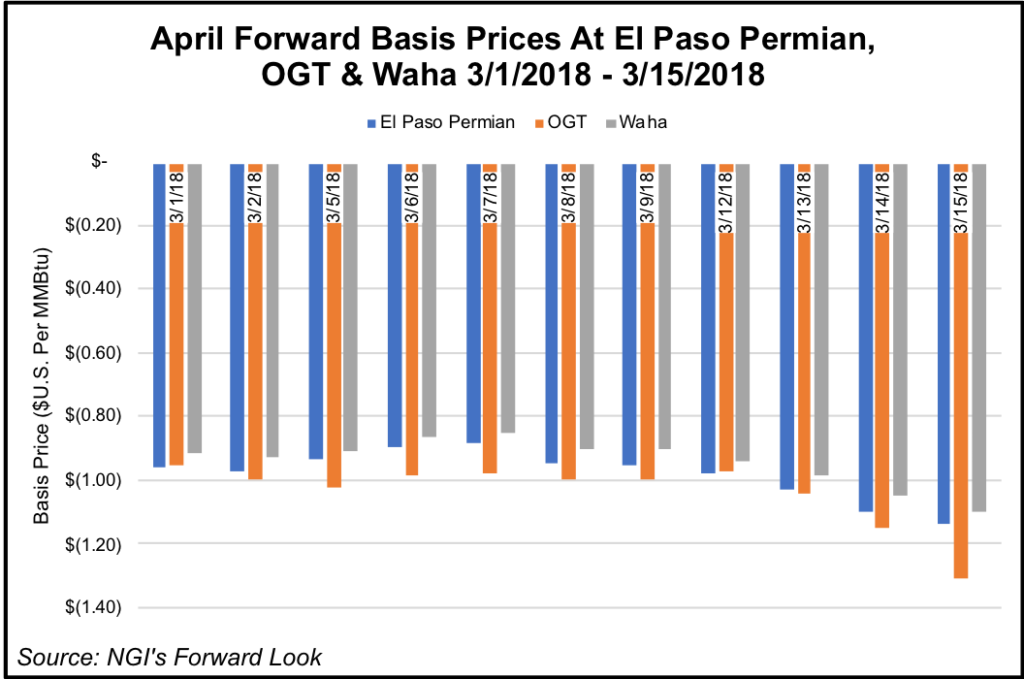

The March 9-15 period proved to be a perfect example of that as Waha April forward prices tumbled 25 cents to $1.582, according to Forward Look. By comparison, the Nymex April contract was down only 5 cents during that time. The rest of the Waha forward curve was beaten just as badly, with May falling 24 cents to $1.573, the balance of summer (May-October) sliding 15 cents to $1.73 and the winter 2018-2019 dropping 9 cents to $1.88.

Waha gas averaged 10-15 cents below the benchmark Henry Hub in 2016; that discount blew out to around 25 cents in 2017.

It’s not only gas prices in the Permian that are suffering. Midcontinent prices have also weakened considerably during the last year, and they took a whopper of a hit in recent days. Oneok Gas Transmission (OGT) forward prices for April plunged 36 cents from March 9-15 to reach $1.372, a $1.31 discount to the benchmark Henry Hub. May was down 28 cents to $1.445, the balance of summer (May-October) was down 23 cents to $1.57 and the winter 2018-2019 was down 21 cents to $1.84, according to Forward Look.

OGT averaged 22 cents below Henry Hub in 2016 and 39 cents below Henry Hub in 2017. “All this competition is centering around the middle of the country where we don’t have a lot of demand. You have a lot of cheap gas fighting for this market,” BTU Analytics senior energy analyst Jason Slingsby said last month at a conference in Houston.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |