E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report

Sundance Bolts On Eagle Ford Acreage in $221.5M Deal with Pioneer

Denver-based Sundance Energy Australia Ltd. struck a deal with Pioneer Natural Resource Co. to buy almost 22,000 acres and 1,800 boe/d of production in the Eagle Ford Shale, bolting on to an existing leasehold in South Texas.

The pure-play Eagle Ford player agreed to pay $221.5 million for the leasehold, which runs through McMullen, Atascosa, LaSalle and Live Oak counties. The transaction would give Sundance 56,600 total acres in the play, with an inventory of 716 gross undrilled locations.

“This acquisition represents a compelling, highly accretive opportunity to continue our strategy of aggregating assets in the Eagle Ford,” said CEO Eric McCrady.

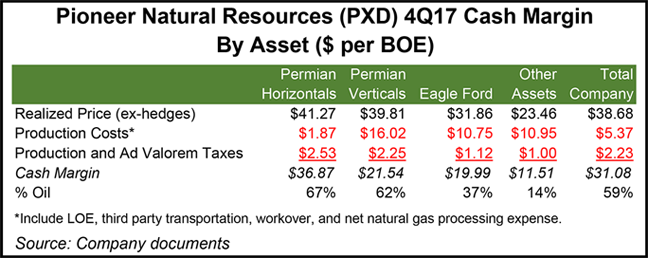

Pioneer last month announced it would put most of its resources going forward into the Permian Basin and planned to sell nearly all “non-Permian” projects, including in the Eagle Ford, Raton Basin and West Texas Panhandle.

Sundance, which began in 2013, at one time had a larger U.S. onshore inventory, but it has since sold and traded acreage in other basins to build its position in the Eagle Ford.

Once the Pioneer acquisition is completed, Sundance estimated its pro forma net proved reserves would total about 87.7 million boe, with probable reserves estimated at 149.3 million boe.

Sundance has been listed on the Australian Securities Exchange since 2005, but its primary focus has been in the Eagle Ford. The company also trades on Nasdaq under “SNDE.”

Sundance also announced it is raising $260 million in equity, with more than 370 million shares to be offered in the initial placement at 5.9 cents/each to raise about $17.2 million. It also is undertaking a one-for-one accelerated entitlement offer by issuing 1.2 billion shares to raise another $58 million. The entitlement offer is underwritten.

“The funding provides ample liquidity to execute a two-rig development program that should result in significant growth in production, cash flows and net asset value per share,” McCrady said.

In addition to the equity funding, Sundance is refinancing its existing debt facilities and has entered into a syndicated institutional term loan to raise $250 million in part to extinguish an existing term loan of $125 million and a reserve-based lending facility of $67 million.

The Sundance sale whittles Pioneer’s portfolio, but for now it remains a substantial Eagle Ford player. Pioneer has since 2010 operated the Eagle Ford acreage with India’s Reliance Industries Ltd., which has working interests (WI) in almost half the leasehold.

“This package represents the 10,500 net acres (at 50% WI) Pioneer has marketed for a year, and is separate from the remaining 59,000 net acres focused in DeWitt, Karnes and Live Oak counties for which data rooms will open this year,” said Tudor, Pickering, Holt & Co. (TPH) analysts. “It is good to see this level of undeveloped value, as we carried no value for this acreage in our recent Pioneer Eagle Ford valuation analysis, representing a positive read-through for other upcoming deals in the basin…”

Pioneer still plans to unload the rest of its Eagle Ford acreage. Producers also expected to sell Eagle Ford packages include BHP Billiton Ltd. and Devon Energy Corp., TPH noted.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |