Markets | NGI All News Access | NGI Data

Bearish Storage Miss Sees Natural Gas Futures Continue Slide; Cash Mixed

Natural gas futures fell a nickel Thursday following an Energy Information Administration (EIA) storage report that missed to the bearish side of expectations. In the spot market, most regions saw small day/day adjustments as points in New England and California continued their recent volatility; the NGI National Spot Gas Average climbed 8 cents to $2.70/MMBtu.

The April contract slid 5.0 cents Thursday to settle at $2.681. May settled at $2.712, down 4.7 cents on the day. A good chunk of the selling Thursday transpired shortly after EIA rolled out its weekly storage inventory report. Prices sold off to as low as $2.664 before climbing into the settle.

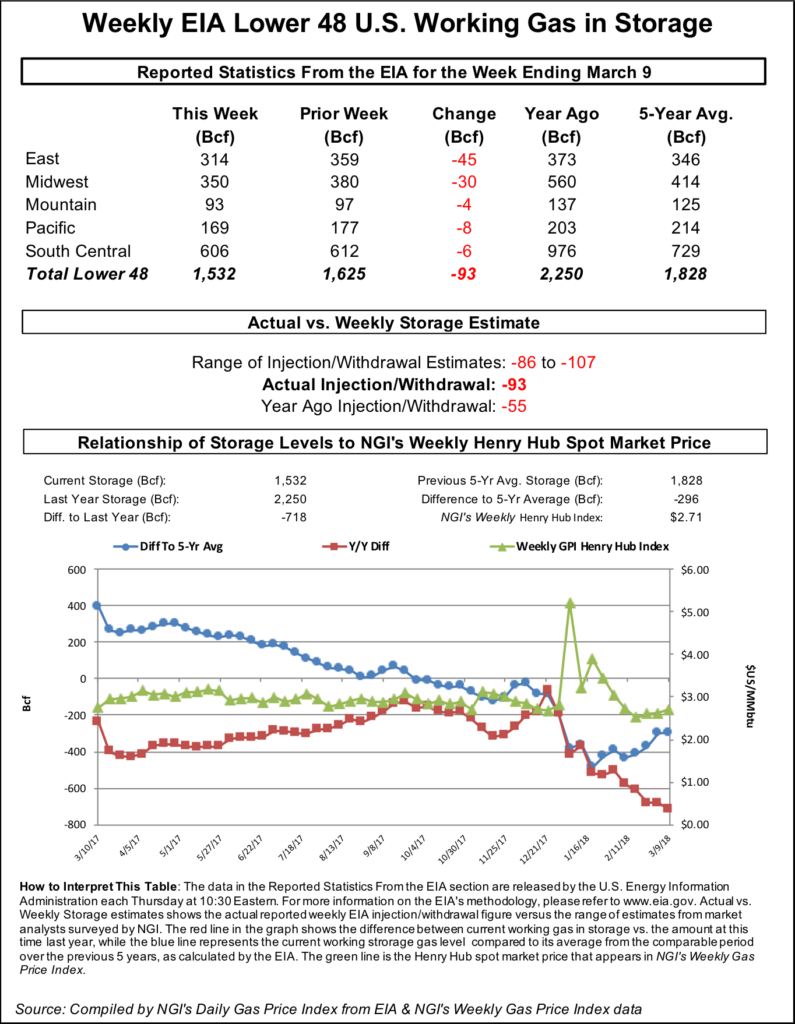

EIA reported a 93 Bcf withdrawal from U.S. gas stocks for the week ending March 9, tighter than the 55 Bcf withdrawn a year ago and close to the five-year average withdrawal of 97 Bcf. Last week, EIA reported a 57 Bcf withdrawal for the week ending March 2.

As the figure crossed trading desks at 10:30 a.m. EDT, the April contract promptly sold off around 3 cents, slipping from $2.730 to around $2.695-2.700. By 11 a.m. EDT, April was trading around $2.685, down about 4.5 cents from Wednesday’s settle.

Prior to Thursday’s report, the market had been looking for a withdrawal slightly tighter than the actual number.

A Reuters survey of traders and analysts had on average predicted a 96 Bcf withdrawal, with responses ranging from -86 Bcf to -107 Bcf. OPIS analysts had predicted a 96 Bcf withdrawal, citing higher demand from the recent winter weather in the Northeast. Stephen Smith Energy Associates had forecast a 99 Bcf draw, while Kyle Cooper of IAF Advisors had called for a 101 Bcf withdrawal.

Intercontinental Exchange EIA storage futures settled at -100 Bcf Wednesday for this week’s report.

Total working gas in underground storage in the Lower 48 ended the week at 1,532 Bcf, versus 2,250 Bcf a year ago and five-year average inventories of 1,828 Bcf. The year-on-year storage deficit increased week/week from -680 Bcf to -718 Bcf, while the year-on-five-year deficit narrowed slightly from -300 Bcf to -296 Bcf, EIA data show.

By region, the largest withdrawal came in the East region at 45 Bcf, while 30 Bcf was pulled in the Midwest. The South Central region saw a 6 Bcf withdrawal for the week, 3 Bcf from salt and 3 Bcf from nonsalt. In the Pacific, 8 Bcf was withdrawn, while 4 Bcf was withdrawn in the Mountain region, according to EIA.

The strip showed “signs it may want to head higher” Thursday morning “before a bearish EIA print pulled prices lower,” Bespoke Weather Services said. “Through much of the morning summer contracts were leading, indicating concerns about balance and limited storage were supporting prices more than minor overnight gas-weighted degree day additions.

Those concerns “were quickly eliminated with an EIA report that was modestly less tight than expected, though there is a chance that the looser print was at least partially caused by widespread power outages across the East last week from multiple nor’easters,” the firm said. “…Despite the losses, prices recovered yet again on a back-led rally into the settle, as we still see the market tight enough for $2.65-2.68 support to hold into the weekend even with a less impressive print Thursday.”

Afternoon weather guidance was also supportive, Bespoke said, noting some heating demand additions in the European model. “We see the potential for one more cold shot at the end of March should the Pacific cooperate, which would allow us to still see stockpiles approach the 1.3 Tcf level by the end of the withdrawal season.”

Analysts with Jefferies LLC said Thursday they expect Lower 48 inventories to exit March at around 1.4 Tcf.

“Storage is likely to enter the refill season around 33% below last year, when storage volumes never dipped below 2 Tcf,” the Jefferies analysts said. “In 2017, 1.7 Tcf was injected into storage to reach 3.8 Tcf by the end of October, roughly in-line with the five-year average. In order to reach 3.8 Tcf of storage prior to Oct. 31, the U.S. will need to inject around 3 Bcf/d more in storage than 2017 injections.”

The market will have more production to tap as injection season ramps up, according to Jefferies.

“After production growth flattened in the back half of February, it has moved slightly higher in March, averaging 77.6 Bcf/d month-to-date, up 0.3 Bcf/d from the prior month average,” the analysts said. “Supply has now gained around 4.2 Bcf/d since October 2017 and is up 6.2 Bcf/d year/year. Northeast production has averaged 27.1 Bcf/d in March month-to-date, in-line with the December 2017 record high.

“Total demand is up 8.4 Bcf/d year/year and down only 3.3. Bcf/d sequentially. The year/year demand increase has been driven by higher residential/commercial (res/com) demand,” up 4.4 Bcf/d, as well as liquefied natural gas (LNG), up 1.5 Bcf/d, power generation, up 1.3 Bcf/d, industrial, up 0.6 Bcf/d, and exports to Mexico, up 0.4 Bcf/d, according to the firm.

Prior to Thursday’s EIA report, Tudor, Pickering, Holt & Co. (TPH) analysts observed that “despite wintry weather in the northeast, heating degree days (HDD) are coming in well below five-year norms, indicating a weather-adjusted market undersupply of more than 3 Bcf/d.

“While this level of undersupply could be taken as a bullish indicator, the commodity hasn’t responded in kind, and Henry Hub has seen a precipitous decline (over 25%) since late January,” TPH analysts said.

“Though demand levels from cold weather patterns could bolster price support for the balance of March, we see supply beginning to outpace demand mid-year” based on an estimated 700 MMcf/d of incremental associated gas production out of the Permian Basin, additional pipeline takeaway out of the Northeast coming online in the second quarter and “warmer weather reducing production constraints in the Rockies and the Northeast.”

Genscape Inc. said Thursday that “currently traded forward curves for gas, crude, natural gas liquids and LNG are pricing end-of-winter inventories at 1,342 Bcf, and end-of-summer is priced to have slightly more than 3,700 Bcf in the ground.

“Oil price movements continue to exert notable influence on our Spring Rock production forecasts, which continue to show more than 7.6 Bcf/d summer-on-summer growth, helping allay concerns about the relatively low end-of-winter storage inventories,” the firm said.

In the spot market Thursday, points in the constrained New England market continued on their upward trajectory amid lingering effects from this week’s winter storm.

“Gas demand remains supported by slightly colder-than-normal temperatures associated with the nor’easter parked over New England,” Genscape said. “The remnants of the storm are expected to keep temperatures low, and even push wind-chills to as much as 20 degrees below normal into early next week.

“Adding to gas price pressure was a brief spike in ISO New England (ISONE) power prices,” the firm said. “At one point Wednesday, prices touched $2,000/MWh due primarily to the loss of about 2,600 MW of supply from Quebec, forcing makeup generation to come from inside ISONE. Simultaneously, the market’s Pilgrim nuclear plant remains offline, so that 55% of ISONE generation is now coming from gas.”

Algonquin Citygate surged $1.52 to average $7.37. This week’s gains have set a new 30-day high at Algonquin, where prices have risen to their highest level since averaging $8.10 on the Feb. 7 trade date, Daily GPI data show.

Elsewhere in the Northeast, Iroquois Zone 2 jumped 18 cents to $3.08, while Transco Zone 6 New York shaved off 2 cents to average $2.81.

In its one- to seven-day outlook Thursday, NatGasWeather.com called for “snow showers and gusty winds [to] linger over the Northeast, only to be enhanced by a strong reinforcing cold shot Thursday night through Saturday.

“The West will see a barrage of weather systems that bring heavy rain and snow, along with colder than normal temperatures,” the firm said. “The central and southern U.S. will be mostly mild to warm, with highs of 60s to lower 80s.”

In California, prices at SoCal Citygate eased further Thursday as other nearby points gained.

Demand on Southern California Gas Co.’s (SoCalGas) system “continues inching up with more gains expected as the coldest of this week’s forecast temperatures are still to come,” Genscape said Thursday. “By Friday, temperatures in the LA Basin are forecast to dip to as much as 10 degrees below normal. SoCalGas system demand is 0.3 Bcf/d stronger Thursday at 2.8 Bcf/d and should crack the 3 Bcf/d mark Friday before retreating slightly with the weekend and a gradual return to normal temperatures by Monday.”

After spiking above $5 earlier in the week, prices at SoCal Citygate retreated to $3.24 Thursday, down 18 cents on the day but still a substantial premium compared to the rest of the region. Other nearby points gained. SoCal Border Average added 7 cents to $2.30, while Southern Border PG&E climbed 16 cents to $2.02.

Further upstream, Transwestern San Juan added 12 cents to $1.90, while El Paso non-Bondad jumped 20 cents to $1.96.

Price action was muted throughout much of the Lower 48 after widespread selling on Wednesday. Henry Hub added a penny to $2.67, while Houston Ship Channel lost a penny to end at $2.72.

“Total U.S. consumption levels dropped a rather significant 4.8 Bcf on the day to 77.3 Bcf” for Thursday, OPIS analyst Luke Larsen said. “Residential/commercial (res/com) demand led declines by dropping more than 3.1 Bcf on the day. The majority of that loss was showing up in the Northeast as res/com measured 12.76 Bcf, which was down almost 1.9 Bcf from Thursday.

“The Southeast region’s res/com also dropped 1.35 Bcf for Thursday as it measured 2.43 Bcf, which was the lowest level of the work week.”

OPIS was calling for demand to pick up Friday to around 80.58 Bcf before falling to around 75 Bcf/d over the weekend, Larsen said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |