Natural Gas Futures Retreat as Late March Seen Milder; SoCal Down After Spike

Natural gas futures sold off more than a nickel Wednesday as forecasts turned milder for late this month, taking some of the edge off generally supportive March cold. In the spot market, a big drop at SoCal Citygate led the way lower as points fell across most of country; the NGI National Spot Gas Average tumbled 13 cents to $2.62/MMBtu.

The April contract settled at $2.731, down 5.5 cents on the day after trading as low as $2.710. May settled 5 cents lower at $2.759. Prior to the opening bell, April had already dropped around a nickel from Tuesday’s settle as overnight weather models advertised milder conditions for the last week of March.

The midday Global Forecast System model “flipped back a little colder through March 25, but was still milder/bearish trending March 26-28, favoring a warming ridge across the Midwest and East,” NatGasWether.com said Wednesday. “The data maintain colder trends for late this week as a reinforcing cold shot out of Canada sweeps across the Northeast. The data slo held colder trends over the eastern U.S. for the middle of next week as another weather system tracks through.”

The market’s relatively muted reaction to colder trends in the models earlier in the week seemed “problematic for the bulls,” and “when the overnight data showed milder trends, the markets seemed to react immediately,” the firm said. “…We still think bears might have been setting a trap on the colder trend, and quickly pushed it lower on the milder trend with prices again testing $2.72, the level where they broke out last week.”

Price Futures Group Senior Analyst Phil Flynn said production is “going to put that much more pressure on prices” as the market transitions into shoulder season.

“I think the clock is ticking on winter,” Flynn told NGI. “I think we’re getting to the point where the markets are turning the corner lower. Now it’s going to be interesting to see how the market reacts to a potential drop in demand when production is probably going to increase based on what we’re seeing in the rig counts.”

Goldman Sachs & Co. LLC released an analysis of 4Q2017 earnings this week that showed U.S. oil and natural gas producers increased their hedging activity in the last three months of 2017, and that 2018 hedging is already above the historical average.

“For natural gas, 2018 hedging rose to 47% from 40% post-3Q2017 results, remaining above the five-year season average of 44%,” said analysts led by Brian Singer.

The estimated 47% hedge for 2018 natural gas production “may actually understate the amount of production that is hedged in the minds of producers,” said NGI’s Patrick Rau, director of Strategy & Research. “We believe much of the expected gains in natural gas production in the U.S. this year will come from associated gas production, which of course can be an afterthought for producers.

“Not too many exploration and production companies are drilling the Permian Basin specifically for its natural gas yield, so any contribution they get from gas is gravy. The fact that crude oil prices are now $60/bbl-plus versus where they were just a few months ago is essentially locking in higher cash flows from associated production already.”

Meanwhile, estimates this week have the Energy Information Administration (EIA) reporting a natural gas storage withdrawal Thursday that could end up in the triple digits.

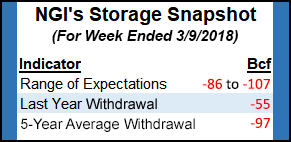

A Reuters survey of traders and analysts showed the market on average expecting the Energy Information Administration (EIA) to report a 96 Bcf withdrawal for the week ending March 9, with responses ranging from -86 Bcf to -107 Bcf. Last year 55 Bcf was withdrawn during the period, while the five-year average is a 97 Bcf withdrawal.

EIA reported 57 Bcf withdrawal for the week ending March 2.

Analysts with OPIS on Tuesday predicted a 96 Bcf withdrawal for the period, citing higher demand from the recent winter weather in the Northeast.

“Cold weather in the Northeast has driven above-average storage withdrawals in the East Region and widened the regional inventory deficit against the five-year average to an estimated 30 Bcf,” analysts with OPIS said in a note to clients. “Near-term weather forecasts continue to call for colder weather to persist through the current week, which would push regional withdrawals above average for a second consecutive week.

“…We currently expect U.S. Lower 48’s 299 Bcf deficit to approach 350 Bcf by the end of this week and fall slightly to less than 360 Bcf by the end of March,” the analysts said. “This deficit would bring the end-of-season inventory to 1.34 Tcf, which would be the third lowest inventory level of the past 10 years and add an additional 3 Bcf/d of summer injection demand year/year.”

Stephen Smith Energy Associates on Monday forecast a 99 Bcf draw for the week ending March 9, versus a seasonally normal draw of 12 Bcf based on 2006-2010 norms. Kyle Cooper of IAF Advisors called for a 101 Bcf withdrawal. Intercontinental Exchange EIA storage futures settled at -100 Bcf Tuesday for the upcoming report.

Large portions of the spot market sold off around a dime Wednesday, mirroring the decline at Henry Hub, which gave up 10 cents to average $2.66.

Most points in the Northeast and Mid-Atlantic pulled back following the latest nor’easter to sweep through the region this month, though Algonquin Citygate and Portland Natural Gas Transmission System (PNGTS) continued to drive higher, each adding 71 cents to end at $5.85 and $6.18, respectively.

Genscape Inc. analyst Molly Rosenstein attributed the standout gains at Algonquin and PNGTS to “a major power import disruption Wednesday that boosted prices of generation in that region.”

In the West, SoCal Citygate pulled back after spiking earlier in the week, plummeting $2.07 to average $3.42.

Genscape had pointed to colder weather, depleted storage and new import capacity restrictions through Southern California Gas Co.’s (SoCalGas) Southern Zone as factors potentially driving price volatility this week. But that “volatility may be muted by some steps announced by SoCalGas” this week, the firm told clients Wednesday.

“SoCalGas system demand is at 2.8 Bcf/d, about a 0.6 Bcf/d increase from the start of the week, and is forecast to ramp sharply starting later Wednesday as temperatures across the region fall to around 10 degrees below seasonal norms,” Genscape said. “SoCalGas is taking steps to ease stress on the system, though. Imports from Mexico at Otay Mesa have resumed after a one-day shutdown.

“SoCalGas also posted notice stating they will increase Southern Zone capacity to 900 MMcf/d. While this remains well below the normal operational level of 1,256 MMcf/d, it is roughly 170 MMcf/d above the last few days’ capacity limit,” the firm added. “SoCalGas also noted they are postponing the shut-in of the Honor Rancho storage facility, which may ease Citygate basis by diversifying storage options.”

SoCal Border Average dropped 39 cents to average $2.23, while El Paso S. Mainline/N. Baja shed 38 cents to $2.29.

Further upstream, prices continued to weaken in West Texas. Transwestern dropped 15 cents to $1.70, while El Paso Permian shed 12 cents to $1.71.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9966 |