Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Best Days Still Ahead for Bakken, Says North Dakota DMR Chief

Recent predictions that the Bakken Shale may be nearing its peak are wrong and, in fact, production in North Dakota may establish a record above 1.3 million b/d by the end of the year, according to Department of Mineral Resources (DMR) director Lynn Helms.

During a webinar to discuss the latest monthly production statistics, Helms said production in January did not decline nearly as much as expected despite severe winter conditions. Based on rig counts increasing outside of the Bakken core area, oil production should again begin surge this summer, he said.

“I think by mid-year we will be producing more oil than we’ve ever produced in North Dakota,” he said. “I’m predicting we will hit 1.3 million b/d by the end of the year, well above our record” of 1.22 million b/d in December 2014.

A lot depends on favorable weather and road conditions needed to help facilitate the ramp up in drilling. “We’re starting from a much better place this year, because I really expected a much larger production drop in January.”

During January North Dakota oil production was 36.4 million bbl (1.17 million b/d), down from 36.6 million bbl (1.18 million b/d) in December. January natural gas production also fell slightly to 64.1 Bcf (2.06 Bcf/d) from 64.6 Bcf (2.08 Bcf/d).

Helms was asked about comments earlier this month at the CERAWeek by IHS Markit conference in Houston by Centennial Resource Development Inc. CEO Mark Papa, who suggested the Bakken and Eagle Ford shales may “soon be past their prime.” Papa previously ran EOG Resources Inc., which he helped lead into the Bakken and Eagle Ford. He said producers in the Bakken and Eagle Ford would be moving beyond the Tier One core area to acreage that would take more money and better technology to produce as much.

Helms said he “strongly disagrees” with Papa’s assessment, calling him a “very smart individual, but one who hasn’t been involved in the Bakken play for several years.

“When we look at the numbers, we still have only 14,000 producing wells, so we’re only at the end of the first period if this was a football game, or in the third inning of a baseball contest. The concern would be if we stay in the core area for another five years, and if that happened, I would have to agree” with Papa’s assessment, “but that’s not what is happening. Oil prices are higher and they are improving and we’re seeing a lot of rigs move outside the tight core area.”

Production in the Bakken core will not be “exhausted anytime soon.”

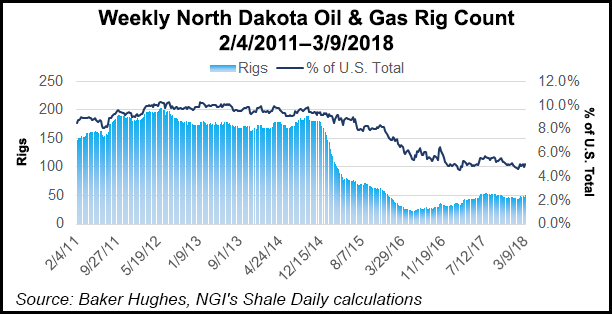

The current rig count as of Tuesday in the North Dakota Bakken was 59, compared to 52 in December. It was 56 in January and 57 in February. Current levels are still 74% lower than the all-time high of 218 rigs in May 2012, but Helms said the average drilling rig is “twice as efficient” as it was four years ago and three times more efficient than in 2012.

Bakken sweet crude averaged $54.08/bbl in January but the price has fallen in recent weeks, hitting an average $50.98/bbl in February and $49.25/bbl on Tuesday, according to the monthly report. West Texas Intermediate (WTI) crude prices have remained above $55/bbl for more than 90 days, which Helms viewed as helping increase rig counts, which he expects will continue.

Bakken operator plans currently “are to add five-to-10 rigs in the second and third quarters this year, depending on work force and infrastructure constraints,” Helms said.

The volumes of flared wellhead natural gas rose by about 34 MMcf/d in January, or 15% of the associated gas produced that month, he said. At 85% capture, those amounts meet the current state goal, but that threshold is rising to 88% in the fourth quarter. More takeaway infrastructure is needed for producers to reach upcoming higher capture goals, Helms said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |