Cold March Becoming More Certain; NatGas Forwards End Week in Black

For all the talk about the disappointing winter, some late-season cold this month lifted natural gas April forward prices up an average 8 cents from March 2-8, according to NGI’s Forward Look.

Nymex futures led the way, with small increases of less than a nickel on most days as weather models continued to point to mostly colder-than-normal conditions through at least March 25. In fact, just as one strong weather system was set to exit the Northeast late Friday into Saturday, another one was expected to arrive early in the week with another round of rain and snow, although this time advancing deeper into the Southeast.

A mild ridge was expected to follow the cold weather system, expanding over the eastern half of the United States next weekend (March 16-19), although not nearly as impressive/warm and the duration not nearly as long by almost one and a half days, according to NatGasWeather. The data has become “solidly on board” with colder systems returning across the northern half of the country March 20-25 for stronger-than-normal national demand, although trending slightly milder in the Friday midday data, it added.

Given the cold outlook, Nymex April gas futures ended the March 2-8 period 6 cents higher at $2.756, while May rose 6 cents to $2.787.

The last gasp of winter is certainly helping keep prices up — or at least not falling — from a fundamental standpoint, and technicals have been constructive as well, according to NGI’s Patrick Rau, director of Strategy and Research. “April has been trading in an upward sloping channel since mid-February, and that has been pretty resilient.”

The fact that the most recent weather model runs indicate it’s not out of the question that nearly 70% of the United States could be dominated by below-normal temperatures later this month are certainly helping the bulls’ cause. But NatGasWeather expected more as it viewed the bulls not taking full advantage of the colder trending data. After all, prices hit the skids beginning Thursday, when the April contract slipped 2 cents.

However, Rau said the prompt month was probably due for a correction, since April had been flirting with the top of the upward sloping channel, which also is at the top of the 20-day Bollinger Band. “Not to mention that April was clearly overbought on a slow stochastics basis,” he said.

Indeed, the Nymex April gas futures contract remained in the red on Friday, settling 2.4 cents lower at $2.732.

“Time hasn’t quite run out for bulls, especially with the end of the forecast cold weighted, but it sure seems they would need to show some strength soon as eventually the pattern isn’t going to look as good/cold,” NatGasWeather said.

How weather patterns trend over the weekend could dictate early week trade, the forecaster said, where the onus is on cold holding over the northern half of the United States. “The failure to do so and bears could be waiting to take advantage, hoping to see the first signs of widespread spring-like conditions.”

And if spring doesn’t come around for a few more weeks, bears still have robust production to hang their hat on. Lower 48 dry gas production continues to hover around the upper 70 Bcf range, coming in Friday at around 78 Bcf, which is down slightly on the week but still above the 30-day average.

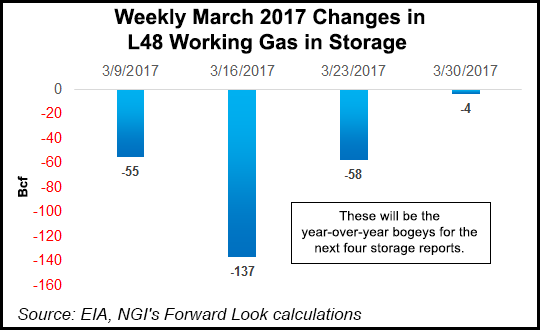

With additional production growth expected this year, current below-average storage inventories also don’t appear to be a concern for the market. The U.S. Energy Information Administration reported a 57 Bcf withdrawal for the week ending March 2, matching the year-ago withdrawal of 57 Bcf and looser versus a five-year average pull of 129 Bcf. The previous week, the EIA reported a 78 Bcf withdrawal.

Total working gas in underground storage stood at 1,625 Bcf as of March 2, according to EIA. That’s versus 2,305 Bcf a year ago and five-year average inventories of 1,925 Bcf. The current year/year storage deficit held week/week at -680 Bcf, while the year-on-five-year deficit shrank from -372 Bcf to -300 Bcf, EIA data show.

When compared to degree days and normal seasonality, a -57 Bcf draw appears tight by -0.7 Bcf/d versus the prior five-year average, according to Genscape Inc. The Louisville, KY-based data and analytics company noted the significant growth in residential/commercial (res/com) demand per heating degree day (HDD) that it has seen over the past few years.

“This phenomenon was the main driver behind extremely tight stats over the coldest weeks this winter; however, this winter is approaching its expiration date, and balances have been trending looser as weekly HDD totals have dwindled along with the added res/com demand,” Genscape said.

Mobius Risk Group analysts agreed the weekly EIA storage reports continue to imply strong year/year demand growth this winter, and said how production growth and demand unfold during the next few months could lead to some unexpected price swings.

If production stays flat or only grows modestly through the first half of the summer, and the storage reports continue to imply year/year demand growth, “summer 2018 gas contract prices could move higher without increasing the risks of late summer storage containment,” the Houston-based company said.

On the other hand, if production begins to grow quickly again this summer, or if the demand growth witnessed this winter does not carry through to the summer, the October 2018 and November 2018 contracts could trade below the summer of 2019 contracts, it said.

As of Thursday (March 8), the Nymex balance of summer (May-October) contract stood at $2.86, up 7 cents from March 2. The winter 2018-2019 strip was at $3.04, while the summer 2019 was at $2.70.

Already, several market observers have pointed to slowing production growth in the second half of 2018. “This would likely take some of the downward pressure off gas, especially if we have a hot summer,” Rau said.

Midcontinent Posts Double-Digit Gains

Midcontinent gas prices have been in the news lately mostly because of their ever steepening discount to benchmark Henry Hub thanks to supply growth in and around the region, but the week told a different story as the cold weather on tap lent some much-needed support to prices. Genscape projected Midcontinent demand to peak at 3.65 Bcf/d on March 12 and then average 3.17 Bcf/d for the March 12-16 week, up from 3.02 on March 9.

That was enough to send prices at Northern Natural-Demarc up 15 cents from March 2-8 to $2.453. May climbed 14 cents to $2.32, while the balance of summer (May-October) rose 9 cents to $2.34, according to Forward Look. Northern Natural-Ventura April was up 11 cents to $2.455, May was up 12 cents to $2.347 and the balance of summer (May-October) was up 8 cents to $2.37.

At Panhandle Eastern, April climbed 12 cents during that time to $2.069, as did May, which rose to $2.065. The balance of summer (May-October) was up 11 cents to $2.13. NGPL-Midcontinent April climbed 12 cents to $2.227, May picked up 11 cents to reach $2.238 and the balance of summer (May-October) tacked on 11 cents to hit $2.28.

Farther West, forward prices in Southern California bounced back as cold weather lifted demand in the state and even prompted Southern California Gas Co. (SoCal Gas) to withdrawnatural gas supplies from its hobbled major underground storage facility Aliso Canyon.

On March 2, the Sempra Energy gas-only utility requested permission from the California Public Utilities Commission (CPUC) to begin tapping Aliso for supplies to protect and preserve the volumes remaining in its other three storage facilities as colder-than-normal weather hit the region, slashing the maximum deliverability from the three operable fields by 240 MMcf/d to under 1 Bcf/d.

As of March 2, SoCal Gas officials told the CPUC the utility was down to 28.2 Bcf of storage inventory collectively at the three other facilities — Playa del Rey, Honor Rancho and La Goleta.

With the region grappling with supply and pipeline restrictions, prices across the forward curve got a boost. At SoCal City-gate, April prices jumped 15 cents from March 2-8 to reach $2.561, May shot up 12 cents to $2.524 and the balance of summer (May-October) rose 11 cents to $2.73, Forward Look data show.

But milder weather is on the way, and Genscape showed demand falling to an average 6.048 Bcf/d during the March 12-16 work week, down from 6.23 Bcf/d on March 9. The following week — March 19-23 — demand is expected to average even lower at 5.99 Bcf/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |