EIA Storage Bearish Versus Five-Year; Natural Gas Futures Inch Lower

Natural gas futures sold off a few cents on Thursday as the Energy Information Administration (EIA) reported a weekly storage withdrawal that was bearish versus the five-year average, although the 15-day weather outlook remained supportive overall for a market seen as generally balanced.

Spot prices posted broad-based declines Thursday, including in the Northeast, where points moderated as another nor’easter swept through the region. The NGI National Spot Gas Average fell 12 cents to $2.54/MMBtu.

The April contract settled at $2.756 Thursday, down 2.1 cents from Wednesday’s settle. May settled 1.9 cents lower at $2.787.

Thursday’s EIA storage data aligned with market expectations, and following the report prices traded in a tight range after selling off to as low as $2.737 earlier in the trading session.

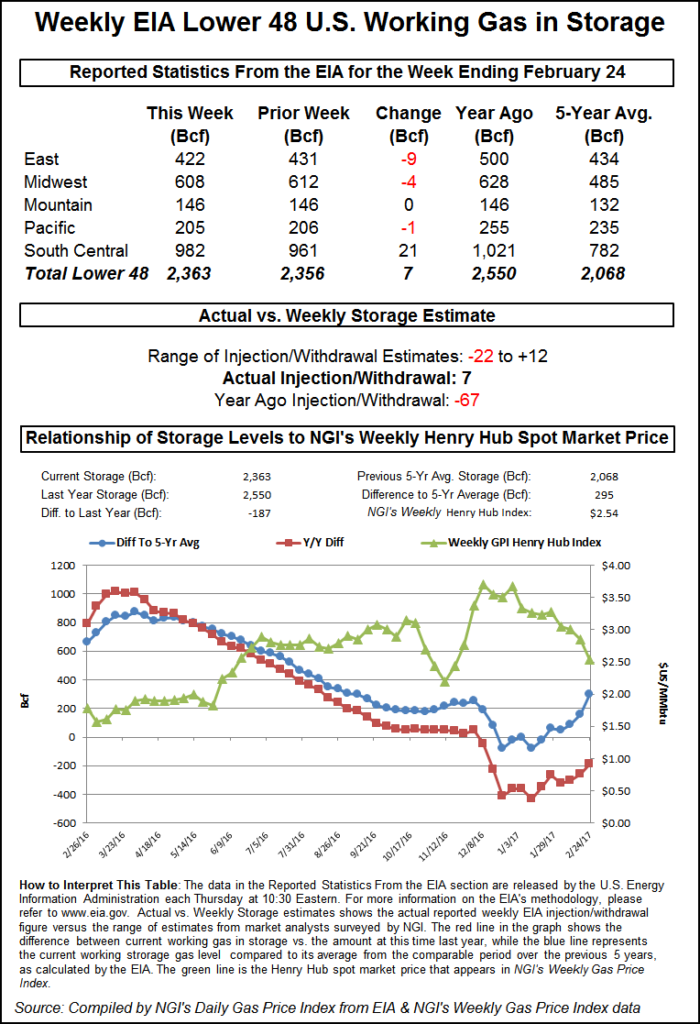

EIA reported a 57 Bcf withdrawal from U.S. gas stocks for the week ending March 2, matching the year-ago withdrawal of 57 Bcf and looser versus a five-year average pull of 129 Bcf. Last week, EIA reported a 78 Bcf withdrawal.

In the minutes following the 10:30 a.m. EDT release of the final number, the April contract hovered around $2.752, within a penny of where prices stood prior to the report. By 11 a.m. EDT, after briefly moving as high as $2.764, April was trading around $2.750, down about 2.5 cents from Wednesday’s settlement.

Prior to Thursday’s report, estimates had pointed to a withdrawal that was close to the actual figure.

A Reuters survey of traders and analysts had on average predicted a 58 Bcf withdrawal for the week. Responses had ranged from -44 Bcf to -69 Bcf. A Bloomberg survey had showed a median -58 Bcf and a range of -50 Bcf to -69 Bcf. OPIS, through its newly formed analytics division (formerly PointLogic Energy), had estimated a 61 Bcf withdrawal for the week. Stephen Smith Energy Associates had called for a 57 Bcf withdrawal. Intercontinental Exchange storage futures had settled at -58 Bcf Wednesday.

Total working gas in underground storage stood at 1,625 Bcf as of March 2, according to EIA. That’s versus 2,305 Bcf a year ago and five-year average inventories of 1,925 Bcf. The current year/year storage deficit held week/week at -680 Bcf, while the year-on-five-year deficit shrank from -372 Bcf to -300 Bcf, EIA data show.

By region, the largest withdrawal came in the East at 23 Bcf, followed by 18 Bcf withdrawn in the Midwest. The Pacific saw a 12 Bcf pull for the period, while 5 Bcf was withdrawn in the Mountain region. The South Central region finished nearly unchanged for the week, with 6 Bcf injected into salt offsetting 6 Bcf pulled from nonsalt, according to EIA.

Bespoke Weather Services attributed Thursday’s price action to “modest” overnight heating demand losses in the weather outlook “and an EIA print that hit most market expectations but indicated week/week and seasonal loosening.

“With prices having ground higher over the last few weeks off structural tightness it would appear that the market has at least found a decent balance here, and later contracts along the strip provided significant support to keep the front of the strip from dipping back below $2.75 for any significant amount of time, indicating a relative fair value at these price levels,” the firm said.

Bespoke said it expects $2.72-2.75 support to hold through the weekend “unless we lose a significant amount of heating demand on overnight guidance.”

Analysts with Societe Generale on Thursday said they’re bullish on 2018 U.S. gas prices, “although our near-term price conviction is soft given the lack of visibility around the production growth rate over the next eight months, as well as weather.”

The analysts pointed to well freeze-offs at the start of the year in key natural gas producing regions that dented “supply growth trends. In addition, we expect winter 2017/18 to result in a 2.2 Tcf draw, leaving storage at end-March at around 1.55 Tcf. This would be the second largest net storage draw since 2010/11. The storage start to the 2018 injection season…will likely be 200 Bcf below the five-year average.

“Finally, total U.S. demand should increase by approximately 6%, and growth in the liquefied natural gas (LNG) export market is a significant driver,” the Societe Generale team said. “As a result, we forecast second quarter 2018 prices at $2.89/MMBtu and third quarter 2018 at $3.00/MMBtu, both above current forward prices.”

NatGasWeather on Thursday reported “no major changes” in the latest weather data. “After one strong weather system and cold shot gradually exits the Northeast Friday, another one will arrive into the East early next week with another round of rain, snow and wind, while also advancing deeper into the Southeast with near freezing temperatures.”

After a mild period March 16-19, “the data has become solidly on board with colder systems returning across the northern and eastern U.S. March 21-25 for stronger than normal national demand as winter looks to hold on past the official end date.”

After recent cold, the next two storage reports could “come in a bit larger than the five-year, and with the 10-15 day forecast becoming cold-weighted, there’s plenty of reason for markets to use weather as an excuse to push prices higher, if they choose,” NatGasWeather said. “…We aren’t convinced bears aren’t just setting a trap, or waiting for the first signs of milder spring patterns to show up in the maps to push prices lower.”

In the spot market, moderate temperatures accompanied falling prices across most regions, while East Coast points pulled back after surging earlier in the week ahead of inclement weather that hammered the region Wednesday and Thursday.

Algonquin Citygate shed 43 cents to average $3.77, while Transco Zone 6 New York gave up 30 cents to $2.79.

In Appalachia, Dominion South added 10 cents to average $2.40, while Columbia Gas added a penny to $2.51.

“Structural demand in the Appalachian region is on pace to register its second winter of growth, and one of its largest winter-on-winter gains since Winter 2013/14,” Genscape told clients Thursday. “Although there are more than 20 days left this winter, winter-to-date weather-normalized demand in Appalachia is on pace to average 13.6 Bcf/d. If realized, that will mark a 0.61 Bcf/d gain from last winter’s weather-normalized levels, and sustains a trend that has been in the works for many years.”

Structural demand in the region has increased seven of the past nine winters, according to the firm, with the largest gains occurring in the power burn sector.

“The gains have been facilitated by new pipeline infrastructure to move regional production growth into demand markets to serve load growth, fuel switching in the residential heating space and fuel switching in the power sector,” Genscape said.

In the West, spot prices sold off by double digits across the Rockies and California amid warmer temperatures throughout much of the region, but NWS was calling for snowfall Friday in higher elevations in the Pacific Northwest and northern Rockies.

“Temperatures across the West will generally be somewhat above normal given the influx of Pacific air across the region,” NWS said Thursday. “The remainder of the country is expected to be dry and relatively mild with temperatures generally above normal. This will especially be the case across the central and southern High Plains, where temperatures will be as much as 10-20 degrees above normal.”

Genscape was forecasting demand in California and Nevada to total 5.96 Bcf/d Friday and around 5.3 Bcf/d over the weekend. That’s versus demand of 6.66 Bcf/d Thursday and a recent seven-day average of 7.57 Bcf/d.

Malin tumbled 23 cents to $2.18, while SoCal Citygate dropped 17 cents to $2.80 and SoCal Border Average gave up 17 cents to $2.27.

Further upstream in the Rockies, most points dropped around 20 cents, including Opal, which fell 20 cents to $2.18. It was a similar story in West Texas, where El Paso Permian gave up 24 cents to $1.83.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9966 |