Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report

Centennial’s Papa Says Eagle Ford, Bakken Already Long in the Tooth

Exploration and production guru Mark Papa, former chief of EOG Resources Inc. who now runs Centennial Resource Development Inc., this week threw a bit of shade on Lower 48 oil and gas optimists, warning that some of the onshore basins may “soon be past their prime.”

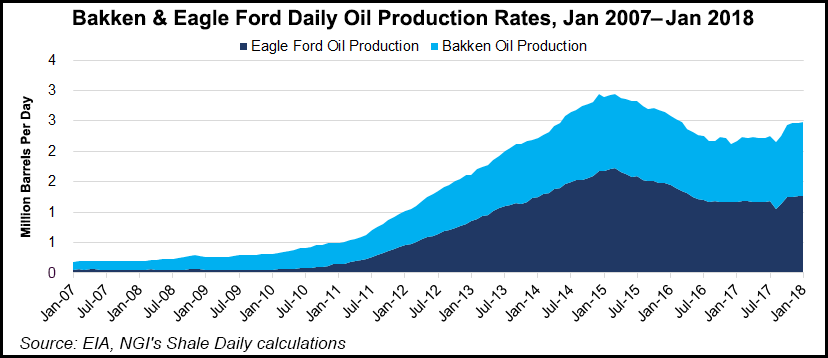

Speaking in Houston this week at CERAWeek by IHS Markit, Papa cited geologic concerns at two actively developed unconventional plays, the Eagle Ford and Bakken shales.

“I really view the Eagle Ford and the Bakken as approaching the point where they would soon be past their prime,” Papa said.

He also expressed some concern about the most active play in the nation, the Permian Basin. Overactivity in the three biggest oil basins could rapidly reduce output over the long-term, Papa told the audience. Nearly 80% of the 6.7 million b/d produced in the Lower 48 is from the Permian, Eagle Ford and Bakken.

Producers working the Eagle Ford and Bakken may soon have to start developing their acreage outside the Tier One areas, considered lower quality and higher cost, Papa said. The burden to U.S. production has surged beyond anyone’s dreams of a decade ago, but Papa said he worries that without some restraint, the basins may peter out moving to 2020.

“I think we’re approaching a sense of quality resource exhaustion” in the Eagle Ford and Bakken in particular. “A hot percentage of the Tier One geologic quality locations have already been drilled…I would say 70% of the good geologic locations have already been drilled.”

By some estimates, there is only around 30% of the Tier One areas left. The second and third tier shale and tight gas and oil will take more capital and better technology to pull out comparable reserves.

Producers have already completed the best wells, and now they are tightening up their capital programs. It’s not an ideal situation, said Papa. He said much the same during Centennial’s recent quarterly conference call, calling out critics who think it is “bad” for producers to outspend cash flow.

“The impression of U.S. shale as the big bad wolf is perhaps a bit overstated,” Papa said, referring to the annual oil outlook report issued by the International Energy Agency last Monday, which is forecasting the United States will surpass all other global producers.

“There are good geological spots in shale plays and weaker geological spots, and a lot of the good geological spots have already been drilled,” Papa said. “My theory is that you’ve got basically resource exhaustion that is beginning to take place.

“It’s no secret that you’ve only got three shale oil plays in the U.S. of any consequence…The rest of them don’t amount to a hill of beans.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |