Markets | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Turbulent NatGas Price Forecasting Continues: EIA Sees Henry Hub at $2.99/MMBtu in 2018

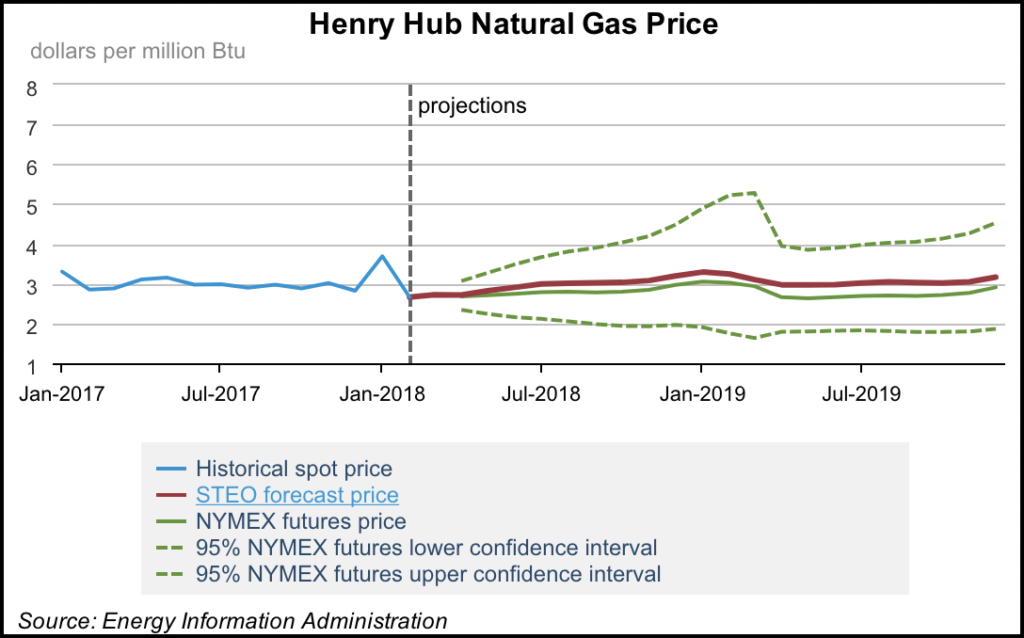

The roller coaster ride that has symbolized forecasting of 2018 Henry Hub natural gas prices continued Tuesday when the Energy Information Administration (EIA) said it expects record production to moderate the market, and prognosticated prices at $2.72/MMBtu this month, $2.99/MMBtu for all of 2018 and $3.07/MMBtu in 2019.

Last month, EIA said it expected Henry Hub prices to average $3.20/MMBtu in 2018. That was up 32 cents/MMBtu from its $2.88/MMBtu forecast in January.

Dry natural gas production, which averaged 73.6 Bcf/d last year, will average a record 81.7 Bcf/d in 2018 and will increase another 1.0 Bcf/d in 2019, EIA said in its latest Short-Term Energy Outlook (STEO). As a consequence, natural gas inventory levels will fully recover from last year’s low levels by next winter, according to EIA Administrator Linda Capuano.

“Following record high gas inventory withdrawals in early 2018, the short-term outlook estimates that inventories for March 2018 will total 1,481 Bcf, which represents a nearly 28% drop from March 2017. In fact, March 2015 was the last time inventories came close to that level,” Capuano said.

New York Mercantile Exchange contract values for June 2018 delivery traded during the five-day period ending March 1 suggest a price range of $2.16-3.49/MMBtu, encompassing the market expectation of Henry Hub prices in June at the 95% confidence level, EIA said.

The front-month natural gas futures contract for delivery at Henry Hub settled at $2.70/MMBtu on March 1, a decrease of 16 cents/MMBtu from Feb. 1.

“Warmer weather in the second half of January and in February contributed to the fall in natural gas prices,” EIA said. “U.S. population-weighted heating degree days averaged 12% below normal for the four weeks ending Feb. 22, which put downward pressure on natural gas prices throughout the month. The Henry Hub natural gas spot price averaged $2.66/MMBtu in February, $1.03/MMBtu lower than January.”

Historical and implied volatilities of gas prices both increased in January, as typically happens each winter, according to the STEO.

“Historical volatility reached 67% on Feb. 5, the highest level since January 2017, reflecting the price spikes at the beginning of January and significant price declines at the end of the month. Implied volatility, however, declined quickly at the end of January and fell to 26% on Feb. 28, the lowest implied volatility since June 2014. Implied volatility represents the market’s expectation about near-term price movements; as a result, the low natural gas price implied volatility may indicate that strong production growth will be sufficient to meet demand, despite inventories that are currently below their five-year average,” EIA said.

“Natural gas futures prices fell in the front-month contract, and substantial price decreases occurred in contracts several months into the future. These price declines significantly reduced the market-derived probability of the July 2018 Henry Hub futures contract expiring above $3/MMBtu; the probabilities fell from 42% at the beginning of the month to 28% on March 1.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |