Bearish February Weather Has Natural Gas Markets Looking for Shoulder (Season) to Cry On

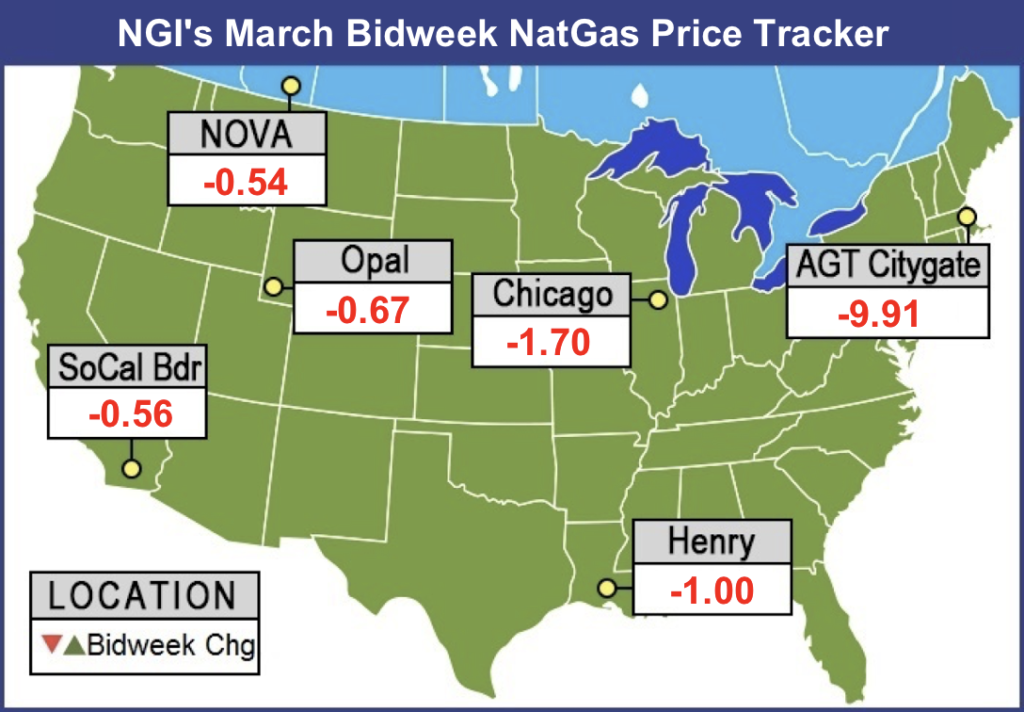

Forecasts for more Arctic chills during the month of February never panned out, and March bidweek traders responded by shifting into shoulder season mode a little early, recording significant natural gas price cuts across the board.

NGI’s March National Bidweek Average finished at $2.43/MMBtu, $1.80 lower than February 2018, but in a striking coincidence, on the nose to the penny with March 2017’s $2.43 bidweek average.

The steep drop in futures prices between the February and March contracts — reflecting the bearish impact of strong production and sustained periods of above-normal temperatures in the eastern half of the Lower 48 — seemed to pull the rug out from this month’s bidweek market. And coming in on par with March 2017 bidweek price levels lends natural gas bulls no traction, as the 2016-2017 winter is remembered as being no friend to those looking for increased gas demand.

The February contract rolled off the board at $3.631 after a sharp rally ahead of expiration. March never looked like carrying over that momentum, dropping steadily on disappointing February weather before eventually expiring at $2.639.

The $1 month/month loss at Henry Hub set the tone for widespread triple digit declines in March bidweek averages.

Losses were heaviest along the populated and pipeline-constrained East Coast — where frigid temperatures had sparked $100-plus price spikes in January. Algonquin Citygate traders hardly showed any concern for sustained March heating demand, as bidweek trades averaged $3.42, down $9.91 for the month. Transco Zone 6 New York tumbled $8.81 to $2.99, while Transco Zone 5 gave up $7.05 to average $3.

Western markets saw some below-normal temperatures in late February, and while prices in the Rockies and California fell month/month, points there generally gained ground on Henry Hub for March.

Northwest Sumas dropped 57 cents to $1.97, while Cheyenne Hub fell 55 cents to $2.15.

Meanwhile, at SoCal Citygate, where chilly temperatures and elevated demand caused spot prices to spike to $25-plus in late February, bidweek prices suggested the recent constraints aren’t expected to have a lasting price impact.

SoCal Citygate basis “has fallen under $1.00 for the first time in two weeks after setting a new record high” at $16.97 in late February, Genscape Inc. told clients Tuesday.

While demand on Southern California Gas Co.’s (SoCalGas) import-constrained system had started to moderate, Genscape analyst Joseph Bernardi also noted to NGI Wednesday that recent storage withdrawals could be easing supply concerns.

“The forecasts are all still colder than seasonal norms, but getting much closer to norms for this Friday and then again by early to middle of next week,” Bernardi said. “Also, it’s entirely possible that there’s some effect of SoCalGas establishing that it can meet this elevated level of demand (up to 3-4 Bcf/d) via massive storage withdrawals, thus diminishing any fear that may have been baked into last week’s price spike.”

As the calendar rolled over to March Thursday, the latest forecasts showed mixed signals for the heating demand outlook through the first half of the month.

NatGasWeather.com was calling for “stronger cold blasts tracking out of the central U.S. and into the East during the middle of next week and lasting through the following weekend. This will result in a period of stronger than normal national demand as much of the country experiences colder than normal conditions.

“However, the pattern March 12-16 continues to favor a mild ridge gaining ground over the central and southern U.S., eventually shifting into the eastern U.S.,” the firm said. As of Thursday’s midday data this shift was “slower in its development…thereby allowing cool air to linger along the East Coast a day or two longer to add several heating degree days.”

With the market’s focus shifting to injection season, the impact on end-of-March storage levels is likely to frame the price significance of any last gasps from Old Man Winter.

PointLogic Energy said in a two-season natural gas supply and demand forecast issued in late February that based on “lackluster weather” it expects end-of-March inventories of 1,388 Bcf. That’s 84 Bcf higher than the estimate it issued the month before.

“Prospects for another severe cold weather event are diminishing as the end of February approaches,” PointLogic said. “Cold weather in March is typically not as severe on a burn per degree basis as cold weather at the height of winter.

Societe Generale analyst Breanne Dougherty said in a recent note that the firm’s natural gas price outlook for the balance of 2018 is $3.03/MMBtu, higher than the current average of around $2.77/MMBtu.

“As reference, 2017 prices averaged $3.02/MMBtu, 2016 $2.55/MMbtu and 2015 $2.63/MMBtu. 2015 and 2016 prices came under pressure due to oversupply triggered largely by surging associated gas volumes and limited structural demand growth,” Dougherty said. “2017 saw a transition to fundamental tightening, but it was camouflaged by very mild weather.

“In 2018, year/year supply growth has to outpace demand growth this injection season to accommodate structural demand growth and bring storage to a comfortable position for winter 2018/19; current prices don’t reflect that concept,” she said. “Spring contracts are more reasonably priced at the moment given the downside price risk of shoulder seasons, but core summer contracts look undervalued in particular. Conviction is soft given potential for production outperformance.”

Dougherty said the firm is considering raising its 2018 production outlook and consequently lowering the price outlook, “but even a higher production scenario leaves first half 2018 open to periods of bullish sentiment.”

Meanwhile, analysts with Jefferies LLC said Thursday that production growth showed signs of stalling in late February.

“Production averaged 77.4 Bcf/d in February, up about 1.3 Bcf/d from January (a month impacted by freeze-offs early on) and up about 0.4 Bcf/d from the prior monthly high in December 2017,” the analysts said. “Production growth has slowed, as the second half of February averaged 77.3 Bcf/d, slightly below the first half of the month (77.4 Bcf/d). In the Northeast, production has yet to recover to December highs,” averaging 27.0 Bcf/d versus 27.2 Bcf/d in December.

The market may need to tap this higher production as it looks to make up for storage deficits to year-ago and five-year levels.

The Energy Information Administration (EIA) reported a 78 Bcf withdrawal for the week ending Feb. 23, which was tighter versus the 7 Bcf withdrawn a year ago, but looser than the five-year average pull of 118 Bcf.

Total working gas in underground storage stood at 1,682 Bcf as of Feb. 23, according to EIA. That’s versus 2,362 Bcf in the year-ago period and five-year average inventories of 2,054 Bcf. The year-on-year storage deficit increased week/week from -609 Bcf to -680 Bcf, while the year-on-five-year deficit shrank from -412 Bcf to -372 Bcf, EIA data show.

Prior to the 10:30 a.m. EDT release of the storage figure, the April contract on Thursday had been trading around $2.695. As the number crossed trading desks, April briefly shot up to as high as $2.731 before pulling back to around $2.670-2.680. By 11 a.m. EDT, April was trading right around $2.70, up about 3 cents from Wednesday’s settle.

Before the report, the market had on average been looking for a withdrawal close to the actual number, though surveys showed a fairly wide range of expectations among respondents.

A Reuters survey of traders and analysts on average had predicted a 77 Bcf withdrawal, with responses ranging from -60 Bcf to -98 Bcf. Kyle Cooper of ION Energy had called for an 82 Bcf withdrawal, while PointLogic Energy on Tuesday had predicted a withdrawal of 72 Bcf.

Stephen Smith Energy Associates had predicted a 74 Bcf withdrawal, and Intercontinental Exchange futures for this week’s report had settled at -80 Bcf Wednesday. The Desk’s Early View survey, released last week, showed participants expecting on average a 70.9 Bcf withdrawal, with responses ranging from -60 Bcf to -86 Bcf.

“This number perfectly confirms our balance expectations, with the market balance being tight enough to keep support around the $2.62 level rather firm but weather not cooperating enough for any move above resistance from $2.70-2.75,” Bespoke Weather Services said following the report.

“Without a bullish miss there is a risk that $2.62 support gets tested again today, especially if afternoon model guidance eases off overnight medium-range trends, but for now we still expect to be range-bound.”

By region, the largest weekly withdrawal occurred in the Midwest at 30 Bcf, followed by a 21 Bcf withdrawal in the East. The Pacific Region saw a 15 Bcf withdrawal for the week, while 9 Bcf was withdrawn in the Mountain region. The South Central region recorded a net 3 Bcf withdrawal, with an 11 Bcf pull from nonsalt offsetting an 8 Bcf injection into salt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |