Markets | NGI All News Access | NGI Data

No Surprises in EIA NatGas Storage Report; April Still Range-Bound

The Energy Information Administration (EIA) on Thursday reported a storage withdrawal that fell in line with market expectations, and prompt-month futures continued to trade sideways.

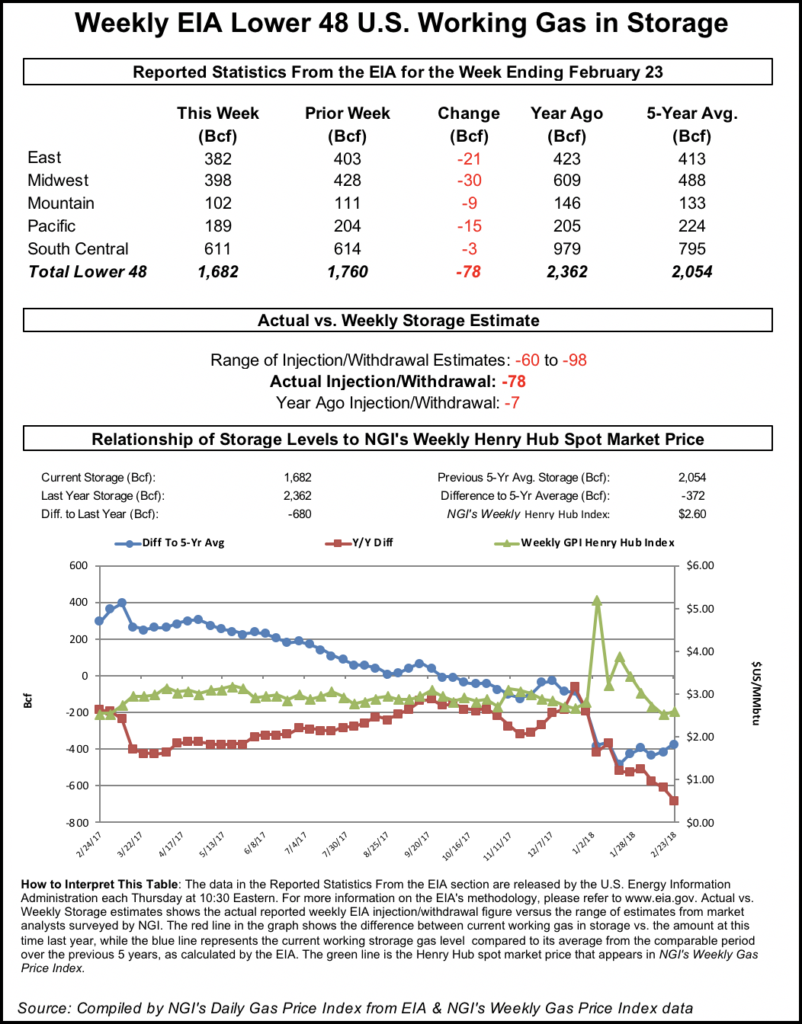

EIA reported a 78 Bcf withdrawal for the week ending Feb. 23, which was tighter versus the 7 Bcf withdrawn a year ago, but looser than the five-year average pull of 118 Bcf.

Prior to the 10:30 a.m. EDT release of the storage figure, the April contract on Thursday had been trading around $2.695. As the number crossed trading desks, the April contract briefly shot up to as high as $2.731 before pulling back to around $2.670-2.680. By 11 a.m. EDT, April was trading right around $2.70, up about 3 cents from Wednesday’s settle.

Before the report, the market had on average been looking for a withdrawal close to the actual number, though surveys showed a fairly wide range of expectations among respondents.

A Reuters survey of traders and analysts on average had predicted a 77 Bcf withdrawal, with responses ranging from -60 Bcf to -98 Bcf. Kyle Cooper of ION Energy had called for an 82 Bcf withdrawal, while PointLogic Energy on Tuesday had predicted a withdrawal of 72 Bcf.

Stephen Smith Energy Associates had predicted a 74 Bcf withdrawal, and Intercontinental Exchange futures for this week’s report had settled at -80 Bcf Wednesday. The Desk’s Early View survey, released last week, showed participants expecting on average a 70.9 Bcf withdrawal, with responses ranging from -60 Bcf to -86 Bcf.

“This number perfectly confirms our balance expectations, with the market balance being tight enough to keep support around the $2.62 level rather firm but weather not cooperating enough for any move above resistance from $2.70-2.75,” Bespoke Weather Services said following the report.

“Without a bullish miss there is a risk that $2.62 support gets tested again today, especially if afternoon model guidance eases off overnight medium-range trends, but for now we still expect to be range-bound.”

Total working gas in underground storage stood at 1,682 Bcf as of Feb. 23, according to EIA. That’s versus 2,362 Bcf in the year-ago period and five-year average inventories of 2,054 Bcf.

The year-on-year storage deficit increased week/week from -609 Bcf to -680 Bcf, while the year-on-five-year deficit shrank from -412 Bcf to -372 Bcf, EIA data show.

By region, the largest weekly withdrawal occurred in the Midwest at 30 Bcf, followed by a 21 Bcf withdrawal in the East. The Pacific Region saw a 15 Bcf withdrawal for the week, while 9 Bcf was withdrawn in the Mountain region. The South Central region recorded a net 3 Bcf withdrawal, with an 11 Bcf pull from nonsalt offsetting an 8 Bcf injection into salt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |