[Article Headline]

Natural gas futures moved lower Wednesday as weather guidance offered mixed signals for the first half of March. In the spot market, SoCal Citygate recorded a steep drop on a looser supply/demand balance, while most other points saw only small changes; the NGI National Spot Gas Average climbed 3 cents to $2.39/MMBtu.

The April contract settled at $2.667 Wednesday, down 1.6 cents after trading as high as $2.710 and as low as $2.659. May settled 1.6 cents lower at $2.696.

“The latest midday weather data was mixed, with some days slightly colder and some slightly milder, thus seen offsetting and little changed,” NatGasWeather.com said Wednesday. “Where changes have occurred is with cold air arriving into the East slightly faster next week, and also a touch colder this round over the Northeast March 12-15, although still favoring a relatively mild pattern during this period as weak high pressure covers large stretches of the country besides the West and far East Coast.”

Prices have held despite recent milder changes to the forecasts, the firm noted.

“We believe this suggests factors other than weather have been the reason for prices finding support, especially when considering Lower 48 production is back to near record levels above 77 Bcf/d,” NatGasWeather said. “We expect the next two days could be telling as to whether prices can continue to find support for another leg higher, or will finally give in to what appear to be rather bearish forces.”

Bespoke Weather Services said the tight trading range in futures makes sense given “relatively tight balance thanks to continued strong burns cancelling out the impacts of bearish forward weather expectations in the long-range forecast. Model guidance added a bit of heating demand in the medium-range, a trend that could continue as models determine just how much cold moves across the country and gets trapped across the Southeast.”

The models are still uncertain on the long-range outlook for how quickly the pattern breaks down to allow heating demand to return to seasonal averages, with the models pointing to warmer trends for the second half of March, the firm said.

“At least for now, we see these warm long-range trends as limiting upside at the front of the strip to the $2.75 level, as the market has likely not yet priced in the full extent of warmth through the second half of the month,” Bespoke said.

The upcoming medium-range cold pattern could be “the bulls’ last shot,” Price Futures Group Senior Analyst Phil Flynn told NGI.

“If we get some of these cold temperatures, it could impact production” through freeze-offs, “it could increase demand, and that could definitely change the dynamic, cause a breakout and give natural gas a little bit of a rally,” Flynn said.

“On the other hand, there is a possibility that it will drive the market back down.” If cold disappoints “then what do the bulls have to hang their hat on? We’re going to be in the heart of shoulder season, the demand’s going to drop, production decreases probably won’t happen, and that could mean we see storage refill at a faster rate…We know it’s going to get colder. Is it going to be cold enough to sustain a breakout?”

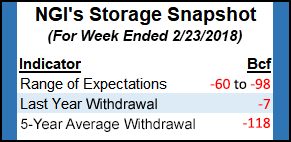

Estimates for Thursday’s Energy Information Administration (EIA) storage report have been pointing to a smaller withdrawal versus the five-year average but tighter than a year ago.

A Reuters survey of traders and analysts on average predicted a 77 Bcf withdrawal for the week ending Feb. 23, with response ranging from -60 Bcf to -98 Bcf. Last year, 7 Bcf was withdrawn, while the five-year average withdrawal is -118 Bcf, according to EIA.

Kyle Cooper of ION Energy called for an 82 Bcf withdrawal, while PointLogic Energy on Tuesday predicted a withdrawal of 72 bcf based on “significantly warmer weather across the eastern half of the country.”

Stephen Smith Energy Associates said Tuesday it’s expecting a 74 Bcf withdrawal for the week ending Feb. 23. The Desk’s Early View survey, released last week, showed participants expecting on average a 70.9 Bcf withdrawal, with responses ranging from -60 Bcf to -86 Bcf.

Intercontinental Exchange futures for the upcoming report settled at -81 Bcf Tuesday.

In the spot market, the last vestiges of premium pricing at SoCal Citygate evaporated Wednesday, as trades averaged $2.56, down 66 cents on the day.

Demand on utility Southern California Gas Co.’s (SoCalGas) import-constrained system has moderated somewhat this week, according to Genscape.

SoCal Citygate basis “has fallen under $1.00 for the first time in two weeks after setting a new record high early last week at $16.97,” the firm told clients Tuesday. “Demand over the next several days is forecasted in the 3.3-3.6 Bcf/d range, which is still somewhat elevated compared to this season’s norms. However, this is still considerably less than the demand high of over 4.0 Bcf/d experienced last weekend.”

Genscape analyst Joseph Bernardi also noted to NGI Wednesday that SoCalGas has increased imports across the southern border at Otay Mesa.

On Wednesday, SoCalGas was reporting actual system demand of around 3.1 Bcf/d for Tuesday’s gas day, with demand forecast to hover around 3.3-3.4 Bcf/d over the next several days.

“The forecasts are all still colder than seasonal norms, but getting much closer to norms for this Friday and then again by early to middle of next week,” Bernardi said. “Also, it’s entirely possible that there’s some effect of SoCalGas establishing that it can meet this elevated level of demand (up to 3-4 Bcf/d) via massive storage withdrawals, thus diminishing any fear that may have been baked into last week’s price spike.”

Other points in California gained Wednesday. Malin added a nickel to $2.30, while SoCal Border Average climbed 6 cents to $2.33.

Further upstream, in West Texas El Paso Permian bounced back from declines earlier in the week, adding a dime to $2.05.

A force majeure declared earlier this week due to equipment failure at one of El Paso Natural Gas Co. LLC’s (EPNG) Permian Basin compressor stations was lifted Tuesday. Genscape had estimated that the event would require about 100 MMcf/d to be re-routed.

Meanwhile, EPNG declared a separate force majeure Wednesday due to “pipeline anomalies” on its Line 2000 requiring repairs downstream of its Tom Mix Compressor Station in Arizona. EPNG did not provide a timetable for the repair work. Starting with Thursday’s gas day, capacity through Tom Mix will be reduced to 504,099 Dth/d, the pipeline said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9966 |