Markets | NGI All News Access | NGI Data

Cold West, Warm East Shapes Weekly Natural Gas Spot Prices; Futures Bottoming

It was a tale of West versus East in the natural gas spot market for the week ended Friday. Weather maps seemed to split the Lower 48 down the middle, with colder than normal temperatures driving up prices across the Rockies and California as East Coast cities experienced unseasonable February warmth.

The NGI Weekly Spot Gas Average added 18 cents to $2.64/MMBtu.

As chilly temperatures drove up demand across the West, SoCal Citygate — dealing with ongoing import constraints — saw day-ahead prices blow out to $25 or more during the week. Weekly prices there averaged $11.75, up $7.81.

Elsewhere in the region, SoCal Border Average added $1.06 to $3.45, while El Paso S. Mainline/N. Baja jumped $1.60 to $4.03.

Further upstream, Rockies points enjoyed strong week/week gains amid the widespread below-normal temperatures in the West. Opal added 47 cents to $2.77, while CIG gained 46 cents to $2.75.

In the East, cities like Boston and New York saw highs in the 70s during the week, and the lack of heating demand kept a lid on Northeast prices for the most part.

Algonquin Citygate tumbled 64 cents to $2.48, while Tennessee Zone 5 200L gave up 19 cents to $2.46.

Natural gas futures traded near even Friday thanks to an afternoon rally as prompt-month expiration loomed and weather models continued to advertise colder patterns developing in early March. To cap off its last full week before expiration, the March contract settled at $2.625 Friday, up more than a nickel from the previous Friday’s settlement of $2.558.

March had traded as low as $2.555 Friday but rallied into the close.

Powerhouse Vice President David Thompson pointed to a “bottoming process playing out” in the market.

“We keep hitting lows in that mid-$2.50s range that has now been holding for nine days,” a support level that has managed to “keep prices from getting another lurch down regardless of what we learn about weather,” Thompson told NGI Friday.

He noted long lower shadows in the candlestick chart two out of the last three trading days.

“That starts to tell you there’s some bullishness creeping back into the market,” Thompson said. “Will it be enough to push it back above $3.00? I don’t think so,” based on fundamentals. “But from a technical point of view, there’s clearly some bullishness building in those chart patterns.”

That said, it’s February and there’s still some cold risk through the remainder of winter, even if the market seems to have its doubts. “We’ll see if this holds or if there’s a little more weakness as we move into shoulder season and people look at production alongside the absence of any winter demand,” Thompson said.

After weather models trended warmer overnight, afternoon guidance Friday “stopped this medium-range warmer trend and increased cold risks in the long-range, with a modestly more supportive Pacific and a stronger lingering North Atlantic block,” Bespoke Weather Services said.

“Were these trends to continue over the weekend, we would walk into the day on Monday with noticeably more heating demand forecast through the next two weeks, likely supporting the front of the natural gas strip further.” Still forecast confidence is “limited,” the firm said.

“It is clear that the natural gas market is very tight regardless; demand at current price levels is impressive, as we saw $2.55 support hold yet again,” Bespoke said. “This seems to skew risk upwards, with a clear floor for prices if weekend trends do not impress but further upside into the $2.70-2.75 range if we continue to add gas-weighted degree days in the long-range” as indicated by the Friday afternoon weather data.

The Energy Information Administration (EIA) on Thursday reported a natural gas storage withdrawal that was slightly tighter than market expectations. Futures traded on both sides of even following the news.

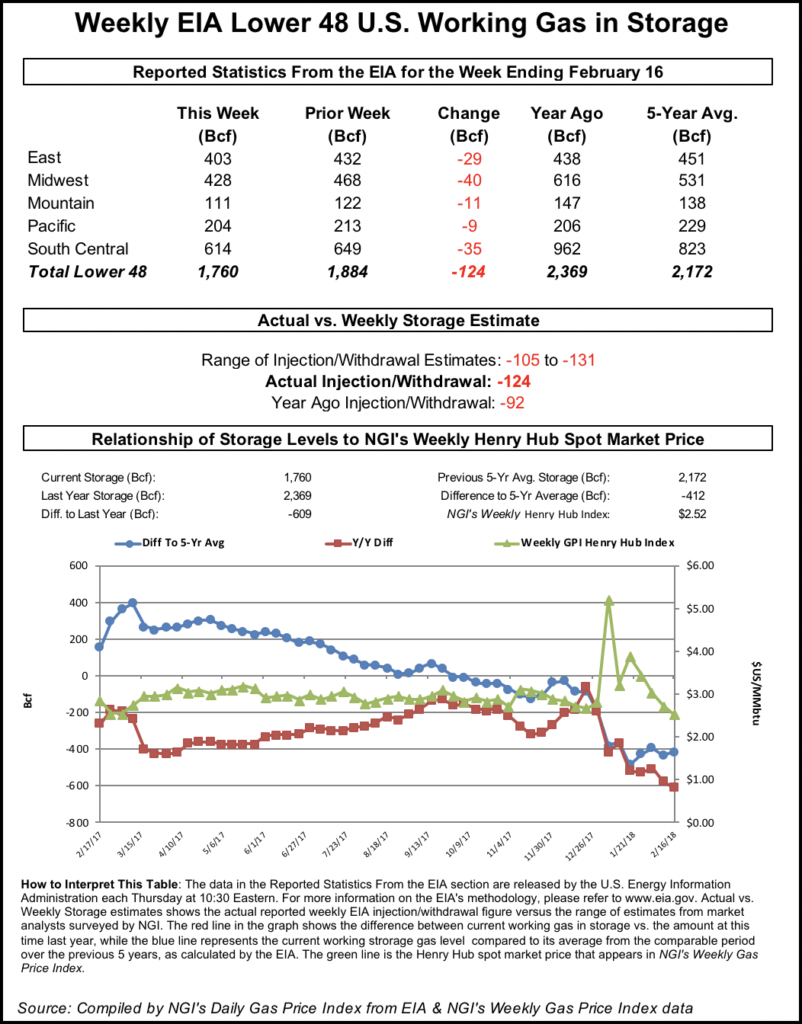

EIA reported a 124 Bcf withdrawal from U.S. gas stocks for the week ending Feb. 16, a slightly larger pull than the average predictions leading up to the report. Last year 92 Bcf was withdrawn and the five-year average is a pull of 145 Bcf. Last week, EIA reported a 194 Bcf withdrawal.

As the number crossed trading desks at 10:30 a.m. EDT, the March contract briefly went above $2.660 before pulling back to around $2.640. By 11 a.m. EDT, March was trading around $2.646, down about a penny from Wednesday’s settle.

Prior to Thursday’s report, the market had been looking for a withdrawal close to the actual figure. A Reuters survey of traders and analysts had predicted on average a 120 Bcf withdrawal for the week ending Feb. 16. Responses ranged from -105 Bcf to -129 Bcf. A Bloomberg survey had showed a median -121 Bcf, with responses ranging from -116 Bcf to -131 Bcf.

PointLogic Energy had predicted a withdrawal of 120 Bcf, attributing the smaller withdrawal week/week “to warmer weather in the East and Midwest regions.” Kyle Cooper of ION Energy had predicted a 116 Bcf pull, while Intercontinental Exchange futures for Thursday’s storage report settled at -120 Bcf Wednesday.

“Yet again, this print is quite tight, confirming the tightness that we saw in data last week that kept prices bid against $2.55 support,” Bespoke Weather Services said Thursday. “…With any further gas-weighted degree day additions we continue to see the market as tight enough to rally into the $2.70-2.75 range, with this print only confirming our expectations of market tightness moving into March. Should afternoon model guidance trend colder we could even see $2.70 hit today.”

Total working gas in underground storage stood at 1,760 Bcf as of Feb. 16, versus 2,369 Bcf last year and five-year average inventories of 2,172 Bcf. The year-on-year deficit widened from -577 Bcf to -609 Bcf for the week, while the year-on-five-year deficit shrank from -433 Bcf to -412 Bcf, EIA data show.

By region, 40 Bcf was withdrawn in the Midwest during the week, while 29 Bcf was withdrawn in the East. The South Central saw a withdrawal of 35 Bcf, including 3 Bcf pulled from salt and 32 Bcf pulled from nonsalt. In the Mountain region, 11 Bcf was withdrawn, and the Pacific saw 9 Bcf pulled from storage for the period.

“Deviating from the last several weeks, storage numbers were finally in-line with Wall Street expectations as inventories break away from five-year minimums and market undersupply stabilizes closer to 1 Bcf/d,” analysts with Tudor, Pickering, Holt & Co. (TPH) said of the week’s withdrawal. “As February winds to a close with no major weather demand events and storage levels begin to normalize, we’re looking to the second and third quarters for supply to begin to outpace demand.

“Though we may see a brisk March, the end of winter tends to have less of an impact from a historical burn per degree perspective,” the TPH analysts said. “On the export front, look for liquefied natural gas volumes to ramp back to (or above) normal as Sabine Pass resolves temporary storage tank issues and Cove Point comes online.”

Spot prices fell across the board Friday amid expectations for weekend demand declines and warmth in the East; the NGI National Spot Gas Average shed 16 cents to $2.40/MMBtu.

The heaviest losses occurred in the West. SoCal Citygate, which saw trades above $25 earlier in the week, gave up 34 cents to average $4.09.

Southern California Gas Co. (SoCalGas) reported actual system demand of around 3.4 Bcf/d Thursday, versus reports of demand closer to 4 Bcf/d earlier in the week. The utility was forecasting system demand to hover around 3.5 Bcf/d over the weekend before climbing to just under 3.9 Bcf/d by Monday.

El Paso Natural Gas (EPNG) declared a force majeure Thursday at the Topock Compressor Station that was expected to cut deliveries into California from Arizona by about 75 MMcf/d day/day, Genscape Inc. said in a note to clients Friday.

A mechanical failure at one of the Topock compressor’s units was expected to limit operational capacity to 369 MMcf/d until further notice, according to Genscape. The restriction comes during a period of elevated flows into California where chilly temperatures across the West have stoked higher demand.

The monthly average flows through the meter from EPNG have averaged 354 MMcf/d, “however, the scheduled volumes for Thursday’s gas day were considerably higher than the monthly average at 443 MMcf/d, so a reduction of 74 MMcf/d is expected day/day,” Genscape said.

“EPNG’s deliveries to Mojave do not typically show any correlation with the downstream Kern/Mojave deliveries to SoCalGas. Also, EPNG has not delivered gas to SoCalGas at the Topock interconnect since 2016, due to SoCalGas’ L3000 remediation maintenance, which is not expected to end until this May.”

Genscape was calling for demand in California and Nevada to ease over the weekend, falling to 5.61 Bcf/d by Sunday, well below the recent seven-day average 8.42 Bcf/d.

Kern Delivery tumbled 85 cents to $2.51, while Malin shed 41 cents to $2.36.

Further upstream, in West Texas El Paso Permian fell 16 cents to $2.24, in line with the rest of the region, while in the Rockies, most points gave up around 40 cents or more on the day.

“High pressure will retake ground over most of the eastern half of the country, although temperatures will remain cold over the West and into the Plains,” NatGasWeather.com said in its one- to seven-day outlook Friday. “With the South and East again expected to experience widespread highs of 50s to 80s this weekend through much of next week, national demand will remain lighter than normal until late next week when the strong eastern U.S. ridge finally weakens to allow colder air to arrive.”

Total Lower 48 demand came in at 77.6 Bcf/d Friday, down about 4.6 Bcf/d from Thursday’s total, according to PointLogic Energy.

“Residential/commercial (res/com) demand for Friday is lower by a total of 3.3 Bcf/d across the Northeast, Midcontinent and Texas regions as population-weighted temperatures are 2 degrees higher in the Northeast, 4 degrees higher in the Midcontinent and 9 degrees higher in Texas” day/day, PointLogic told clients Friday.

Overall Lower 48 consumption was forecast to dip significantly over the weekend to around 71 Bcf/d. Warm weather in the Northeast and Southeast regions was expected to drive lower res/com demand, according to PointLogic.

The Northeast Regional Average fell by double digits Friday as most points posted heavy losses heading into the weekend. Points in the Midwest and Midcontinent also fell.

Northern Natural Ventura tumbled 15 cents to $2.37, while Chicago Citygate fell 13 cents to $2.40.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |