Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

WPX Banking on Permian, Bakken to Drive Growth

Tulsa-based WPX Energy Inc. on Thursday set a goal of 150,000 b/d of production by 2022 through a strategy that includes midstream investments in the Permian Basin and new wells in the Bakken Shale, CEO Rick Muncrief said during a 4Q2017 earnings conference call.

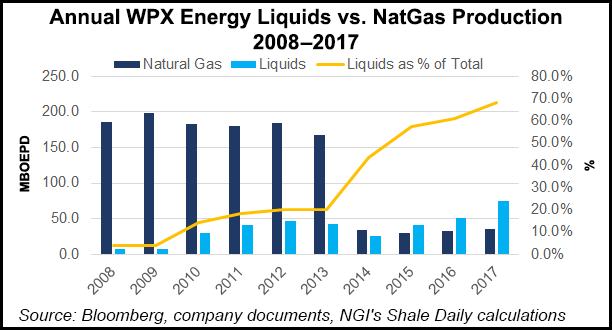

WPX’s production mix is now 80% liquids, 20% natural gas, and it should stay that way, Muncrief told analysts.

He and COO Clay Gaspar outlined bullish expectations for the Permian’s Delaware sub-basin and the Bakken in the Williston Basin of North Dakota, where two recent wells yielded record-setting 90- and 120-day production in the range of 2,000-2,500 boe/d, 81% oil.

Gaspar said the two wells at North Sunday Island were “the best performing horizontal wells ever drilled in the Middle Bakken or Three Forks formations.”

By the end of March WPX expects to have seven record wells online from the Mandan North pad wells. WPX also is redirecting a third rig to the Williston following the sale of assets in the San Juan Basin.

In the Permian Delaware, Muncrief said WPX is reaping the benefits from longer laterals and the midstream joint venture with Howard Energy Partners Inc.

Permian resources — people and equipment — are in short supply to maintain the torrid drilling pace, and the CEO said the workforce is most vulnerable.

“The Delaware and the Midland sub-basins are two of the hottest basins in the world, and with that comes scarcity of people and equipment, and so we have to make sure that we are doing our very best to recruit, to retain and engage our employees, and to make sure our service companies are doing the same,” Muncrief said.

As to what’s in shortest supply, “I would put people first, and a distant second are all the other tangible things, such as sand and water and disposal.”

Howard Energy and WPX are developing infrastructure in the Stateline area of the Delaware, with management confident it will have the infrastructure to get its output processed and sold, he said.

Roughly 90% of a planned 50-mile crude oil pipeline under the JV has been built. WPX also has two 200 MMcf/d gas plants and increased interests in the Agua Blanca and Oryx Midstream Services systems, with in-service targets later this year.

Gaspar said the first of the two gas plants should be in service this summer.

During 4Q2017, Delaware production reached 58,700 boe/d, a 41% jump sequentially and 134% higher year/year. Permian volumes reached 31,200 b/d, a 37% sequential increase and 160% above year-ago levels. Williston volumes in 4Q2017 reached 33,100 b/d, a 6% increase sequentially and 38% higher year/year.

WPX reported a net loss in 4Q2017 of $35 million (minus 9 cents/share), compared with a year-ago loss of $174 million (minus 51 cents). For 2017, WPX reported a loss of $26 million (minus 6 cents), versus a loss of $652 million (minus $2.08) in 2016.

Citing a “financial transformation” underway for the company, Muncrief said WPX should become free cash flow positive in 2019.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |