Natural Gas Bulls Running Out Of Options As Weather Trends Warmer For Early March

Weather forecasts that showed a colder start to March lifted March natural gas forward prices up an average 6 cents between Feb. 16 and 22, but markets began running out of steam Thursday and showed no signs of turning back ahead of the weekend as weather data trended warmer, according to NGI’s Forward Look.

The market got off to a surprisingly strong start for the last full week of February as weather outlooks early in the week indicated a cooler-than-normal pattern emerging by March 2. At the time, atmospheric conditions were favorable as well. The Nymex March futures contract gained a total of 10.1 cents during Tuesday and Wednesday trading.

But that’s where the rally ended as weather models overnight Wednesday were mixed, with near-term outlooks reflecting slightly warmer changes and longer-term outlooks showing some potential colder weather moving back into the Southeast. It’s this mixed message that appears to have the market questioning the longer-term forecasts, forecasters at Bespoke Weather Services said.

Not even a slightly bullish storage report from the U.S. Energy Information Administration (EIA) could not prevent the Nymex futures curve from weakening. The EIA reported a reported a 124 Bcf withdrawal from U.S. gas stocks for the week ending Feb. 16, a slightly larger pull than the average predictions leading up to the report. Last year, 92 Bcf was withdrawn and the five-year average is a pull of 145 Bcf.

Total working gas in underground storage stood at 1,760 Bcf as of Feb. 16, versus 2,369 Bcf last year and five-year average inventories of 2,172 Bcf. The year-on-year deficit widened from -577 Bcf to -609 Bcf for the week, while the year-on-five-year deficit shrank from -433 Bcf to -412 Bcf, EIA data show.

Looking ahead to the next EIA storage report, for the week ending Feb. 23, the market will have to consider a week that had 26 less heating degree days week on week, according to analysts with Mobius Risk Group.

The Houston-based company projects a storage withdrawal of around 70 Bcf, which compares with extremely mild conditions during the same week in 2016 that saw a 7 Bcf build. “…so the storage deficit will continue to widen and easily surpass 600 Bcf.”

Still, with Lower 48 dry gas production at around 78 Bcf/d and continuing to grow, market bulls are running out of options. By Friday, all the weather models had turned warmer, although the European model — the one most trusted by the market for its historical accuracy — remained colder than the rest.

The market was unimpressed, though, as the Nymex March futures contract remained in negative territory throughout the day on Friday, ultimately settling nine-tenths of a cent lower at $2.625.

Technicals don’t paint much of a rosier picture either for Nymex futures. NGI Director of Strategy and Research Patrick Rau said the March contract isn’t quite as oversold as it was, thanks to the rally this week. “Both the Relative Strength Indicator and Slow Stochastics signal are between 35-40 right now, still closer to being oversold than overbought, but definitely approaching middle-of-the-road territory,” he said.

But, trading volatility has increased in recent days as the Nymex March futures contract nears expiration on Feb. 26. The volatility has been so pronounced that the 20-Day Bollinger band, which is in essence a two-standard deviation bell curve around the trailing 20-day average price, is becoming wider.

“The bottom of the current Bollinger band is $2.334, which is well below the previous reaction low of $2.532, so that’s not really in play,” Rau said.

On the storage front, Rau said given the record production build, which will continue to grow in 2018, “it is good that we are more than 600 Bcf behind last year’s storage total, since that provides something of a buffer to absorb that extra production until summer cooling demand begins.”

Also providing a buffer is the impending start of the Cove Point liquefied natural gas (LNG) facility in early March, and the recent completion of the fourth train at Sabine Pass LNG in the fourth quarter of 2017, he said. “But I don’t anticipate much else in terms of export-induced demand increases until later in the year” as the market awaits the completion of additional LNG export trains and pipelines in Mexico.

“That puts all the more pressure on cooling demand this summer, everything else being equal,” Rau said.

Taking a closer look at the markets, the Nymex March futures contract ended the Feb. 16 to 22 period up 8 cents at $2.634. April futures also climbed 8 cents to $2.676, while summer (April-October) rose 7 cents to $2.75. The winter 2018-2019 strip was up a nickel to $2.96, while the winter 2019-2020 strip was up 2 cents to $2.93.

Western Cold, Supply Limitations Lift SoCal, Sumas

Most other market hubs followed the Nymex higher, with gains of anywhere from a few pennies to a dime being the norm for the prompt month. Some unseasonably chilly weather out West, however, lifted a couple of markets there.

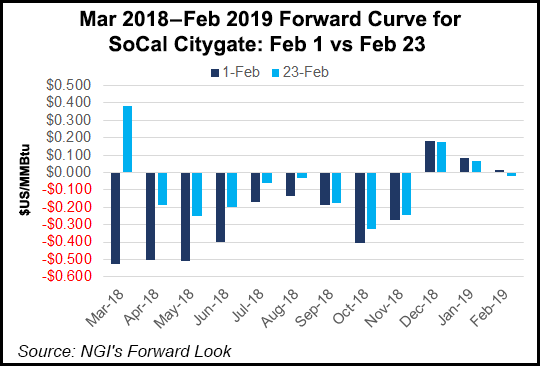

The most pronounced gains were at the Southern California City-gate (SoCal CG), where March forward prices shot up 39 cents between Feb. 16 and 22 to reach $3.014. The gains come as cash prices at SoCal CG reached their highest levels in four years, surging as high as $25 in intraday trading on Tuesday and then climbing even higher to $28 in intraday trading on Wednesday. Prices traded as high as $30 on Feb. 5, 2014, Daily GPI historical data show.

The recent rally stems from a cold front blanketing much of the West, with temperatures in Los Angeles expected to remain about 10 degrees below normal throughout the week. The drop in temperatures thus far led to a spike in demand, with system-wide sendout on Southern California Gas (SoCal Gas) exceeding 3.9 Bcf/d for the first time in more than a year, according to data and analytics company Genscape Inc.

SoCal Gas forecast total system demand just shy of 4 Bcf/d for Friday. This is also the first time demand has risen to this level following “the unplanned L235-2 remediation event” that went into effect at the beginning of October 2017, which is still limiting SoCal Gas’ two Needles receipt points by over 500 MMcf/d. The ongoing import constraints mean SoCal Gas is now relying more on storage even as total demand is similar to the cold snap last January, Genscape said.

For example, when demand averaged 3.96 Bcf/d for four days in January 2017, SoCal Gas’ system-wide receipts averaged 3.03 Bcf/d. That left 930 MMcf/d that needed to be made up via storage withdrawals, the Louisville, KY-based company said. But with demand at 3.82 Bcf/d Monday through Wednesday, receipts coming at 2.64 Bcf/d, that necessitated an average withdrawal of 1.18 Bcf/d.

Adding another wrinkle into the mix is a force majeure declared Thursday on El Paso Natural Gas (EPNG) that cut about 75 MMcf/d of deliveries day-over-day to Mojave from Arizona into California. Due to a mechanical failure, one unit at EPNG’s Topock Compressor Station is unavailable, and the meter will see its operating capacity reduced to 369 MMcf/d until further notice.

Genscape noted, however, that EPNG’s deliveries to Mojave do not typically show any correlation with the downstream Kern/Mojave deliveries to SoCal Gas.

Still, the current supply/demand dynamics in the region could linger, based on forecasts. Genscape meteorologists are forecasting a prolonged cold snap for southern California, with temperatures expected to remain well below seasonal norms through at least the end of the month.

The rest of the SoCal CG forward curve saw relatively muted action for the Feb. 16-22 period, with April and the summer (April-October) strip edging up only 1 cent each to $2.491 and $2.58, respectively. The winter 2018-2019 was up 6 cents to $2.89, according to Forward Look.

Over in the Pacific Northwest, forward prices at Northwest Pipeline-Sumas (NWP-Sumas) got a boost as some areas were placed under their first winter storm warning of the 2017-2018 season, as up to six inches of snow were forecast to drop in the region, according to PointLogic Energy.

NWP-Sumas March forward prices rose 14 cents from Feb. 16-22 to reach $2.00, while April rose 8 cents to $1.762 and the summer (April-October) moved up 4 cents to $1.81. Cash prices at NWP-Sumas soared as high as $3.16 for gas day Wednesday before retreating to $2.81 for gas day Friday.

Genscape shows demand in the Pacific Northwest reaching 2.93 Bcf/d on Feb. 23 but then averaging 2.356 Bcf/d for the Feb. 26-March 2 week. The strong demand has led to operational flow orders on the GTN, Tuscarora and SoCal Gas systems, as well on neighboring eastbound Rockies pipelines CIG and Tallgrass.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |