Fiscal Incentives Seen as Key to Unlocking Mexico’s Unconventional Oil, Natural Gas

Mexico’s oil and natural gas fields are so near but yet so far from the United States, where the hydraulic fracturing (fracking) and horizontal drilling revolution have turned it into a global behemoth. Now Mexico stands poised as an unconventional threat as well.

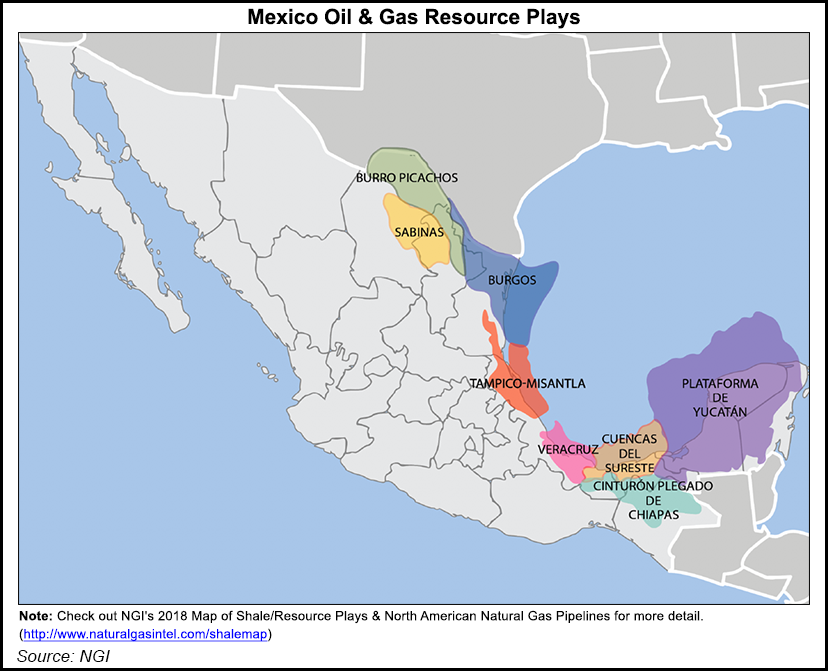

The Eagle Ford Shale in South Texas, in the cradle of the unconventional fields, extends into the Mexican state of Tamaulipas. But while the small companies that were the guerrilla fighters of the revolution continue to buzz the formation in Texas with drilling activity, the Tamaulipas side is eerily silent.

Mexico’s state oil company Petroleos Mexicanos (Pemex) drilled about 20 wells a few years ago, but without apparently being unable to master the fracking/horizontal drilling technology. This time round, with the instruments of the 2013-14 energy reform under their belt, the Mexican energy authorities have announced the nation’s first upstream auction of unconventional resources in the wake of a government-sponsored forum in the border city of Reynosa, Tamaulipas.

The auction has been described by Energy Secretary Pedro Joaquin Coldwell as a “pilot” project, giving the impression that it could be little more than a trial balloon after the successive cancellations of similar auctions in Rounds One and Two of the reform.

But it is much more than that, energy ministry sources say. It is to be followed, they add, by a much bigger auction for blocks in the neighboring states of Nuevo Leon and Coahuila that would include spurs from the Tampico-Misantla Basin that are regarded as too promising for the production of oil to be left out.

Prospects in the southern Gulf state of Veracruz are unlikely to be included for the time being, the sources said, because indigenous communities would have to be consulted and that would take time.

In addition, grassroots opposition to what could be regarded as harming the environment is much better organized in Veracruz than in the northern states.

The precursor to pilot project was the forum in Reynosa, where David Shields, editor and publisher of the magazine Energia a Debate, was one of the moderators. Shields defined what he sees as the sharp difference between the highly developed unconventional drilling industry in Texas and its incipient equivalent in Tamaulipas.

“What is important to note,” he said, “is that the U.S. is the only country where fracking has been a really major success.

“It’s not so much just a question of geology. The U.S. is a unique case where it has legal, fiscal and social advantages, along with technological knowledge of the subsoil that Mexico, for example, lacks.”

Experienced U.S. unconventional explorers would probably have to reckon on an $8/bbl additional cost in Mexico because of the shortage of information on the subsoil requirements, Shields said.

Juan Carlos Zepeda, president of the National Hydrocarbons Commission, the CNH, told the forum audience that, in order to get the ball rolling in unconventionals, Mexico has to apply fiscal incentives. “There’s no other way,” added Shields.

Pablo Zarate also agreed. Zarate is director of Pulso Energetico, a think tank supported by Amexhi, the Mexican private-sector association of oil and gas companies.

Shields and Zarate strongly support efforts to develop Mexico’s unconventional resources as soon as possible.

“There’s no time to lose,” said Shields, pointing to the near-relentless decline in the nation’s crude and natural gas production, in addition to the massive imports of natural gas from the United States.

Unconventional drilling techniques have to be promoted in Mexico, he added. And the way to do so is to have serious talks with the U.S. companies that have the necessary know-how by finding a way to make fracking possible and profitable in Mexico, Shields said.

Zarate pointed out that shale and tight resources require considerable capital-intensive infrastructure in roads and ports, for example, where there are differences in the quality and management of infrastructure between the United States and Mexico.

Mexico may have a long way to go in developing its unconventional resources industry, Zarate said, “but it’s really important to start and to start now.” He said that is “exactly why the authorities are launching the shale pilot auction…It’s absolutely vital that we reach a point where Mexico can develop its own shale resources.”

Added Zarate: “We have to find a way to unlock investment challenges with the help of what the new Mexican energy model provides.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2158-8023 |