Markets | NGI All News Access | NGI Data

Natural Gas Futures Sell Off Despite Supportive Storage; SoCal Moderates

Natural gas futures moved lower Thursday as supportive government storage data couldn’t inspire a rally even with indicators pointing to oversold conditions. In the spot market, SoCal Citygate moderated after spiking earlier in the week, leading broad declines across most of the country; the NGI National Spot Gas Average fell 24 cents to $2.56/MMBtu.

The March contract settled at $2.634, down 2.5 cents on the day after trading as high as $2.670 and as low as $2.618. April settled at $2.676, down a half cent.

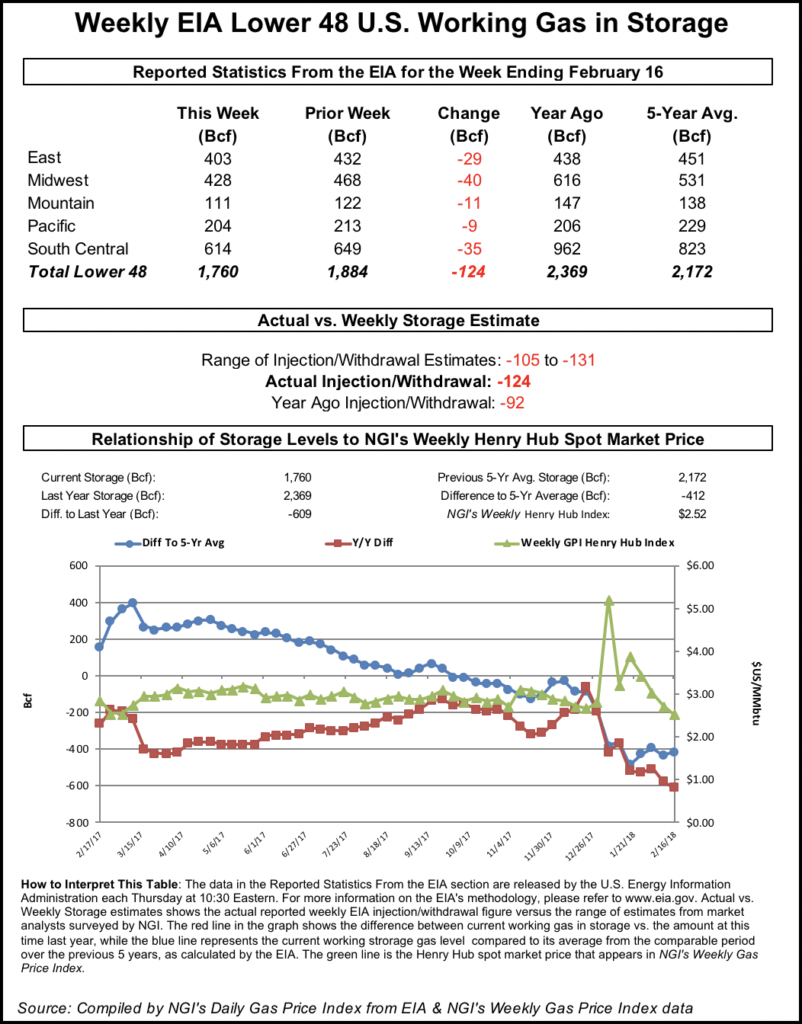

The Energy Information Administration (EIA) reported a 124 Bcf withdrawal from U.S. gas stocks for the week ending Feb. 16, a slightly larger pull than the average predictions leading up to the report. Last year 92 Bcf was withdrawn and the five-year average is a pull of 145 Bcf. Last week, EIA reported a 194 Bcf withdrawal.

As the number crossed trading desks at 10:30 a.m. EDT, the March contract briefly went above $2.660 before pulling back to around $2.640. By 11 a.m. EDT, March was trading around $2.646, down about a penny from Wednesday’s settle.

Prior to Thursday’s report, the market had been looking for a withdrawal close to the actual figure. A Reuters survey of traders and analysts had predicted on average a 120 Bcf withdrawal for the week ending Feb. 16. Responses ranged from -105 Bcf to -129 Bcf. A Bloomberg survey had showed a median -121 Bcf, with responses ranging from -116 Bcf to -131 Bcf.

PointLogic Energy had predicted a withdrawal of 120 Bcf, attributing the smaller withdrawal week/week “to warmer weather in the East and Midwest regions.” Kyle Cooper of ION Energy had predicted a 116 Bcf pull, while Intercontinental Exchange futures for Thursday’s storage report settled at -120 Bcf Wednesday.

Total working gas in underground storage stood at 1,760 Bcf as of Feb. 16, versus 2,369 Bcf last year and five-year average inventories of 2,172 Bcf. The year-on-year deficit widened from -577 Bcf to -609 Bcf for the week, while the year-on-five-year deficit shrank from -433 Bcf to -412 Bcf, EIA data show.

By region, 40 Bcf was withdrawn in the Midwest during the week, while 29 Bcf was withdrawn in the East. The South Central saw a withdrawal of 35 Bcf, including 3 Bcf pulled from salt and 32 Bcf pulled from nonsalt. In the Mountain region, 11 Bcf was withdrawn, and the Pacific saw 9 Bcf pulled from storage for the period.

Weather models this week have pointed to more cold risks for the East starting in early March.

An afternoon run of the European model Thursday “trended milder with the first cold shot into the eastern U.S. that breaks down the mild ridge March 2-5,” NatGasWeather.com said. “…The data is still quite cold across a large portion of the country March 6-11, but since the first cold shot into the East to start March isn’t as impressive compared to Wednesday night’s run, the markets are likely to view it as a little milder overall.

“…Although, to our view, the loss of several heating degree days March 2-5 could eventually be overlooked by the markets as long as cold can prove to hold over the eastern half of the country March 11-15.”

Price Futures Group senior market analyst Phil Flynn described Thursday’s price action as quite bearish.

“We had a drawdown that was higher than anticipated, and we just couldn’t hang on to the rally,” he told NGI. “It kind of shows you, even if we get a supportive number, we’re not getting any bounce here. So it’s really not boding well for the market.”

The weather outlook could add some cold for the first half of March, “but we’re just not seeing it right now. The fundamentals are really starting to weigh on the market,” Flynn said. “…When you’re in an oversold market and you get a bullish report and you still can’t bounce, that shows we could get more oversold before it bounces…the market action is still not signaling a bottom. The indicators are, but the market action just isn’t.”

After the afternoon European guidance came in “decently less impressive, we have seen the market break below our $2.62 level, with the rest of the strip finally joining in the selling,” Bespoke Weather Services said after the close Thursday. “We would expect $2.55-2.58 support to still hold into options expiry Friday; today’s EIA print was quite tight and we see strong burns continuing.

“This market tightness would seem to pave the way for more upside even with average weather, but heating demand lags so much over the next week that weak cash prices could hold us back, especially if there are any concerns that the cold we are forecasting for early March is not as impressive,” Bespoke said.

In the spot market Thursday, SoCal Citygate fell back to earth after trading at a $15-plus premium to Henry Hub the previous two days amid higher demand and import constraints.

SoCal Citygate plummeted $14.49 to average $4.43 Thursday, while SoCal Border Average gave up $1.38 to $2.88.

Southern California Gas Co.’s (SoCalGas) tight supply/demand conditions appeared to be easing Thursday at least a bit for the next few days. After previously forecasting system demand to remain near 4 Bcf/d, SoCalGas on Thursday estimated demand would total 3.7 Bcf/d Friday before falling to 3.4 Bcf/d by Saturday. Receipts were expected to total around 2.8 Bcf/d through the end of the week, including a little under 200 Dth/d imported through the southern border at Otay Mesa.

Genscape Inc. was calling for demand in California and Nevada to decline from 9.55 Bcf/d Thursday to 6.50 Bcf/d Friday and to around 5.6 Bcf/d by the weekend.

Other western points declined as well. PG&E Citygate tumbled 44 cents to $2.90, while Kern River dropped 24 cents to $2.77.

The western declines matched a broader downtrend across the spot market Thursday.

“We have Lower 48 demand entering a period of retreat through the weekend, with the chance for another — albeit modest — uptick coming back into the market next week,” Genscape told clients Thursday. The firm’s daily supply/demand model was showing “Lower 48 demand topping out Thursday at 80.1 Bcf/d, then dropping to a low of 69.5 Bcf/d by Sunday. Temperatures east of the Mississippi are projected to remain above seasonal norms, and the coming weekend will contribute to demand loss.”

As for next week, “weather forecasts are calling for a modest cold front to descend into Great Lakes and Northeast markets. That said, forecast temperatures are still expected to remain around to slightly above seasonal norms, so the demand gains are not expected to be extreme,” according to the firm. “We project demand to make a gradual rise to a high near 82 Bcf/d by the end of the workweek.”

In the West, on the other hand, conditions are expected to “remain notably colder than normal,” putting pressure on pipelines serving the region, Genscape said.

“TransWestern issued an overage alert for the Phoenix area, and El Paso declared an operational flow order (OFO) Wednesday, joining OFOs already in effect on SoCalGas, PG&E, Southwest Gas and CIG,” the firm said. “Ruby and Kern River, though, lifted their OFOs, with Kern noting linepack has been restored to normal.”

Prices were mixed in West Texas, with El Paso Permian adding 3 cents to $2.40 as Waha gave up 4 cents to $2.40.

During a conference call Thursday, midstream operator Energy Transfer Partners LP’s management team shared its outlook for growth in exports to Mexico via the Trans-Pecos and Comanche Trail pipelines.

“Although we continue to expect volumes to Mexico to grow, particularly as a result of” its Trans-Pecos and Comanche Trail pipes, “we are dependent upon infrastructure buildout in Mexico, which has been running behind U.S. infrastructure,” CFO Thomas Long said. “While we currently believe volume growth will be slower than originally anticipated, all capacity is contracted under firm transportation agreements.”

In the East, another round of moderate temperatures heading into the weekend had points selling off Thursday. AccuWeather was calling for highs in the 40s in Boston and New York Friday, with temperatures expected to get into the 50s by the weekend. Washington, DC, was expected to see highs into the 60s and 70s over the weekend.

Algonquin Citygate fell 43 cents to $2.51, while Transco Zone 6 New York gave up 14 cents to $2.57. Further south, Transco Zone 5 dropped 10 cents to $2.58.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |