U.S. Drops Seven NatGas Rigs as Oil Tally Climbs, Says Baker Hughes

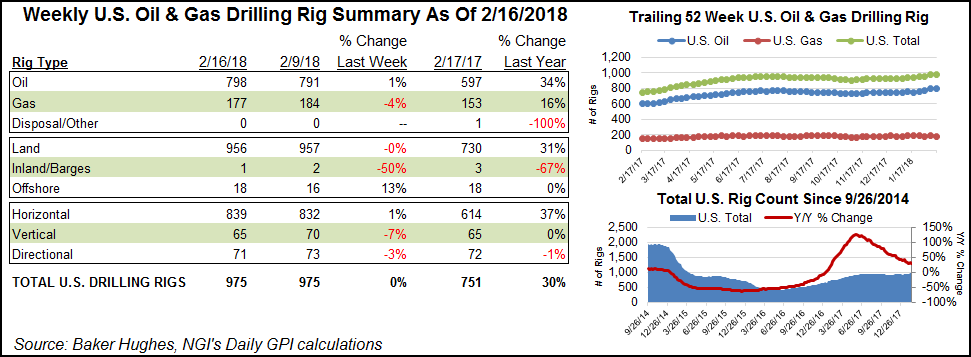

Seven U.S. natural gas rigs were dropped for the week ended Friday, although continued growth in oil drilling helped the combined domestic tally to finish flat, according to data from Baker Hughes Inc. (BHI).

The United States added seven oil-directed rigs to end the week right where it started at 975, up from 751 active rigs a year ago. Seven horizontal units returned to the patch, while five vertical and two directional packed up shop, according to BHI.

The Gulf of Mexico added two units to end the week at 18 (17 a year ago). Land drilling declined by one week/week, while one rig left the “inland waters.”

Canada dropped seven units overall for the week, including three oil-directed and four gas-directed. That left the combined North American rig count at 1,293 for the week, up from 1,082 active rigs at this time last year.

Among plays, the Permian Basin, the most active in the U.S. onshore by a wide margin, dropped four rigs for the week to finish at 433, still 130 higher than its year-ago tally of 303. The Utica Shale in Appalachia dropped two units to finish at 22, close to the 21 active units a year ago.

Other plays experiencing weekly declines included the Williston Basin, the Denver Julesburg-Niobrara, the Arkoma Woodford and the Ardmore Woodford, which each dropped a rig.

Gainers for the week among plays included the Marcellus Shale, the Mississippian Lime, the Granite Wash, the Eagle Ford Shale and the Cana Woodford, which each added a rig.

Among states, Alaska had a good week, nearly doubling its rig total by adding four units to end at nine. Oklahoma netted five rigs week/week as Pennsylvania added three, according to BHI.

West Virginia and Ohio each saw two rigs pack up shop for the week, as did Louisiana. New Mexico dropped three units to end at 85 (versus 48 a year ago). Colorado and North Dakota dropped a rig a piece.

While the domestic rig count finished flat for the week, this comes after an impressive 29-rig increase the week before, the eleventh largest weekly gain since 2000, according toNGI’s calculations and BHI data.

Meanwhile, U.S. permits to drill onshore for oil and natural gas dipped in January from December but still climbed by more than half from a year ago, Evercore ISI said earlier in the week. Domestic land permits totaled 3,870 in January, a 22% sequential decline — but 53% higher than in January 2016, said the analyst team led by James West.

“The disassociation between permits and rigs toward the end of 2017 was symptomatic of E&P budget exhaustion and a transitory drilling and completion planning period, but last week’s 29 unit surge in the U.S. rig count is illustrative of a domestic shale market poised to push on the gas pedal even harder,” West said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |