Markets | NGI All News Access | NGI Data

EIA Storage Beats Market Estimates to Give Natural Gas Futures a Bump

The Energy Information Administration (EIA) on Thursday reported a triple-digit withdrawal from U.S. natural gas inventories that surprised to the bullish side of expectations, giving a small bump to a futures market weighed down by an unimpressive heating demand outlook.

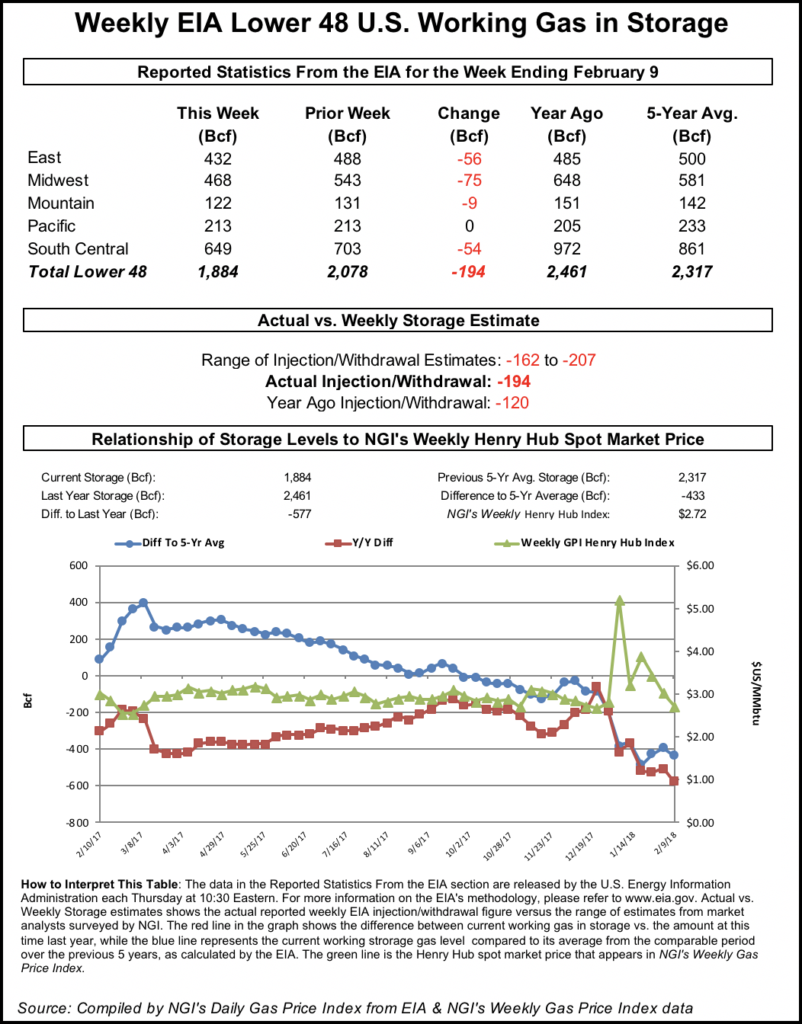

EIA reported a net withdrawal of 194 Bcf from storage for the week ending Feb. 9, about 10 Bcf more than consensus estimates. Last year, 120 Bcf was withdrawn for the week, and the five-year average pull for the period is 154 Bcf.

In the minutes following the 10:30 a.m. EDT release, futures inched higher, with the March contract trading as high as $2.605 after hovering in the $2.555-2.565 earlier in the morning. By 11 a.m. EDT, March was trading around $2.583, near even with Wednesday’s settle.

Prior to Thursday’s report, the market had been looking for a withdrawal somewhat smaller than the actual figure.

A Reuters survey of traders and analysts on average had estimated a 183 Bcf withdrawal, with responses ranging from -162 Bcf to -207 Bcf. Stephen Smith Energy Associates had estimated a withdrawal of 183 Bcf, while PointLogic Energy had called for a withdrawal of 179 Bcf.

Kyle Cooper of ION Energy had estimated a withdrawal of 186 Bcf. Intercontinental Exchange futures for this week’s EIA report settled at -187 Bcf Wednesday.

“We see this print as very tight on a historical basis, as it is quite tight for similar gas weeks and even tight on a 10-week average basis,” Bespoke Weather Services said following the release of the final figure. “We see market tightness as at least temporarily counteracting bearish weather revisions overnight, with prices bouncing off the data release as expected.

“Production levels do remain elevated, and we will need more impressive weather to move up into the $2.70-2.75 level, meaning a rally above $2.62 may be fade-able for now, but it is clear that market tightness is putting in a floor for prices right around the $2.55 level.”

Total working gas in underground storage as of Feb. 9 stood at 1,884 Bcf, versus 2,461 Bcf a year ago and five-year average inventories of 2,317 Bcf, according to EIA. The current year-on-year deficit increased for the week from -503 Bcf to -577 Bcf, while the year-on-five-year deficit increased from -393 Bcf to -433 Bcf, EIA data show.

Analysts with Wells Fargo Securities LLC said they’re forecasting a cumulative withdrawal of 158 Bcf over the next two weeks based on their model and government weather data.

By region, the largest withdrawals came in the Midwest (-75 Bcf) and the East (-56 Bcf). The South Central saw a withdrawal of 54 Bcf, including 46 Bcf pulled from nonsalt and 6 Bcf pulled from salt. In the Mountain region, 9 Bcf was withdrawn, while the Pacific finished flat for the week.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |