E&P | NGI All News Access | NGI The Weekly Gas Market Report

Energy Execs Bulls on Oil, Bears on NatGas and Ready for Higher OFS Costs, Says Raymond James

Energy executives are bullish on oil, bearish about natural gas and “acutely aware” that oilfield service (OFS) costs likely are trending higher over the next several quarters, according to a survey by Raymond James & Associates Inc.

The analyst team led by J. Marshall Adkins and John Freeman hosted a dinner last week in Houston at the 16th annual North American Prospects Expo, or NAPE, for about 150 executives. Most work for private exploration and production (E&P) firms and private equity involved in the energy industry. Others represented the OFS and midstream sectors.

As they have done for several years, Raymond James analysts quizzed the executives anonymously to get their outlook about the North American market, specifically commodity prices, capital expenditure (capex) plans and costs.

“The mood throughout the room appeared cautiously upbeat,” said Adkins and Freeman. “In sum, the industry seems to be more bullish on oil and in-line with gas relative to the futures markets. “Industry professionals also seem to be acutely aware that service costs would likely rise over the next several quarters as the service market continues to tighten.”

There are concerns by E&Ps about the expected rise in OFS costs. Also an issue is the potential for the Organization of the Petroleum Exporting Countries to flood the market with crude oil supply while U.S. E&Ps continue ramping up output. Another concern is that despite their assurances, E&Ps would be unable to live within their cash flow.

The survey’s results don’t represent a consensus view, but they are “predominantly based on those seeing operating results firsthand within their own firms on a daily basis,” Adkins and Freeman noted.

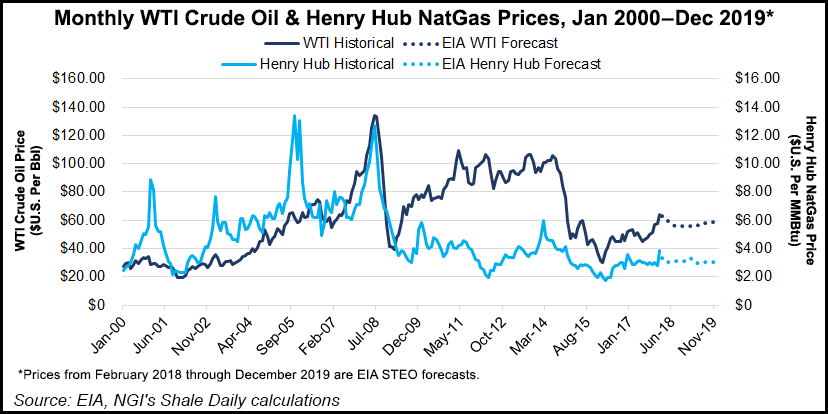

Executives surveyed expect West Texas Intermediate (WTI) crude prices to exit 2018 averaging $65/bbl, sharply above the futures market at $58. Attendees expect U.S. natural gas to exit the year averaging $2.80/Mcf, which is close to the futures estimate of $2.79.

Asked whether or not they believed that the E&P industry as a whole would remain “prudently committed” to living within cash flow this year, as some have publicly said they would, the audience survey said otherwise.

“Despite the supporting evidence from our publicly traded coverage, audience expectations for more responsible U.S. E&P spending was virtually nonexistent,” said Adkins and Freeman. “A whopping 91% of attendees believe that E&Ps will fail to live within cash flows this year even at $60/bbl WTI.”

Although the question was posed to an audience that overall is well funded, “there still appears to be a fairly significant disconnect between what investors want to see E&Ps do and what industry representatives think E&P companies will do,” said analysts.

Meanwhile, OFS costs are seen escalating as bottlenecks for some services begin to emerge. Cost inflation continued to be “top of mind” for the dinner guests.

“While the most common expectation was for U.S. service costs to increase in the 5-10% range, it is important to note that 45% of respondents expect over 10% cost inflation,” said analysts.

“This compares to the view from most public E&Ps for service cost inflation in the 5% range.”

Some public E&Ps already are citing costs savings in the onshore by using locally sourced sand, from higher priced rig contracts falling off and from continued efficiency gains.

What that means is that 2018 spot service pricing may be higher than well costs.

The NAPE audience “sent a clear signal” that available pressure pumping fracture spreads may represent the largest bottleneck (60%) this year. “We are firmly in agreement with this result,” said analysts.

Other notably tight markets are expected for trucking and drilling rigs. A squeeze is forecast for labor, cementing, wireline, high-spec drillpipe and chemicals, along with compression, coiled tubing and alternating current land rigs.

Appalachian E&P-focused Seneca Resources Corp. reported higher OFS costs and bottlenecks for services in National Fuel Gas Co.’s recent quarterly report. Stronger demand for services has been reported during quarterly conference calls by Patterson-UTI Energy Inc. and National Oilwell Varco Corp., along with the largest North American pressure pumper Halliburton Co. and No. 1 OFS operator Schlumberger Ltd.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |