Markets | NGI All News Access | NGI Data

Natural Gas Futures Sell-Off Continues for Second Straight Week; Spot Prices Sink Too

A precipitous slide in the natural gas futures market that began when the calendar rolled over to February continued for the week ending Friday, setting a bearish tone for spot prices across most regions. The NGI Weekly Spot Gas Average skidded 50 cents to $2.75/MMBtu.

Henry Hub dropped 31 cents week/week to $2.72, almost matching the 40-cent decline recorded the week before. The drop at Henry Hub paved the way for most regional averages to fall by double digits for the week.

California and West Texas were the exceptions.The California Regional Average finished flat thanks in part to a 12-cent gain at SoCal Citygate, which traded at a discount to Henry on average for the week at $2.59.

In West Texas, Waha added 6 cents to $2.13, while El Paso Permian added 4 cents to $2.06.

Rockies prices posted gains Thursday and Friday thanks to colder weather but finished lower on a weekly basis. CIG shaved off 7 cents to $2.10.

Some points in the Northeast traded at winter premiums on average for the week, though a $2.03 decline in the regional average showed a market far removed from the frigid arctic cold of January. Algonquin Citygate averaged $6.70, down $1.90 week/week, while Transco Zone 6 New York averaged $3.37, down $2.32.

Meanwhile, futures sold off throughout the week, punctuated by a steep decline Friday as weather models offered a discouraging winter prognosis for the bulls.

The March contract settled at $2.584 Friday, down 11.3 cents. Friday’s intraday low of $2.576 came to close to matching the recent prompt month intraday low set Dec. 21, when the January contract reached $2.568.

One week earlier, March had settled at $2.846, and was trading closer to $3.200 just two weeks before.

“Natural gas prices are in solidly oversold levels now, settling lower eight out of the last nine days as any winter premium has been priced out,” Bespoke Weather Services said in a note to clients Friday. “Afternoon European guidance Thursday warned of further downside, and overnight guidance seemed to confirm, helping prices sell off right to the $2.58 level that had been our downside target since the start of the week.

“…With this support level holding and the market tightening at these levels, we see risk/reward getting skewed more towards the upside moving into next week,” the firm said. “…Of course, there remain risks that model guidance continues to amplify the southeastern ridge over the weekend, which would lead to further short-term downside on Monday.”

Going back to 2016, $2.50 has served as major psychological support for natural gas futures, according to INTL FCStone Financial Inc. Senior Vice President Tom Saal. He counted “at least five separate weeks” over the past two years “where the market traded towards $2.50 but didn’t go through.

“…In order for the market to go lower you’ve got to have sellers, and who’s selling it? The people who are already long. I don’t think there are too many producers out there selling gas at” current prices, Saal told NGI. “So when the speculators get done selling, then it’s over.”

The Energy Information Administration (EIA) on Thursday reported a weekly natural gas storage withdrawal that was slightly larger than market expectations, and futures traded in a narrow range following the release of the number.

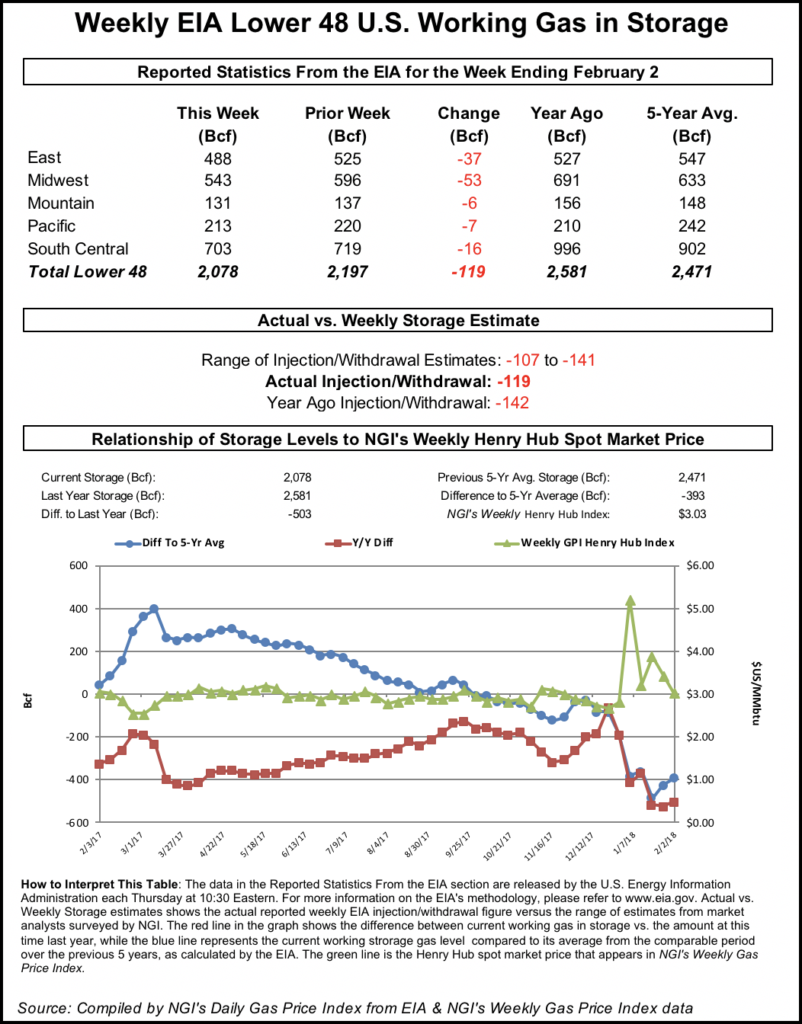

EIA reported a 119 Bcf withdrawal from U.S. gas stocks for the week ending Feb. 2, versus a year-ago withdrawal of 142 Bcf and a five-year average pull of 151 Bcf.

Shortly after the number crossed trading desks at 10:30 a.m. EDT, the March futures contract climbed above $2.740 before pulling back to around $2.720. By 11 a.m. EDT, March was trading around $2.723, up about 2 cents from Wednesday’s settle.

Prior to Thursday’s report the market had been looking for a withdrawal close to the actual figure.

A Reuters survey of traders and analysts on average had estimated a withdrawal of 116 Bcf. Survey responses ranged from -107 Bcf to -141 Bcf.

Kyle Cooper of ION Energy had estimated a 118 Bcf withdrawal. PointLogic Energy in a note Monday had estimated a 116-Bcf withdrawal for the period. Stephen Smith Energy Associates in a revised estimate Tuesday had predicted a withdrawal of 121 Bcf.

Intercontinental Exchange storage futures settled Wednesday at -118 Bcf for the period.

The 119 Bcf withdrawal “was on the higher end of analyst estimates but fits in perfectly with our model,” Bespoke Weather Services said in a note to clients shortly after the release of the number. “This continues to reinforce the idea that the natural gas market is still sensitive to forward weather expectations, as it is tight enough for colder weather to put a sizable dent in storage into the spring.

“However, production remains high enough to keep a ceiling on prices as well, and the price reaction off the number was not particularly bullish,” Bespoke said. “We see this number reaffirming our neutral market outlook and confirming upside once models trend colder.”

Analysts with Wells Fargo Securities said Thursday they expect a cumulative 258 Bcf withdrawal over the next two weeks based on their model and current forecasts from the National Oceanic and Atmospheric Administration.

Total working gas in underground storage as of Feb. 2 stood at 2,078 Bcf, versus 2,581 Bcf a year ago and five-year average stocks of 2,471 Bcf. The current year-on-year storage deficit narrowed week/week from -526 Bcf to -503 Bcf, while the year-on-five-year deficit shrank from -425 Bcf to -393 Bcf, EIA data show.

By region, the largest pull came in the Midwest (-53 Bcf), followed by the East (-37 Bcf). The Pacific region saw a 7 Bcf withdrawal for the week, while 6 Bcf was withdrawn in the Mountain region. Net withdrawals in the South Central region totaled 16 Bcf, with 32 Bcf pulled from nonsalt, offsetting 15 Bcf injected into salt, according to EIA.

“Disappointment versus recent norms coupled with a tough market led to a lukewarm day for Henry Hub, which traded slightly down,” Tudor, Pickering, Holt & Co. analysts told clients Friday. “Next week’s number is setting up for a larger than normal draw on early estimates as HDD forecasts fall back in line with norms and the market shifts to more than 1 Bcf/d undersupplied, weather adjusted.

“However, the East Coast cold snap forecasted on eight- to 14-day weather models” earlier this month “looks to have shifted to the less populous Midwest, potentially weakening or delaying the last throes of winter demand.”

Genscape Inc. said the market’s attitude toward the storage picture appears the same as it was earlier in the year.

“The market is simply not concerned with the ability to refill storage with all the anticipated production growth projected to hit now through summer,” the firm’s analysts said in a note to clients Friday. “In fact, we at Genscape have been grappling with trying to figure out how the market absorbs the quantity of production economically priced to flow in 2018.”

Genscape expects “gas-on-gas competition” to continue to increase, “with a squeeze of volumes towards the middle of the continent, leading us to believe that one or some of the producing regions will have to blink and choke back volumes.”

Lower crude oil prices could also limit production growth, according to the firm.

“Our Spring Rock group shows the bulk of gas production growth occurring from liquid-rich basins with volumes buoyed by” $65/bbl oil. But since the start of February West Texas Intermediate (WTI) prices have been “highly volatile and dropping. Thursday closed at $60.51/bbl, about 15 cents above the 52-week range.

“It is not quite clear how much of the drop is affected by crude fundamentals versus correlations to the stock market declines and increased bond yield reports of recent days,” Genscape said. “…Should the WTI price retreat become sustained, though, there will be a reduction in forecast volumes of associated gas production for the summer, potentially alleviating (but far from eliminating) the tight gas-on-gas competition that is setting up.”

WTI crude oil futures on the New York Mercantile Exchange settled at $59.20/bbl Friday, down $1.95.

Stephen Smith Energy Associates said in its latest Monthly Energy Outlook Friday that it expects production to keep natural gas prices below $3.00/MMBtu through the summer.

“Our base case 2018 model assumes a 3% hotter-than-normal summer, but also a strong gas production ramp-up as the year progresses,” Smith analysts said. “While the net effect is to keep storage somewhat below 2006-2010 norms through early fall 2018, we expect the steady upward gains for U.S. gas production to keep a sub-$3/MMBtu lid on spring and summer gas prices.

“Production growth for 2018 is likely to approach 6.5-7.0 Bcf/d per year. There will be some offsets to this strong production growth, but likely not enough to tighten gas markets unless summer heat surprises. Combined annual gains for gas exports to Mexico and also liquefied natural gas exports should exceed 2 Bcf/d. Barring a much hotter-than-expected summer we expect this combination of factors to lead to an annual average 2018 price in the $2.85/MMBtu neighborhood.”

In the spot market Friday, cold temperatures forecast for the northern United States lifted Rockies prices as New England pulled back ahead of a weekend warm-up; the NGI National Spot Gas Average fell 16 cents to $2.55/MMBtu.

PointLogic Energy forecasts on Friday called for cold to linger over the northern Plains for the next week or so, according to analyst Alan Lammey. The firm’s one- to five-day outlook Friday forecast a U.S. population-weighted low temperature of 34.8 degrees, or 1.7 degrees warmer than average, with a high of 54 degrees, 3.1 degrees above normal.

“For the most part, the below normal temperatures will engulf a large percentage of the northern tier of the nation stretching from the Pacific Northwest to the Heartland and northern Plains, but cold will also be dominant throughout the central Plains, upper-Midwest and portions of the Northeast,” Lammey said.

“Some of the below-normal temperatures are expected to dive as far south as Texas during the early portion of the five-day period before temperatures rebound into the low 70s,” he said. “Elsewhere, warmer than normal temperatures will be located in a majority of the Southeast quadrant of the U.S. Out West, above average temperatures will remain anchored in place in most locations west of the Rockies.”

Points in the Rockies posted a second straight day of double digit gains Friday. Northwest Sumas added 28 cents to $2.17, while Kingsgate jumped 22 cents to $2.09.

In California, Malin climbed 12 cents to $2.35. West Texas prices saw a lift as well, including a 19 cent increase at Transwestern, which averaged $2.24.

In New England, Genscape was forecasting regional demand to fall over the weekend to around 2.5 Bcf/d versus a prior seven day average of 3.7 Bcf/d. Weather Underground was calling for temperatures in Boston to reach into the 50s Saturday after overnight lows in the 20s Friday.

Algonquin Citygate plummeted $3.20 to average $3.10, while Portland Natural Gas Transmission System gave up $1.85 to $4.64.

Midcontinent prices were mixed. NGPL Midcontinent jumped 20 cents to $2.37 as Northern Natural Ventura tumbled 46 cents to $2.57.

Natural Gas Pipeline Co. of America LLC (NGPL) on Friday lifted a force majeure following repairs at its Compressor Station 801 in Grady County, OK, in Segment 15 of its Texok A/G Zone.

During the force majeure, NGPL had limited primary firm and secondary in-path firm transports through the station to no less than 79% of contracted volumes, according to information posted to the pipeline’s bulletin board.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |