Infrastructure | E&P | NGI All News Access

U.S. Rig Count Surges on Oil Drilling Gains in Permian

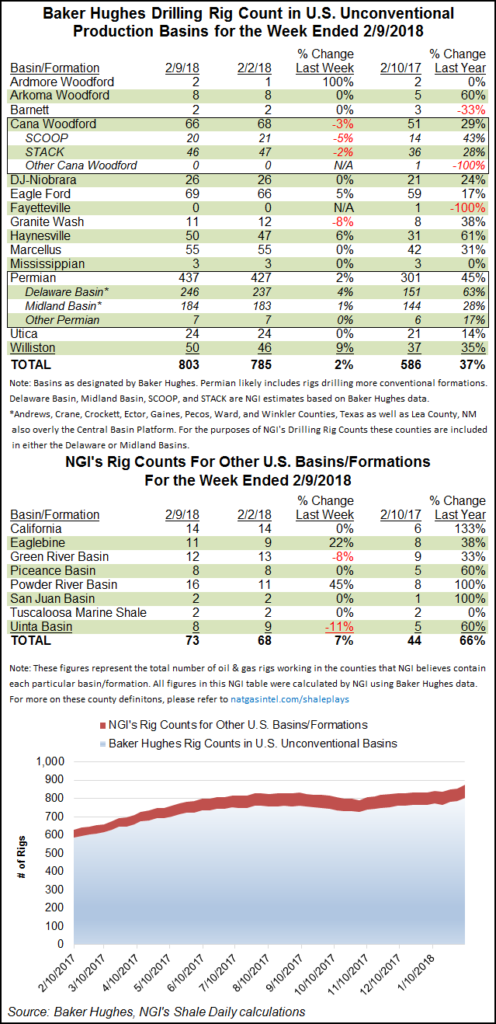

The U.S. rig count added 29 units for the week ended Friday thanks to a surge in oil-directed drilling led by the Permian Basin, according to data from Baker Hughes Inc. (BHI).

U.S. drillers brought 26 oil-directed rigs back to the patch for the week, along with three natural gas-directed units, to increase the domestic tally to 975. It was the 11th largest weekly increase in the domestic rig count since 2000, on a percentage change basis, according to NGI calculations. A year ago 741 rigs were running across the United States.

The gains included 24 horizontal units, four vertical and one directional rig. Drilling in the Gulf of Mexico was unchanged week/week, while one rig was added in “inland waters” and 28 were added on land.

Canada, meanwhile, saw 17 rigs pack up for the week, including the loss of 13 oil-directed rigs and four gas-directed.

The combined North American rig count ended the week at 1,300, up 12 week/week and 207 higher than the year-ago tally of 1,093.

The Permian, in West Texas and southeastern New Mexico, led the charge for the week, adding 10 rigs to finish at 437, up from 301 a year ago.

Further contributing to the oil-centric gains, North Dakota’s Bakken Shale added four rigs to finish the week at an even 50, up 13 year/year. Other shale gainers included the Eagle Ford (up three) and Haynesville (up three) shales. The Ardmore Woodford added one rig for the week, which doubled its running tally.

Among states, Texas unsurprisingly led with a net gain of 14 rigs week/week. Wyoming saw its count rise by four, while Louisiana and New Mexico each added three. Oklahoma and Kansas added one rig a piece, while Colorado dropped one rig overall.

The week’s ramp-up comes as oil prices have shown signs of pulling back. As of Friday afternoon, crude oil futures on the New York Mercantile Exchange were trading about $2.75 lower on the day to $58.37/bbl. That’s after trading above $66/bbl as recently as Feb. 1.

National Oilwell Varco Corp. (NOV), during a 4Q2017 earnings conference call earlier in the week, said the oil and gas market finally is nearing an inflection point after a difficult downturn. But NOV CEO Clay Williams also said the market remains cautious about what the upturn may look like.

“No. 1, it’s not clear that oil companies believe higher oil prices, at least not yet.” Exploration and production companies are “under tremendous pressure” to generate a higher return on invested capital “and all projects appear to look to West Texas Intermediate as the benchmark,” Williams said.

“I believe the consensus view is that unconventional oil from the Permian Basin carries a roughly $45/bbl breakeven, and there persist fears that the oil price could revisit that level.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |