Markets | NGI All News Access | NGI Data

EIA Reports Natural Gas Storage Pull Slightly Higher Than Expected; Futures Market Shrugs

The Energy Information Administration (EIA) on Thursday reported a weekly natural gas storage withdrawal that was slightly larger than market expectations, and futures traded in a narrow range following the release of the number.

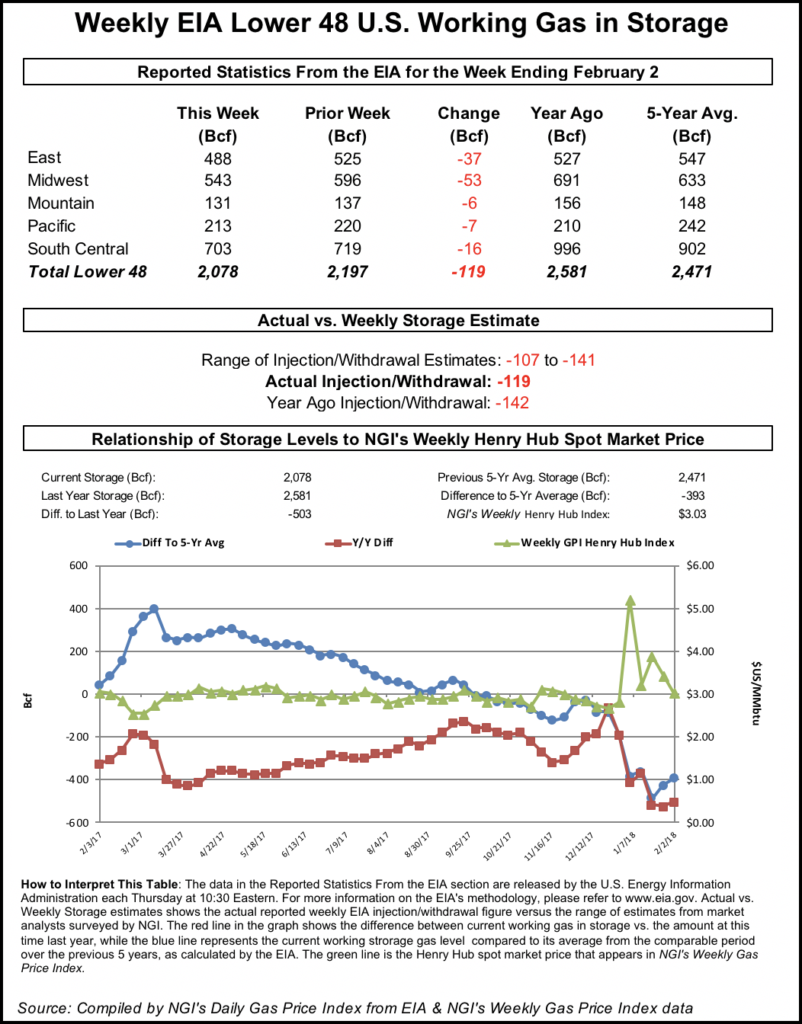

EIA reported a 119 Bcf withdrawal from U.S. gas stocks for the week ending Feb. 2, versus a year-ago withdrawal of 142 Bcf and a five-year average pull of 151 Bcf.

Shortly after the number crossed trading desks at 10:30 a.m. EDT, the March futures contract climbed above $2.740 before pulling back to around $2.720. By 11 a.m. EDT, March was trading around $2.723, up about 2 cents from Wednesday’s settle.

Prior to Thursday’s report the market had been looking for a withdrawal close to the actual figure.

A Reuters survey of traders and analysts on average had estimated a withdrawal of 116 Bcf. Survey responses ranged from -107 Bcf to -141 Bcf.

Kyle Cooper of ION Energy had estimated a 118 Bcf withdrawal. PointLogic Energy in a note Monday had estimated a 116 Bcf withdrawal for the period. Stephen Smith Energy Associates in a revised estimate Tuesday had predicted a withdrawal of 121 Bcf.

Intercontinental Exchange storage futures settled Wednesday at -118 Bcf for the period.

The 119 Bcf withdrawal “was on the higher end of analyst estimates but fits in perfectly with our model,” Bespoke Weather Services said in a note to clients shortly after the release of the number. “This continues to reinforce the idea that the natural gas market is still sensitive to forward weather expectations, as it is tight enough for colder weather to put a sizable dent in storage into the spring.

“However, production remains high enough to keep a ceiling on prices as well, and the price reaction off the number was not particularly bullish,” Bespoke said. “We see this number reaffirming our neutral market outlook and confirming upside once models trend colder.”

Analysts with Wells Fargo Securities said Thursday they expect a cumulative 258 Bcf withdrawal over the next two weeks based on their model and current forecasts from the National Oceanic and Atmospheric Administration.

Total working gas in underground storage as of Feb. 2 stood at 2,078 Bcf, versus 2,581 Bcf a year ago and five-year average stocks of 2,471 Bcf. The current year-on-year storage deficit narrowed week/week from -526 Bcf to -503 Bcf, while the year-on-five-year deficit shrank from -425 Bcf to -393 Bcf, EIA data show.

By region, the largest pull came in the Midwest (-53 Bcf), followed by the East (-37 Bcf). The Pacific region saw a 7 Bcf withdrawal for the week, while 6 Bcf was withdrawn in the Mountain region. Net withdrawals in the South Central region totaled 16 Bcf, with 32 Bcf pulled from nonsalt, offsetting 15 Bcf injected into salt, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |