Gas Natural Fenosa to Add One Million Customers in Mexico Over Next Five Years

Gas Natural Fenosa (GNF) aims to connect one million new customers to its natural gas distribution networks in Mexico over the next five years.

Country manager Narcis de Carreras said that GNF’s growth goals in Mexico would be outlined in more detail in the Spanish parent company’s strategic plan for 2018-2020, which is scheduled for release at a later date.

“We also want to work on another angle that perhaps hasn’t received as much attention in this country…, which is new uses for natural gas in other areas,” such as vehicles, rail transport and marine fuels, he told local press. “We believe Mexico has enormous potential in these areas.”

GNF added 115,000 distribution clients in 2017, reaching 1.77 million customers in Mexico by the end of the year, the company reported Wednesday.

“Gas sales increased by 12.5%, mainly in the TPA [third-party access] market, while the industrial market expanded by 1.5% and the residential-commercial market by 1.6%,” according to the company.

GNF distributed 197 Bcf of natural gas in Mexico during 2017, or an average of 540 MMcf/d. Gas sales in Latin America, which also include distribution businesses in Argentina, Brazil and Chile, were up 12.1% to 784 Bcf, accounting for 54% of global distribution sales volumes.

The company is also active in the Mexican power generation business, where it operates 2,343 MW of mostly combined-cycle gas turbines. The plants produced around 17,000 GWh during 2017, up 3.4% from the prior year.

GNF is one of Mexico’s largest distribution companies, controlling 21,940 kilometers (13,633 miles) of pipeline networks spanning 13 states.

Its service areas include the city of Monterrey, the country’s largest local distribution market and a business hub for the industrialized northeast region. GNF served 770,252 customers in Monterrey during 2016, distributing an average 255 MMcf/d, according to data from the Mexican Energy Ministry (Sener).

Last year, GNF received approvals to distribute gas in the southern states of Yucatan, Campeche and Tabasco. It is awaiting approval for a permit to operate in the nearby state of Quintana Roo. The company is also developing new distribution zones in the Valle de Mexico region, which is adjacent to Mexico City, and in the northwestern state of Sinaloa.

The company said Wednesday that it would spend 247 million euros ($304 million) by 2021 on the buildout of its Mexican distribution networks. It added 888 kilometers during 2017.

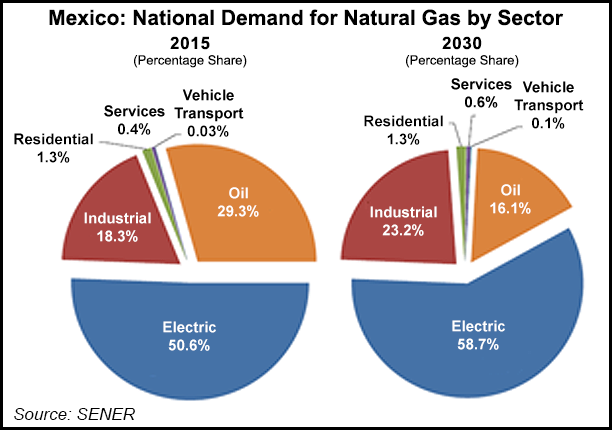

The distribution market comprises a relatively small part of the Mexican natural gas industry, given that liquefied petroleum gas remains the fuel of choice among most households.

A spokesperson for local industry group Asociacion Mexicana de Gas Natural (AMGN) told NGI that the expansion of Mexico’s pipeline transportation network would drive growth in the distribution business. “Another important step was the designation of the national territory as a unified geographic zone, whereby distribution companies can expand their networks throughout the country.”

The unified distribution zone, which would phase out the current geographic concession system, is the first piece of a planned regulatory overhaul intended to boost competition in the sector and reduce the barriers to its growth.

Sener is also readying a public policy document to promote the gas distribution business in Mexico, a draft of which could be released during this quarter at the earliest. Measures potentially on the table include the use of development bank financing, coordination mechanisms for state and municipal permitting, and incentives for natural gas vehicles.

Industry sources also indicate the need for consumer education programs. “Distribution companies affiliated with AMGN have made efforts to disseminate information about the benefits of natural gas,” the spokesperson said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |