E&P | NGI The Weekly Gas Market Report

U.S. to Become Net Exporter on Shale and Tight Oil, Natural Gas Development, EIA Says

The United States, which has been a net energy importer since 1953, will transition to become a net exporter by 2022 or earlier, based on continued development of domestic shale and tight oil and natural gas resources, paired with modest energy consumption growth, according to a series of long-term projections released Tuesday by the Energy Information Administration (EIA).

EIA previously reported that the United States became a natural gas exporter last year for the first time since 1957, and the International Energy Agency has projected that the country will become the largest liquefied natural gas exporter by the mid 2020s.

The reference case in EIA’s Annual Energy Outlook 2018 (AEO2018) projects the United States will become a net energy exporter by 2022, with the transition occurring even earlier in some sensitivity cases that incorporate assumptions supporting larger growth in oil and natural gas production or that have higher oil prices.

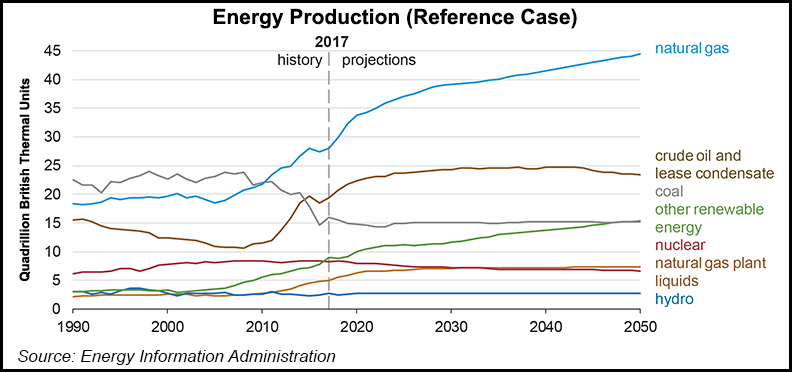

The fuel mix of domestic energy consumption changes over the projection period in the reference case, with natural gas and renewables growing the most. The industrial sector would account for the most growth in gas consumption, EIA said, with significant increases also expected in the power sector as a result of the scheduled expiration of renewables tax credits in the mid-2020s.

Total U.S. energy production increases by 31% through 2050 in the reference case, led by increases in production of nonhydro renewables, natural gas and crude oil. Natural gas would account for 39% of U.S. energy production by 2050 under the reference case.

“Increased U.S. natural gas production is the result of continued development of shale gas and tight oil plays, which account for more than three-quarters of natural gas production by 2050,” EIA said in the AEO2018. “Natural gas production from the shale gas and tight oil plays as a share of total U.S. natural gas production is projected to continue to grow in both share and absolute volume because of the large size of the associated resources, which extend over more than 500,000 square miles.”

Continued development of the Marcellus and Utica plays is the main driver of growth in total U.S. shale gas production across most AEO2018 cases and the main source of total U.S. dry natural gas production, EIA said. Production from the Eagle Ford and Haynesville plays is a secondary source to domestic dry natural gas, though production from those plays is projected to level off after 2028.

At the same time, domestic offshore gas production is expected to remain nearly flat as production from discoveries is offset by declines in legacy fields. Coalbed methane gas output is expected to decline through 2050 because of unfavorable economic conditions for its production, EIA said.

EIA’s reference case forecasts U.S. crude oil production this year will surpass the 9.6 million b/d record set in 1970 and plateau between 11.5-11.9 million b/d. “The continued development of tight oil and shale gas resources supports growth in natural gas plant liquids production, which reaches 5.0 million b/d in 2023 in the reference case — a nearly 35% increase from the 2017 level,” EIA said.

Natural gas prices in all AEO2018 cases are dependent on resource and technology assumptions, but Henry Hub prices in the reference case are 14% lower through 2050 than they were in AEO2017, because of “an estimated increase in lower-cost resources, primarily in the Permian and Appalachian basins, which support higher production levels at lower prices over the projection period.”

The reference case projection assumes trend improvement in known technologies, with a view of economic and demographic trends reflecting current views of leading economic forecasters and demographers, and assumes that current laws and regulations affecting the energy sector remain unchanged throughout the projection period. The reference case also assumes gross domestic product increasing at an annual rate of 2.0% through 2050.

In addition to the reference case, AEO2018 includes energy projections through 2050 under high and low oil price cases, high and low oil and gas resource and technology cases, high and low economic growth cases, and cases assuming that the Clean Power Plan (CPP) is implemented. The Environmental Protection Agency has indicated that it plans to completely repeal the CPP by October.

Even before it was released, EIA’s shale gas and tight oil projections were being questioned by some environmental groups.

“There is no doubt that the U.S. can produce substantial amounts of shale gas and tight oil over the short- and medium-term,” said J. David Hughes, who authored a report for the Post Carbon Institute that was issued Monday. “Unrealistic long-term forecasts, however, are a disservice to planning a viable long-term energy strategy. The very high to extremely optimistic EIA projections impart an unjustified level of comfort for long-term energy sustainability.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 1532-1266 |