Markets | NGI All News Access | NGI Data

Natural Gas Storage Pull Matches Bearish Expectations; Futures Slide

The Energy Information Administration (EIA) reported a storage withdrawal Thursday that fell in line with the market’s bearish expectations, and futures slid further after selling off overnight.

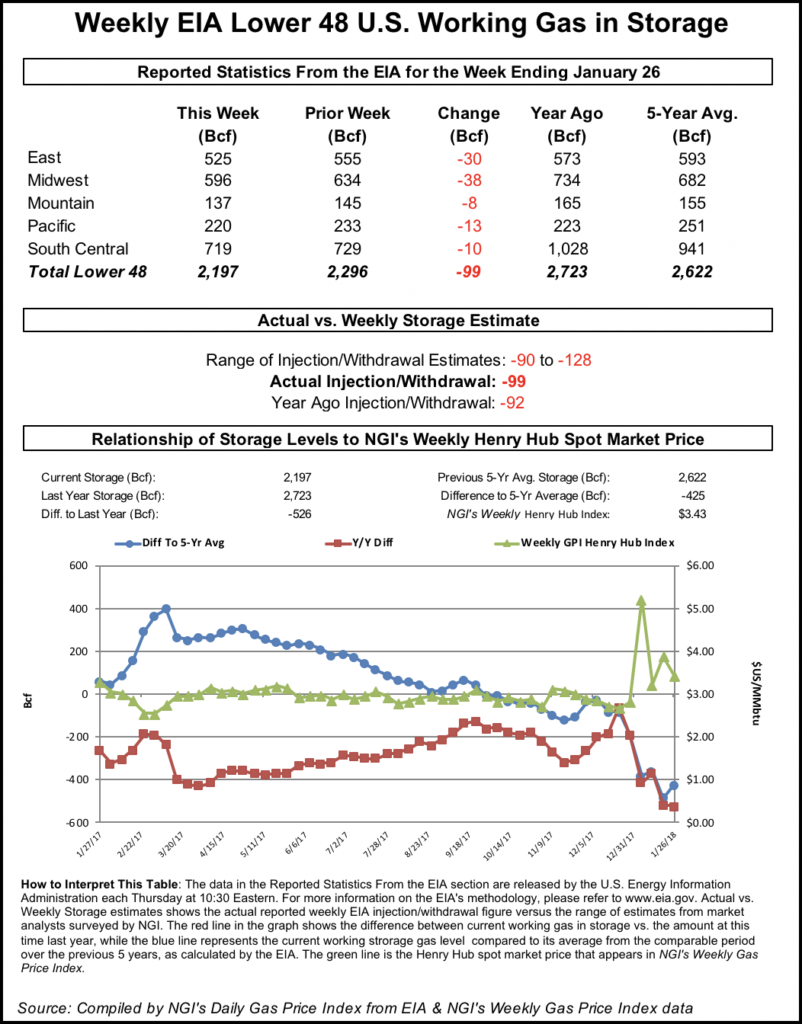

EIA reported a 99 Bcf withdrawal from U.S. gas stocks for the week ending Jan. 26. That’s versus a year-ago withdrawal of 92 Bcf and a five-year average withdrawal of 160 Bcf.

The 99 Bcf pull is a far cry from the 288 Bcf withdrawal reported last week, and it comes as recent weather guidance has backed off on the intensity of arctic cold forecast to sweep into the Lower 48 states later this month.

As the number crossed trading desks at 10:30 a.m. EDT, the March contract briefly dipped below $2.850 before returning to the $2.855-2.875 area, down around 13 cents from Wednesday’s settlement. By 11 a.m. EDT, March was trading around $2.875.

The price action on the March contract Thursday morning stood in stark contrast to the final few trading days of the February contract, which rolled off the board at $3.631.

Prior to the report, the market had been expecting a withdrawal close to the actual figure. The average taken from a Reuters survey of traders and analysts had showed the market expecting a 104 Bcf withdrawal.

PointLogic Energy on Monday estimated a 91 Bcf withdrawal for the week ending Jan. 26. “At this level, net withdrawals would come in 197 Bcf below last week’s reported withdrawal as milder weather spread across the East, Midwest and South Central regions week-on-week,” analysts said in a note. “Additionally, injection demand in the South Central region’s salt cavern storage facilities picked up significantly.”

Kyle Cooper of ION Energy estimated a pull of 111 Bcf. Stephen Smith Energy Associates revised its estimate Tuesday to a withdrawal of 101 Bcf, after previously calling for a 98 Bcf pull. That’s versus a seasonally normal draw of 159 Bcf based on 2006-2010 norms, according to the firm.

“This fits perfectly within the range of expectations and represents clear and significant loosening from the previous week, which makes sense given the rebound in production,” Bespoke Weather Services said of the 99 Bcf withdrawal. “This number confirms that colder weather will be necessary through February to bounce prices, otherwise there could be further downside.”

After EIA’s report the market “bounced right off the $2.85 support level we highlighted this morning, and the strip appears modestly supportive, so any afternoon gas-weighted degree day additions could support prices. Still, no sizable bounces will come without far colder weather.”

Total working gas in underground storage stood at 2,197 Bcf as of Jan. 26, versus 2,723 Bcf a year ago and a five-year average 2,622 Bcf, according to EIA. The current year-on-year deficit increased week/week from -519 Bcf to -526 Bcf, while the year-on-five-year deficit shrank from -486 Bcf to -425 Bcf, EIA data show.

By region, the largest withdrawals came in the Midwest (-38 Bcf) and East (-30 Bcf). The South Central saw a net 10 Bcf withdrawal, based on 28 Bcf pulled from nonsalt, offsetting an 18 Bcf injection for salt. In the Pacific, 13 Bcf was withdrawn, while 8 Bcf was withdrawn in the Mountain region, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |