Infrastructure | Markets | NGI All News Access

Less Impressive February Cold Forecast Sends Natural Gas Futures Reeling

After selling off sharply overnight on a decidedly less impressive outlook for February arctic cold, natural gas futures kept falling Wednesday, making last week’s prompt-month prices above $3.500/MMBtu seem a distant memory. Outside of some weather-driven gains in the Midcontinent, the spot market followed the futures lower; the NGI National Spot Gas Average fell 42 cents to $3.22/MMBtu.

By the 9 a.m. EDT opening bell, the March contract had already tumbled about 15 cents from Tuesday’s settle, trading around $3.050. After trading as low as $2.960, March settled at $2.995, down 20 cents. April settled 10.5 cents lower at $2.860.

After the February contract posted a late surge to expire at $3.631 Monday, it fell to March to maintain that bullish momentum as the newly installed prompt-month. But the outlook for a renewed push of Arctic chills into the Lower 48 that had supported the big rally in the February contract over the last week or so suddenly seemed a lot less supportive Wednesday.

NatGasWeather.com pointed to warmer changes in the Global Forecast System (GFS) guidance, which it said “had been considerably colder than the rest of the data” prior to Wednesday.

“There’s still expected to be numerous cold blasts out of Canada sweeping across the northern and eastern U.S. in the weeks ahead, they’re just trending less impressive overnight and so far midday,” NatGasWeather said. “Some of the more recent data has been a little colder with a weather system Feb. 7-8, but milder” with systems before and after “as the frigid Arctic cold pool retreats further north into Canada.”

Systems expected to deliver cooler temperatures into the northern and eastern United States toward the middle of the month as of Wednesday were “not entertaining as much Arctic air as the data showed just 12-24 hours ago,” the firm said.

Price Futures Group analyst Danny Flynn said traders are now looking ahead to the shoulder season, expecting any price spikes from February cold to be short-lived.

“I think by about mid-February it’s looking like the ride will be over…and we’ll be looking for really hot weather this summer, anything to get this market moving,” he said. The market’s “full to capacity” on the production side, according to Flynn, who said he would be looking for producers to hedge at prices above $3.

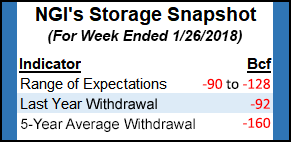

The bulls probably won’t get much help from Thursday’s government storage report. Predictions for this week’s Energy Information Administration (EIA) release have been pointing to a much smaller withdrawal versus the 288 Bcf pull reported last week.

The average taken from a Reuters survey of traders and analysts showed the market expecting a 104 Bcf withdrawal. That’s versus a year-ago withdrawal of 92 Bcf and a five-year average -160 Bcf. Responses ranged from -90 Bcf to -120 Bcf.

PointLogic Energy on Monday estimated a 91 Bcf withdrawal for the week ending Jan. 26.

“At this level, net withdrawals would come in 197 Bcf below last week’s reported withdrawal as milder weather spread across the East, Midwest and South Central regions week-on-week,” PointLogic analysts said in a note to clients. “Additionally, injection demand in the South Central region’s salt cavern storage facilities picked up significantly.”

Kyle Cooper of ION Energy estimated a pull of 111 Bcf. Stephen Smith Energy Associates revised its estimate Tuesday to a withdrawal of 101 Bcf, after previously calling for a 98 Bcf pull. That’s versus a seasonally normal draw of 159 Bcf based on 2006-2010 norms, according to the firm.

Intercontinental Exchange futures for this week’s EIA report settled at -100 Bcf Tuesday.

The -288 Bcf reported last week tied for the second largest pull on record going back to at least 2010, matching the 288 Bcf withdrawal EIA reported Jan. 10, 2014. That -288 Bcf number had stood as the largest on record until earlier this winter, when EIA reported a whopping 359 Bcf pull for the week ending Jan. 5.

In the spot market Wednesday, with March futures dropping below $3 just days after the February contract expired at $3.631, cash prices at Henry Hub fell somewhere in between, tumbling 40 cents to $3.21.

Elsewhere, prices weakened across most of the country outside of a few points in the Midwest and Midcontinent.

In its one- to five-day outlook, Radiant Solutions noted potential cold advancing “into the Plains and Midwest courtesy of northerly flow and high pressure migrating southward out of Canada.”

Northern Natural Demarcation added 10 cents to $3.10 Wednesday, while Northern Border Ventura gained 4 cents to $3.18.

Points in New England posted hefty losses.

Temperatures along the East Coast were expected to moderate Thursday before trending colder heading into the weekend. AccuWeather was calling for highs in the mid-40s Thursday in Boston to give way to lows in the teens and 20s Friday and Saturday. Washington, DC, was expected to see temperatures climb into the 50s Thursday before cooling Friday, ranging from the 30s down into the teens.

In New England, Algonquin Citygate plummeted $4.04 to $6.30, while further south Transco Zone 5 dropped 80 cents to $4.58.

In Appalachia, Dominion South gave up 6 cents to $2.95.

Officials responded to reports of an explosion occurring early Wednesday morning on a Rockies Express Pipeline (REX) lateral in a rural stretch of Noble County, OH, according to the Noble County Emergency Management Agency.

The 24-inch Seneca Lateral “experienced a natural gas release” at around 2:30 a.m. EDT Wednesday between State Route 513 and State Route 379, Phyllis Hammond, spokeswoman for REX backer Tallgrass Energy, confirmed to NGI.

“There were no injuries reported and no evacuations,” Hammond said, adding that the pipeline’s customers were also unaffected.

REX followed emergency protocol to isolate the impacted section of the pipeline “and worked with first responders to safely secure the area, which was our first priority,” she said, noting that the company was investigating the cause and wouldn’t have a timeline for repairs until that investigation was complete.

REX notified shippers Wednesday that its MarkWest Seneca-Noble and Rover-Noble locations would be unavailable until further notice.

The Seneca Lateral connects REX to a nearby processing plant. REX, a 1,700-mile pipeline running from the Rockies to Ohio, has about 2.6 Bcf/d of capacity to transport Marcellus and Utica shale gas east-to-west through its Zone 3.

REX into NGPL fell 8 cents Wednesday to $3.04, while REX into ANR dropped 8 cents to $3.05.

The Seneca processing plant has been “the main new contributor” to recent growth in east-to-west volumes on the Rover Pipeline, according to Genscape Inc., which said the plant “has ceased to deliver to REX and now is nominating only to Rover and Texas Eastern Transmission Co. (Tetco).”

Genscape noted that Rover has recently averaged above 1.4 Bcf/d in throughput.

“The majority of the receipts are still coming from the Cadiz Lateral, which averages just over 600 MMcf/d in deliveries to the pipeline, while the remaining 800 MMcf/d is split between points that came online as part of Rover Phase 1B,” the firm said.

Sponsor Energy Transfer Partners LP has said construction of Rover’s final Phase 2 is 99% complete, with horizontal directional drills (HDD) now 77% complete. But last week, FERC ordered Rover to suspend HDD activities at its Mainline B crossing of the Tuscarawas River, much to the company’s frustration, raising questions about whether Phase 2 could see delays.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |