Mexico’s Beleaguered Pemex Pulls Rabbit Out of Its Statistical Hat

The Mexican state oil company Petroleos Mexicanos (Pemex) achieved, though only by a hair’s breadth, the production targets set by the nation’s 2017 budget.

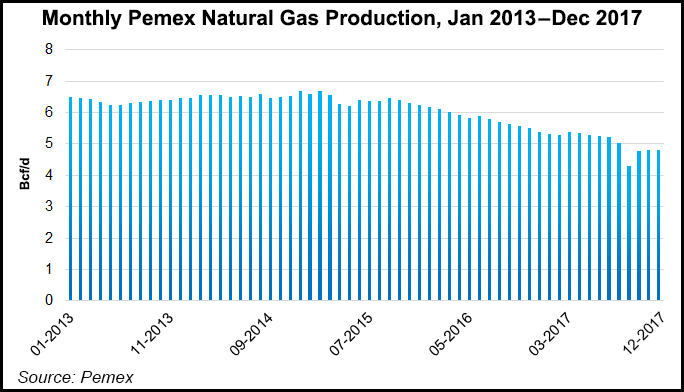

The target set in the budget for natural gas was 5.047 Bcf/d for 2017. In fact, the state company turned out 5.069 Bcf/d, according to the website of Pemex Exploracion y Produccion (PEP), its upstream subsidiary.

The figures include some 800 MMcf/d of nitrogen. Nor do they provide details on the proportion of the gas produced that is used by Pemex itself, whether by injection of wells or in its petrochemical plants.

Production of crude oil last year amounted to 1.948 million b/d, slightly above the budgetary target of 1.944 million b/d.

The figures for production of both crude oil and natural gas would have been higher if not for Hurricanes Harvey and Katia. As a result, production of crude fell to 1.73 million b/d in September, while natural gas fell to 4.3 Bcf/d.

The achievement of the targets was particularly positive for Pemex at a time when much of its downstream business, particularly in the refineries, appears to be going awry.

The immediate future does not appear to be very positive for PEP. June was the last month in 2017 in which output reached 2 million b/d. August was the last to reach 5 Bcf/d of gas. The remainder of the year was almost all downhill.

This year’s budget calls for less natural gas production with a target of 4.828 Bcf/d. Output of crude is expected to grow, but only marginally, to 1.951 million b/d.

This will be the 13th year in which production of crude by Pemex has fallen since the peak of 2004, when it reached 3.38 million b/d. It is also likely certain to be the second — after last year — to fall below 2 million b/d since the Energy ministry’s current records began in 1990.

Natural gas production peaked in 2009 at 7.03 Bcf/d.

In 2004, the Cantarell complex in the Bay of Campeche produced more than 2 million b/d. Now it turns out a mere 130 b/d. By now, however, it is the nation’s leading natural gas producer, at 1 Bcf/d.

In production of non-associated gas, the leader remains the Burgos basin, just over the border from Texas, which has languished under Pemex. Burgos currently produces 0.7 Bcf/d, less than half as much as it did in 2009.

Following the 2013-2014 energy reform, Pemex is no longer a monopoly. So far, however, other producers are marginal. Most are newcomers to the industry and operating in fields abandoned by the state company, with total output of some 2,000 b/d of crude and 34 MMcf/d of natural gas.

But that is only a glimmer of what is likely to begin in the coming years, according to official forecasts. The energy ministry so far expects $61 billion to be invested over the next 25 years under the terms of reform, including the auctions of Rounds One and Two, plus farm-outs and “migrations” of areas previously controlled by Pemex.

The blocks that were auctioned in the Burgos and Tampico-Misantla basins have considerable potential to boost production of gas, says Arturo Carranza, analyst of Mexico National Institute of Public Administration. But, he adds, “they’re not likely to be brought to market within the next couple of years at least.”

Mexico’s production of natural gas seems sure to decline in the short term, he says, “but that’s not really a problem. American gas prices are the cheapest in the world. Imports on a big scale suit Mexico right now, and of course they suit American businesses.”

Mexico needs to realize its potential in natural gas for reasons of national energy security, Carranza adds, “but there’s no immediate problem.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |