More Patience and Liquidity Urged as Mexico Natural Gas Markets Transform

A BP plc executive suggested last Thursday that whatever ails the developing energy markets in Mexico can be resolved with patience and liquidity.

On the final day of the 3rd Mexico Infrastructure Projects Forum in Monterrey, Mexico, BP’s Darrel Thorson, vice president of business development, discussed the lack of a “made-in-Mexico” natural gas pricing index.

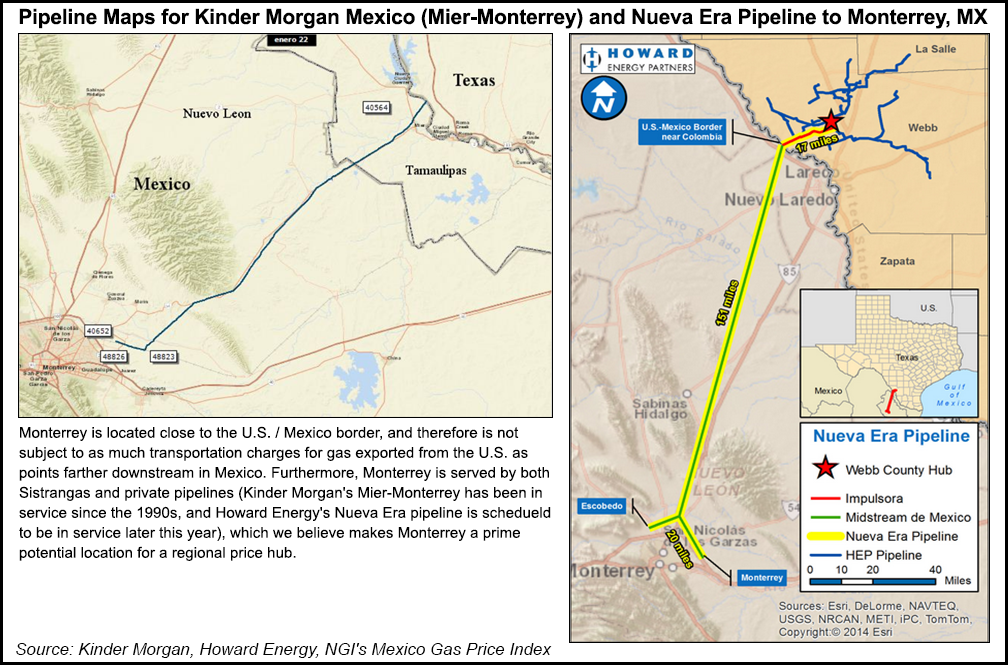

“Right now the most important thing is having pipeline access to a liquid hub, and right now the Houston Ship Channel is influenced by Mexico,” he said. “Over the next two years it will be impacted more,” with the Waha Hub in West Texas expected to be the “made-in-Mexico index.”

A Mexican-based price would not be that different than prices at the two Texas hubs, the Houston Ship Channel and Waha, he said.

“First and foremost, you want liquidity and pipeline access, and then the prices will take care of themselves.”

BP is looking at Mexico as a marketer and consumer, he said. He urged participants “to be a little bit patient, since we are less than seven months into the new market…” BP’s view is that for the the next two years “there needs to be assurance” that pipeline system operator Centro Nacional de Control del Gas Natural (Cenagas) and the energy regulatory commission, the Comison Reguladora de Energia, or CRE “can maintain equity in the market.

“From there, I think there are enough impressive players that we will see market enforcement and transparency.”

BP is “happy with the way things are going so far.” Thorson acknowledged BP is holding “constructive dialogues” with CRE, which he expects to continue.

When new pipelines and interconnections are completed this year, energy trading in Mexico should be transformed, he said. He said the market response to additional infrastructure would be similar to expansions in Appalachia, as gas prices after new pipeline takeaway capacity and gathering/processing came online. He pointed to Royal Dutch Shell plc’s plans to take advantage of the new gas supply.

“All that infrastructure came online and suddenly Shell was building a massive ethane cracker plant,” he said. “Who knew that anyone would be building a cracker in Pennsylvania, but it’s happening.”

Trade and immigration issues between the United States and Mexico may be uncertain under the Trump administration, but BP expects gas imports into Mexico to thrive in the future. BP continued to be the largest natural gas marketer in North America during 3Q2017, based on NGI’s ranking of the top marketers.

“The fact of the matter is there are 14 Bcf/d of capacity in pipelines going into the cheapest supply basins on the planet,” Thorson said. “We certainly hope that there is a very successful, thriving domestic gas business, because we as marketers act as an interface between production side and the consumption side.

“We think ultimately there will be, but there still needs to be a much more cost-effective service sector and Cenagas is working harder at technical conferences to identify critical interconnection locations.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |