E&P | Markets | NGI All News Access

U.S Oil Production to Surpass Saudi Arabia, Rival Russia This Year, Says IEA

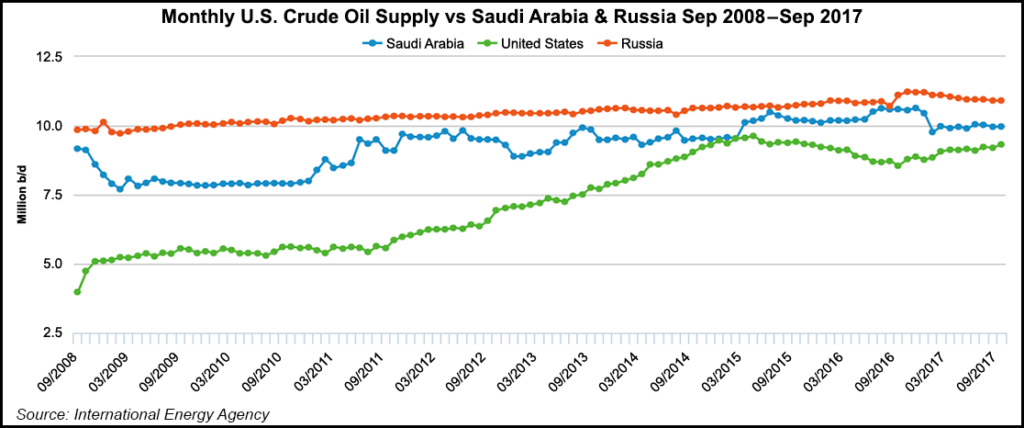

U.S. domestic crude oil production this year is likely to exceed 10 million b/d, surpassing output from Saudi Arabia and rivalling that of Russia, according to the International Energy Agency (IEA).

Rapid production growth in the United States, combined with gains in Canada and Brazil, will drive up non-Organization of the Petroleum Exporting Countries (OPEC) supply by 1.7 million b/d in 2018, compared with 700,000 b/d increase in 2017, IEA said in its latest monthly oil market report.

“A judgement as to whether the recent price strength is sustainable must take into account the rapid growth in global oil supply seen recently and which will continue through 2018,” IEA said. “Short-cycle production from the U.S. is reacting to rising prices and in this report we have raised our forecast for crude oil growth there in 2018 from 870,000 b/d to 1.1 million b/d.”

IEA expects global oil demand in 2018 to grow by 1.3 million b/d, “a conservative number that acknowledges the current perception of healthy global economic activity, but also takes into account the fact that benchmark crude oil prices have increased by 55% since June and this can dampen oil demand growth to some extent.” That’s down compared to demand growth of 1.6 million b/d in 2017. “The slowdown in 2018 demand growth is mainly due to the impact of higher oil prices, changing patterns of oil use in China, recent weakness in OECD [Organisation for Economic Co-operation and Development] demand and the switch to natural gas in several non-OECD countries,”IEA said.

Declining Venezuelan production cut OPEC crude output to 32.23 million b/d in December, and declines are accelerating in Venezuela, which posted the world’s biggest unplanned crude output decline in 2017, according to the report.

The United States will become the world’s top producer of oil and natural gas over the next several decades, according to a recent analysis by Fatih Birol, executive director of the IEA.

“The United States is set to become the undisputed leader of oil and gas production for many years to come, which has huge implications,” Birol told the Senate Energy and Natural Resources Committee. As a supplement to written testimony, he said IEA is projecting an 8 million b/d increase in U.S. tight oil output from 2010 to 2025. IEA is forecasting the United States will become the world’s largest liquefied natural gas (LNG) exporter by the mid-2020s. A few years after that it should become a net oil exporter.

The seemingly inexorable upward trend of oil and natural gas production from the seven most prolific U.S. onshore unconventional plays is likely to continue in February compared with January, according to the Energy Information Administration (EIA). Total oil production in the seven plays is expected to increase to an estimated 6.55 million b/d in February, compared to 6.44 million b/d in January, an increase of about 111,000 b/d, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |