Markets | NGI All News Access | NGI Data

Natural Gas Futures Stumble Before Afternoon Rally; Cash Plunges on Warmer Temps

Natural gas futures stumbled Thursday after a bearish miss on the Energy Information Administration’s (EIA) weekly storage figure, but an afternoon rally helped limit the damage.

In the spot market, moderating temperatures had prices plummeting across the board. The biggest drops came in East Texas and along the East Coast, where wintry conditions sent prices higher earlier in week. The NGI National Spot Gas Average fell $1.01 to $3.35/MMBtu.

The February contract dropped sharply earlier in the day Thursday, trading as low as $3.070 following EIA’s release of a weekly storage withdrawal figure that fell short of market expectations, but it moved higher in the afternoon to settle at $3.189, down 4.3 cents day/day. March settled 3.6 cents lower at $2.988.

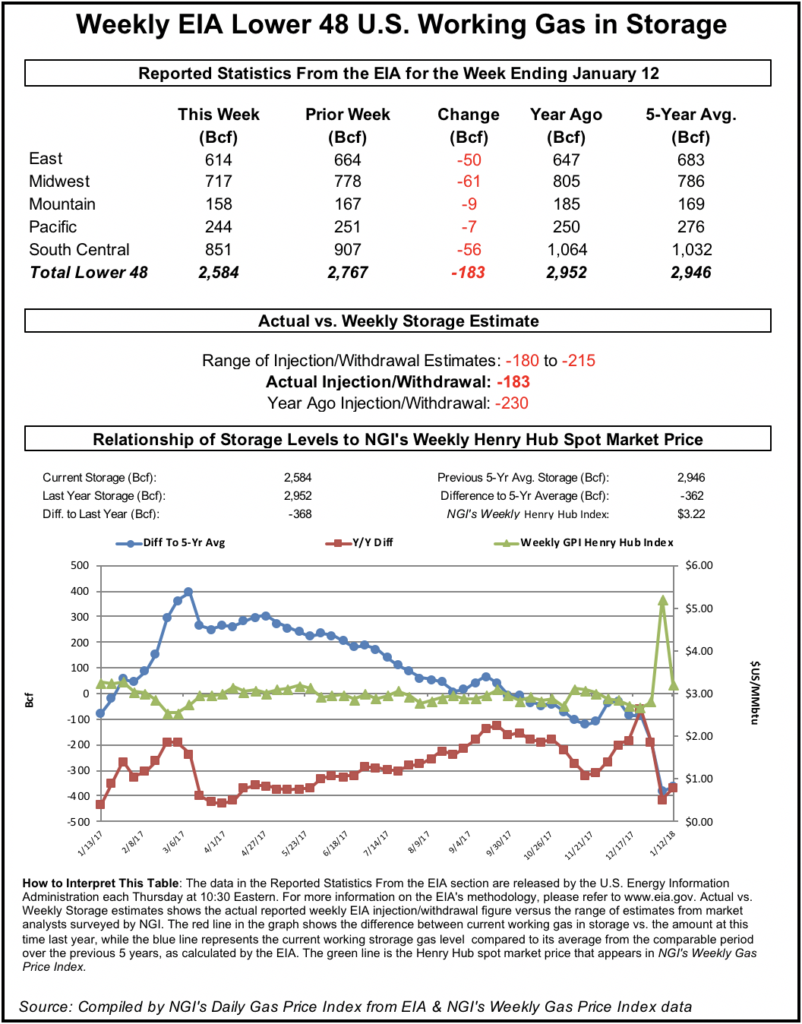

EIA reported a 183 Bcf withdrawal from U.S. gas stocks for the week ending Jan. 12, about 15 Bcf looser than what the market had been expecting. Last year 230 Bcf was withdrawn, and the five-year average for the period is a pull of 203 Bcf.

The February contract fell promptly as the figure reached trading desks at 10:30 a.m. EDT, plunging within minutes from around $3.190 to just under $3.130. By 11 a.m. EDT, February was trading around $3.100, down 13 cents from Wednesday’s settle.

Thursday’s selling came after February rallied to as high as $3.288 on Wednesday, an eight-month intraday high for a spot month contract.

A Reuters survey of traders and analysts this week had showed the market on average expecting EIA to report a 199 Bcf withdrawal. Responses ranged from -180 Bcf to -215 Bcf.

Stephen Smith Energy Associates in its Weekly Gas Outlook had predicted a withdrawal of 196 Bcf, versus a seasonally normal weekly withdrawal of 187 Bcf based on 2006-2010 norms. PointLogic Energy had predicted a 197 Bcf withdrawal, while Kyle Cooper of ION Energy had called for a withdrawal of 193 Bcf.

Last week, EIA reported a record-shattering 359 Bcf withdrawal from U.S. gas stocks for the week ending Jan. 5.

Bespoke Weather Services said that while the final number “came in decently below most analyst expectations…we see it as an implicit revision following a drawdown that likely was a bit exaggerated last week.

“Combine that with production returning from freeze-offs, and the print is clearly not as supportive for the market,” Bespoke said. “This has us tweaking lower drawdown expectations in the coming weeks as concerns about inventory levels may ease a bit. With any further warming to the forecast we could see $2.92 back in play by early next week, as though the print today was quite tight, it clearly underwhelmed.”

Total working gas in underground storage stood at 2,584 Bcf as of Jan. 12, versus 2,952 Bcf in the year-ago period and five-year average stocks of 2,946 Bcf, according to EIA.

The year-on-year storage deficit shrank week/week from -415 Bcf to -368 Bcf, while the year-on-five-year deficit narrowed from -382 Bcf to -362 Bcf, EIA data show.

By region, 61 Bcf was withdrawn in the Midwest for the week, while 50 Bcf was withdrawn from the East, according to EIA. In the South Central, 56 Bcf was withdrawn, including 18 Bcf from salt and 37 Bcf from nonsalt. The Mountain region finished at -9 Bcf for the week, while the Pacific stood at -7 Bcf.

Following Thursday’s close, Bespoke said the February contract “stabilized at support around $3.07-3.08 and reversed higher on a bit more colder risk on afternoon European guidance.

“This trend of significant buying in the last hour and a half of the trading session continued, as we did not see weather guidance as bullish enough to really justify the buying that occured,” Bespoke said. “Rather, it appears that even with a looser EIA print the market still sees it as necessary to price in the risk of stockpile shortages moving through the winter.”

Despite the bearish miss in storage, the year-on-year and year-on-five-year deficits remain supportive, Price Futures Group senior analyst Phil Flynn told NGI. Still, production growth has left the market feeling more calm in the face of such deficits, he said.

“It seems a little range-bound at these levels,” Flynn said. Typically with these kind of storage deficits “you’d be looking for a big pop in prices at some point…it’s not like we’re really breaking out to the upside. I guess what we’re seeing is storage was bearish but not bearish enough to break the market.”

In a note to clients Thursday, analysts with Jefferies LLC said natural gas demand has been on a record-setting pace month-to-date as freeze-offs have impacted production.

“Total gas demand has averaged 118.4 Bcf/d thus far in January,” Jefferies analysts said. “If this level of demand is maintained through the end of the month, it would mark the highest monthly demand on record by over 11 Bcf/d,” surpassing February 2015.

The demand mostly has been driven by the residential/commercial (res/com) sector, “which has averaged 56.5 Bcf/d thus far in January (up 9.3 Bcf/d year/year),” according to Jefferies. “This would also mark the highest level on record, 1.4 Bcf/d higher than the prior record” set in February 2015.

Power demand has averaged 27.3 Bcf/d, “on pace for its strongest January on record,” while exports are down month/month but higher than year-ago totals, the firm said.

As for supply, “gas production has still not returned to December levels” after weather-related freeze-offs this month, said the Jefferies team. January production has averaged 75.5 Bcf/d, about 1.7 Bcf/d lower than December.

“The Northeast has been the region most impacted, with January production of 26.2 Bcf/d down about 1 Bcf/d from December levels. We expect these volumes to eventually return, but the wells have to be turned back on lease by lease (which takes time to visit each well) and continued cold weather may have caused some wells to refreeze.”

A blast of unusually wintry weather in the South this week caused freeze-offs there, according to PointLogic analyst Robert Applegate.

“Subfreezing temperatures made it all the way down to the Gulf of Mexico on Wednesday, wreaking havoc on roads in states not used to the extreme cold, such as Arkansas and Georgia,” Applegate said. By 4:30 p.m. EDT Wednesday “Southeast dry gas production was down by nearly 1 Bcf from the day prior, and total Lower 48 dry gas production was down over 2 Bcf.

“…Lower 48 dry gas production is expected to be nearly 75 Bcf Thursday, with increases in nearly every region except Texas,” which as of Thursday was “expected to be 275 MMcf below” Wednesday’s levels, according to Applegate.

As for demand, Lower 48 res/com demand was “finally expected to drop below 50 Bcf” Thursday “as mild air has moved into the western half of the country and normal temperatures have returned to the Northeast. Power burn is also expected to be down from Wednesday’s 33.1 Bcf to 28.5 Bcf Thursday,” Applegate said.

In the spot market Thursday, the winter-weather premiums seen earlier this week evaporated. In Houston, which saw lows in the teens this week, temperatures were expected to climb into the low 60s Friday, according to Weather Underground.

After trading above $8 this week amid the rare winter storm and a flurry of pipeline constraints, prices at Katy and Houston Ship Channel sold off to around $3.25 Thursday. The East Texas Regional Average dropped $1.71 to $3.18.

It was a similar story along the East Coast. In the Southeast, Transco Zone 5 plunged $4.98 to $4.01 Thursday.

Genscape Inc. was calling for demand in the Southeast and Mid-Atlantic to drop sharply going into the weekend. Regional demand was forecast to fall to 12.85 Bcf/d by Sunday after surpassing 20 Bcf/d on Tuesday.

Further north, Genscape’s data showed New England demand dropping to 2.8 Bcf/d by Sunday after reaching as high as 4 Bcf/d this week. In Genscape’s Appalachia region, which includes New York and New Jersey, the firm was calling for demand to drop to 12.73 Bcf/d by Sunday after totaling around 19 Bcf/d this week.

Prices at several Northeast points gave up $4 or more day/day, while Appalachian prices also finished in the red. Tetco M3 Delivery sold off $3.99 to average $3.82. Columbia Gas dropped 48 cents to $3.09.

“A stronger area of low pressure has changes being in the warmer direction and focused out ahead of this feature in the Midwest from mid to late period and along the East Coast late,” said Radiant Solutions In its six- to 10-day outlook Thursday. :Overall, this brings a period which averages in the above normal category from the Midwest to the East, with most areas in the South also leaning on the warmer side of normal.

“The West, however, has temperatures that are near and slightly below normal, with the colder anomalies focused in the Rockies while the Southwest is variable,” Radiant said.

Genscape said Southern California Gas Co. (SoCalGas) announced a new remediation event on its Line 4000 this week that could put upward pressure on prices there ahead of some colder temperatures expected to arrive over the weekend.

The event began with Wednesday’s gas day and “reduces firm capacity at the two Needles interconnects (Transwestern and Questar Southern Trails) to zero for an unspecified amount of time,” Genscape said in a note to clients Thursday. “This work comes less than a month after the end of a similar event on the same line. The two points now limited to zero had flowed an average of 231 MMcf/d since their return.”

If the Kramer Junction can resume operating with in increased capacity limit it could help “alleviate the additional pressure placed again on SoCalGas’s storage fields and could provide a mild check on potential basis price increases,” the firm said.

SoCal Citygate gave up 27 cents to average $3.34 Thursday, while SoCal Border Average fell 34 cents to $2.79.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |