Infrastructure | NGI The Weekly Gas Market Report

Mexican Energy Development in State of Flux, Officials Indicate

In the midst of Mexico’s historic energy reforms that are encouraging more private investment, both federal and state energy officials on Wednesday indicated their nation’s regulatory and market developments remain in a dynamic state of transformation at the start of 2018.

While established global energy companies are increasingly competing for multi-billion dollar infrastructure projects, Mexican officials are focused more on the demand side of the reform process, looking at ways that government, technology and the private sector can reshape markets south of the border.

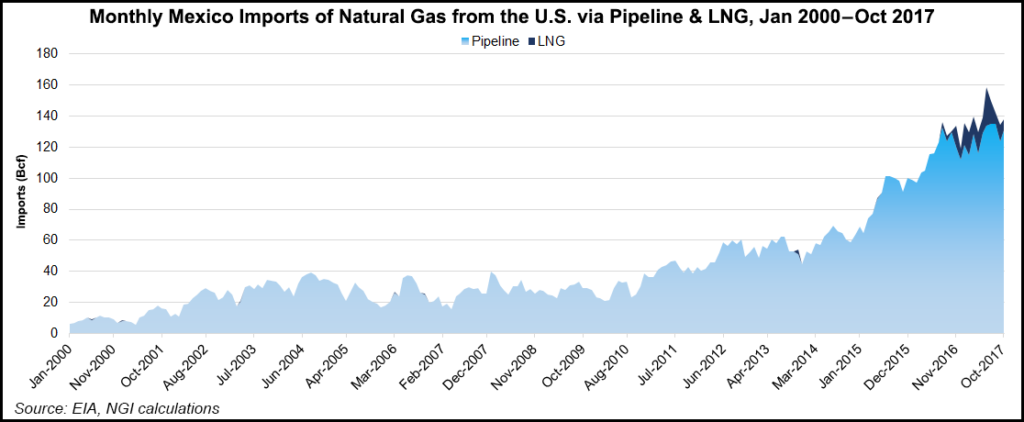

Marcelino Madrigal Martinez, a member of the Comision Reguladora de Energia (CRE), Mexico’s version of FERC, indicated that there is a lot of emphasis on development of more renewables and energy efficiency in the country to help prevent it from becoming overly dependent on U.S. natural gas imports. Madrigal Martinez characterized Mexico’s energy development “as still in the formative stages.” He delivered a keynote address on Wednesday at the 3rd Mexico Infrastructure Projects Forum in Monterrey, Mexico.

Representatives from a cross-section of the Mexican energy industry in the public and private sectors addressed a theme of transition. They acknowledged that natural gas is leading the way in opening up the national electricity sector headed by the Comision Federal Electricidad (CFE), but still concentrated on discussions about renewables and regulatory changes.

Mexican law mandates that by 2024 the country should be producing 35% of its electricity from “clean energy,” or non-fossil fuel sources including nuclear power. Clean energy certificates intended to support this target are due to start trading this year on the wholesale electricity market.

The heavily industrialized state of Nuevo Leon, where Monterrey is located, plans to take advantage of Mexico’s emerging energy markets, according to Fernando Turner, the state’s Harvard-educated economic development secretary, who also offered keynote remarks at the 3rd Mexico Infrastructure Projects Forum.

“Nuevo Leon is definitely going to play a role in energy development for Mexico overall,” said Turner, adding that updating the state’s outdated gas-fired power plants “is a huge opportunity for new gas plants.” He cautioned, though, that his nation should not get too dependent on U.S. natural gas imports. “We should try to develop more of our own resources.”

An official in the national Energy Ministry (Sener), Cesar Contreras Guzman, said that Mexico’s increasing energy development is permitting the development of new markets in the nation of 120 million people that expects to grow by another 20 million inhabitants in the next 20 years.

Contreras Guzman’s speciality is energy efficiency and technology programs, and he touted the nation’s identifying land tracts all over the countryside for potential future renewables development. He said auctions have already been completed for the development of 7,000 MW of new wind and solar power. He sees this development as one of the many benefits of the nation’s ongoing energy reforms.

Similar sentiments were voiced in the morning panel discussions that looked at the nation’s evolving energy markets, the future for power generation, led by gas-fired plants, and the development and sustainability of the nation’s renewables.

Several of the panelists noted that they see “a new level of transparency” developing in Mexico between the government and industry.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9966 | ISSN © 1532-1266 |