NGI The Weekly Gas Market Report | LNG | Markets | NGI All News Access

EIA Slashes 2018 Henry Hub NatGas Price Forecast to $2.88/MMBtu

Strong domestic natural gas production growth in 2018 will help to limit Henry Hub spot prices to an average $2.88/MMBtu, well below previous forecasts, according the Energy Information Administration (EIA).

Prices are expected to average $2.92/MMBtu in 2019, EIA said in its latest Short-Term Energy Outlook (STEO), which was released Tuesday. Henry Hub spot prices averaged $2.99/MMBtu in 2017, up 47 cents/MMBtu from a 17-year low in 2016.

The 2018 price forecast is down 24 cents/MMBtu from last month’s STEO.

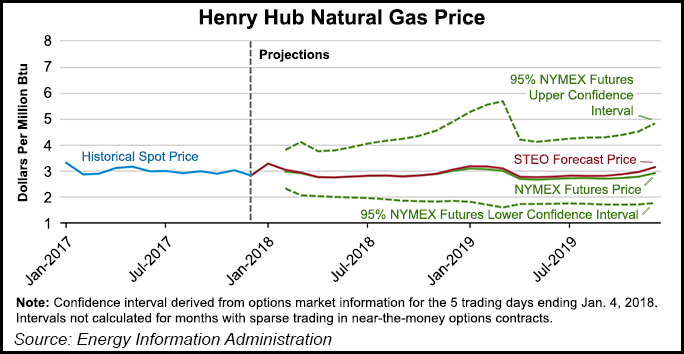

New York Mercantile Exchange contract values for April 2018 delivery traded during the five-day period ending last Thursday (Jan. 4) suggest a price range of $2.01-3.75/MMBtu, encompassing the market expectation of Henry Hub prices in April at the 95% confidence level, EIA said.

“Last year at this time, the natural gas futures contracts for April 2017 delivery averaged $3.38/MMBtu, and the corresponding lower and upper limits of the 95% confidence interval were $2.39/MMBtu and $4.77/MMBtu, respectively,” EIA said.

The front-month natural gas futures contract for delivery at Henry Hub settled at $2.88/MMBtu last Thursday, a decrease of 18 cents/MMBtu from Dec. 1.

Domestic dry natural gas production year-over-year increases estimated at nearly 7 Bcf/d in last month, coupled with temperatures that averaged 9% warmer than normal for the first three weeks of December, contributed to front-month futures prices on Dec. 21 falling to the lowest level since Feb. 2017.

“Much colder-than-normal temperatures at the end of December and the beginning of January resulted in estimates of record-high natural gas demand and helped to reverse the price decline,” EIA said.

Dry natural gas production last year was an estimated 73.6 Bcf/d, up 1.0% compared with the 2016 total. EIA expects 2018 production to increase by 9.3% (6.9 Bcf/d) — the highest production growth on record — and to climb by 3.2% (2.6 Bcf/d) in 2019.

“Growth is expected to be concentrated in Appalachia’s Marcellus and Utica regions, along with the Permian Basin region,” EIA said. “Much of the expected increase in natural gas production is the result of increasing pipeline takeaway capacity out of the Appalachia producing region to end-use markets.

“The greater pipeline connectivity contributes to higher wellhead natural gas prices for producers and is expected to encourage production growth.”

EIA also expects total U.S. crude oil production to surge in 2018, reaching an average 10.3 million b/d, up 1.0 million b/d from 2017. The 10.3 million b/d level would be the highest annual average on record, surpassing the previous record of 9.6 million b/d set in 1970. In 2019, crude oil production is forecast to increase to an average of 10.8 million b/d.

“Looking forward, we see both domestic oil production and domestic gas production to be very robust in the coming year,” said EIA Acting Administrator John Conti during a conference call with reporters.

Natural gas consumption, which declined 1% year/year to 74.0 Bcf/d in 2017, is forecast to increase by 3.5 Bcf/d in 2018 and by 2.2 Bcf/d in 2019.

“In 2018, industrial consumption is expected to rise by 1.2%, averaging 21.7 Bcf/d in 2018,” EIA said. “Industrial consumption is expected to increase by 2.6% in 2019. Most of the increase in the 2019 forecast is attributable to new chemical plants expected to come online.

“A low natural gas price environment in recent years has made it economical to increase the use of natural gas as feedstock in ammonia for nitrogenous fertilizer and methanol.”

EIA projects liquefied natural gas (LNG) gross exports will average 3.0 Bcf/d in 2018, up from 1.9 Bcf/d in 2017. The agency expects U.S. liquefaction capacity will continue to expand in 2018. Expected contributing factors include the Cove Point terminal in Maryland ramping up to full capacity; six modular trains entering service at the Elba Island facility in Georgia; and the first liquefaction train at Freeport LNG in Texas coming online. EIA projects gross LNG exports to average 4.8 Bcf/d in 2019.

Conti said the conference call Tuesday afternoon was his final act as acting administrator. Linda Capuano, a fellow at Rice University’s Baker Institute for Public Policy’s Center for Energy Studies and a previous vice president of technology at Marathon Oil Corp., was confirmed as EIA administrator by the U.S. Senate on Dec. 21.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |