Shale Daily | E&P | Infrastructure | NGI All News Access

Seasonal Rig Slowdown Continues, But for How Long?

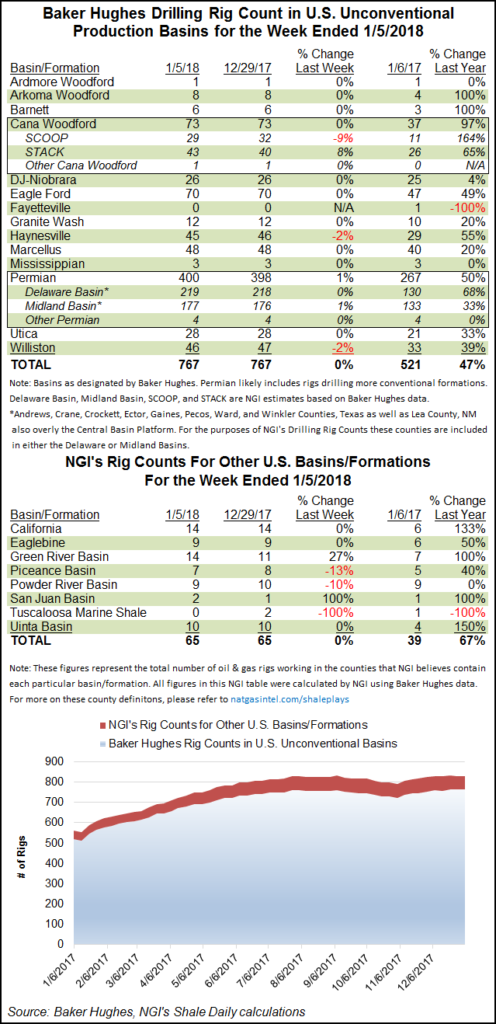

Adhering to the normal winter rig slowdown, the number of U.S. oil and gas rigs in operation for the week ended Jan. 5 dropped by five to 924, according to Baker Hughes data. However, all five lost rigs came from the oil side of the ledger.

Rigs drilling for natural gas stood pat at 182, while the number for oil declined by five to 742. Even with the slowdown, the 924 rig total still marks a 39% increase over the 665 in operation during the same week of 2017.

Similarly, the 182 rig figure for gas marks a 35% bump from the 135 in operation a year ago, while the 742 oil rigs marks a 40% premium to the year-ago 529.

In Baker Hughes Unconventional Production Basin breakout, the biggest movers could be found in the Oklahoma liquids plays. The South Central Oklahoma Oil Province (SCOOP) dropped three rigs for the week to 29, but the STACK (Sooner Trend of the Anadarko Basin) added three rigs to 43.

Other plays on the decline included the Haynesville Shale and the Williston Basin, which both dropped a single rig apiece to 45 and 46, respectively.

Joining the STACK as the only other big winner was the Permian Basin, where the Delaware and Midland sub-basins each added a rig during the week to 219 and 177, respectively.

Putting the week’s overall decline in the rearview mirror, recent economic reports from various officials at the state level point to a possible resurgence within the oil and gas E&P segment.

Last week, Wyoming officials reported that revenues from federal and state oil/natural gas lease sales in the state during 2017 shot up dramatically compared to their anemic levels a year earlier, prompting industry and government officials to conjure up visions of a return to more boom-like times ahead in the state oil/gas fields.

In total, Wyoming net revenues for the lease sales overall produced $146 million, involving nearly a half-million acres of state and federal lands in 2017. Sales of state land leases brought in about $60 million of that, compared with annual proceeds in previous years of $5-$7 million following the global oil commodity price crash in 2014.

State Oil/Gas Supervisor Mark Watson cautioned that he doesn’t think this necessarily points to enough of a resurgence to be designated a “boom” for the oil/gas operators in Wyoming, but it does indicate they are “cautiously optimistic.” And that newfound optimism comes for the increase in current prices, Watson told NGI’s Shale Daily.

Further south, the Federal Reserve Bank’s Dallas arm said late last week that oil and natural gas activity across Texas, northern Louisiana and southeastern New Mexico gained momentum during the 4Q2017.

The business activity index is measured quarterly in the Dallas Fed Energy Survey, offering the broadest measure of conditions facing Eleventh District energy firms. The index climbed to 38.1 from 27.3 in 3Q2017, driven by a surging exploration and production (E&P) sector.

“Positive readings in the survey generally indicate expansion, while readings below zero generally indicate contraction,” economists noted. “All indexes in the latest survey reflected expansion on a quarterly basis.”

Said one E&P executive, “The oil industry in the Lower 48 states appears to be in the ”Goldilocks stage’ — not too strong, not too soft, just right — which incents everyone to be efficient.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |